Baird Investment Banking Pitch Book

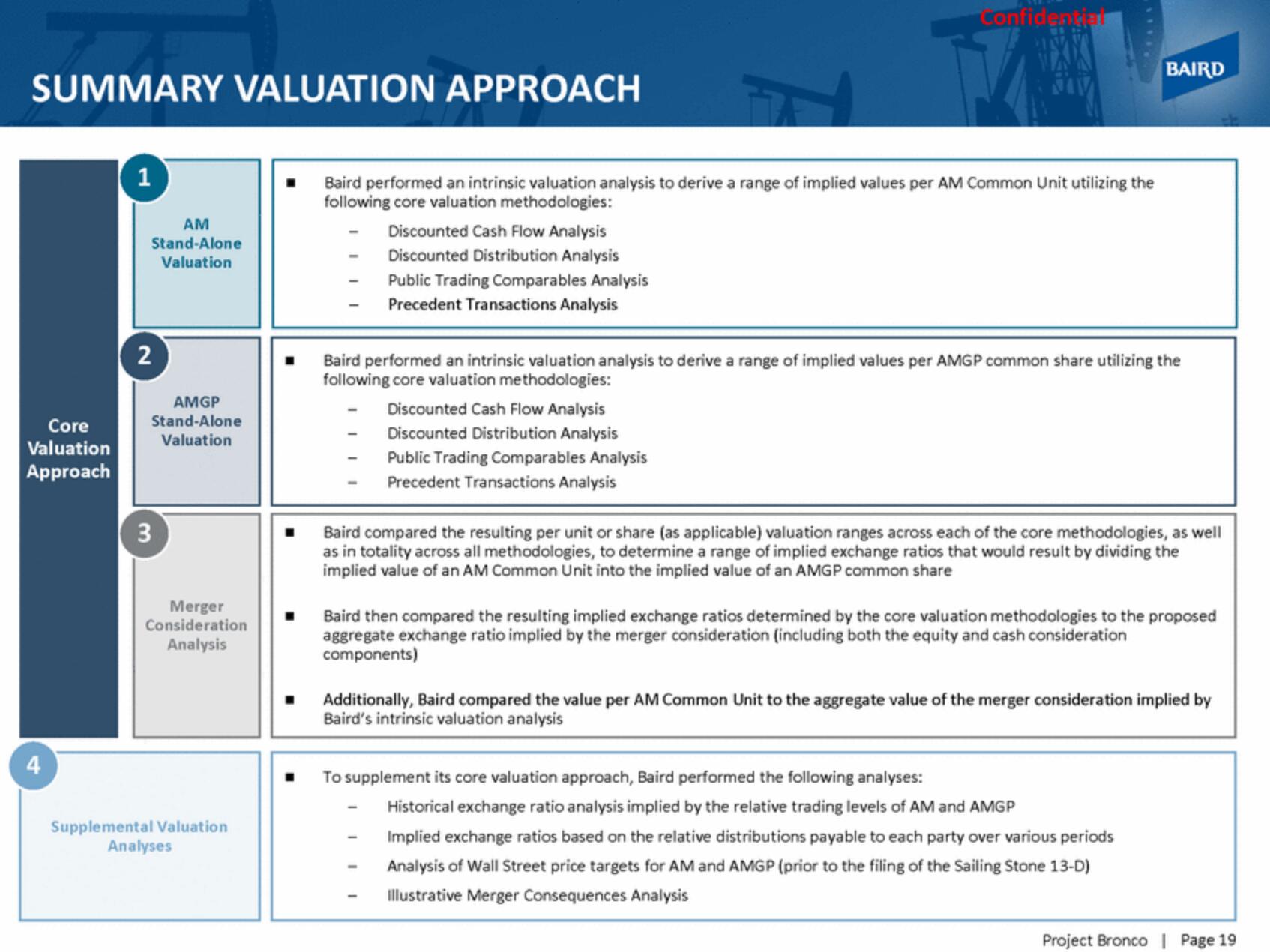

SUMMARY VALUATION APPROACH

Core

Valuation

Approach

4

1

AM

Stand-Alone

Valuation

2

AMGP

Stand-Alone

Valuation

3

Merger

Consideration

Analysis

Supplemental Valuation

Analyses

Baird performed an intrinsic valuation analysis to derive a range of implied values per AM Common Unit utilizing the

following core valuation methodologies:

Discounted Cash Flow Analysis

Discounted Distribution Analysis

Public Trading Comparables Analysis

Precedent Transactions Analysis

Baird performed an intrinsic valuation analysis to derive a range of implied values per AMGP common share utilizing the

following core valuation methodologies:

Confidential

Discounted Cash Flow Analysis

Discounted Distribution Analysis

Public Trading Comparables Analysis

Precedent Transactions Analysis

-

Baird compared the resulting per unit or share (as applicable) valuation ranges across each of the core methodologies, as well

as in totality across all methodologies, to determine a range of implied exchange ratios that would result by dividing the

implied value of an AM Common Unit into the implied value of an AMGP common share

-

Baird then compared the resulting implied exchange ratios determined by the core valuation methodologies to the proposed

aggregate exchange ratio implied by the merger consideration (including both the equity and cash consideration

components)

To supplement its core valuation approach, Baird performed the following analyses:

BAIRD

Additionally, Baird compared the value per AM Common Unit to the aggregate value of the merger consideration implied by

Baird's intrinsic valuation analysis

Historical exchange ratio analysis implied by the relative trading levels of AM and AMGP

Implied exchange ratios based on the relative distributions payable to each party over various periods

Analysis of Wall Street price targets for AM and AMGP (prior to the filing of the Sailing Stone 13-D)

Illustrative Merger Consequences Analysis

Project Bronco | Page 19View entire presentation