DCC Results Presentation Deck

Financial summary

●

●

●

●

●

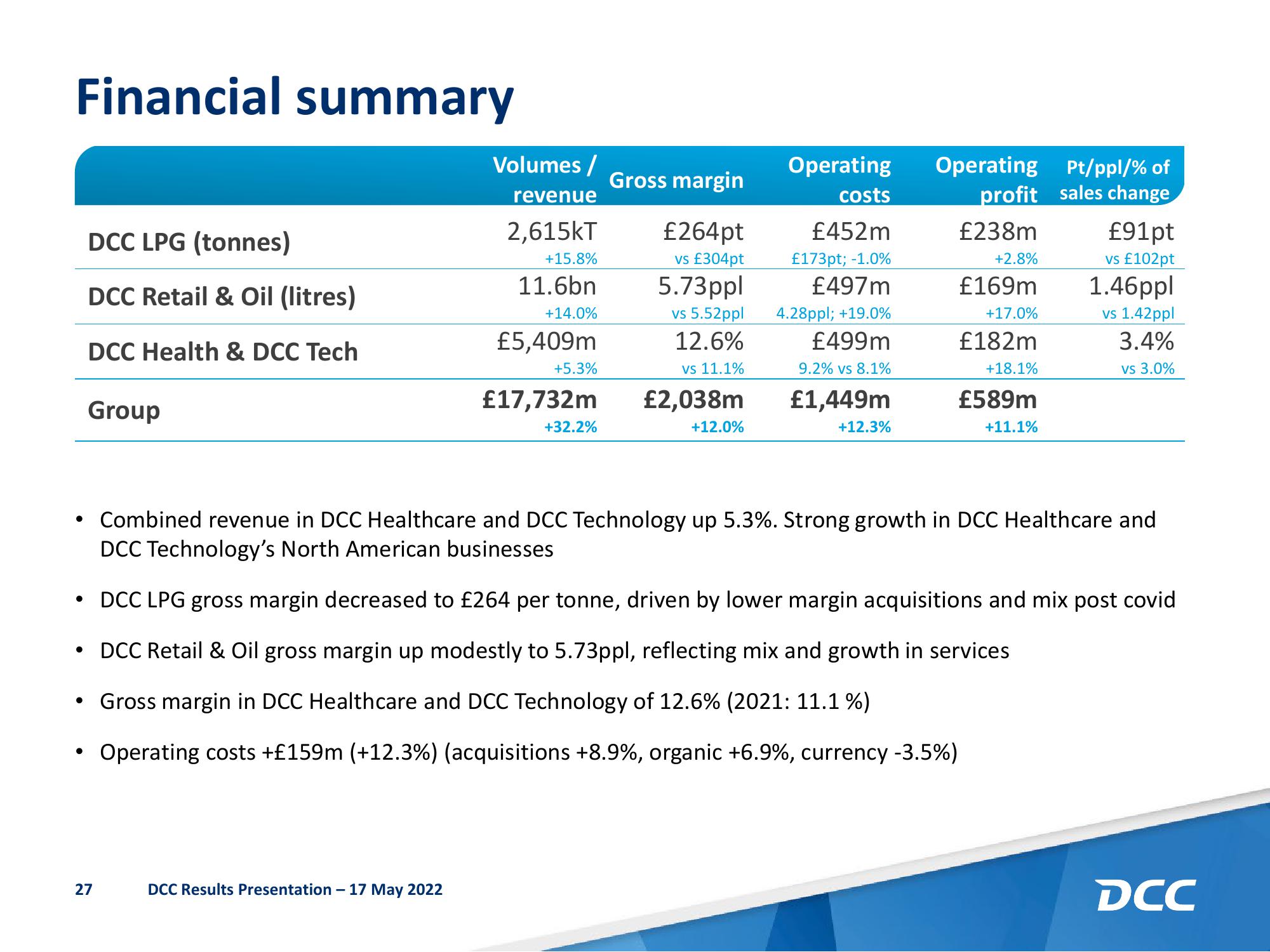

DCC LPG (tonnes)

DCC Retail & Oil (litres)

DCC Health & DCC Tech

Group

27

Volumes/

revenue

2,615kT

+15.8%

11.6bn

+14.0%

DCC Results Presentation - 17 May 2022

£5,409m

+5.3%

£17,732m

+32.2%

Gross margin

£264pt

vs £304pt

5.73ppl

vs 5.52ppl

12.6%

vs 11.1%

£2,038m

+12.0%

Operating

costs

£452m

£173pt; -1.0%

£497m

4.28ppl; +19.0%

£499m

9.2% vs 8.1%

£1,449m

+12.3%

Operating Pt/ppl/% of

profit sales change

£238m

+2.8%

£169m

+17.0%

£182m

+18.1%

£589m

+11.1%

£91pt

vs £102pt

1.46ppl

vs 1.42ppl

3.4%

vs 3.0%

Combined revenue in DCC Healthcare and DCC Technology up 5.3%. Strong growth in DCC Healthcare and

DCC Technology's North American businesses

DCC LPG gross margin decreased to £264 per tonne, driven by lower margin acquisitions and mix post covid

DCC Retail & Oil gross margin up modestly to 5.73ppl, reflecting mix and growth in services

Gross margin in DCC Healthcare and DCC Technology of 12.6% (2021: 11.1 %)

Operating costs +£159m (+12.3%) (acquisitions +8.9%, organic +6.9%, currency -3.5%)

DCCView entire presentation