J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

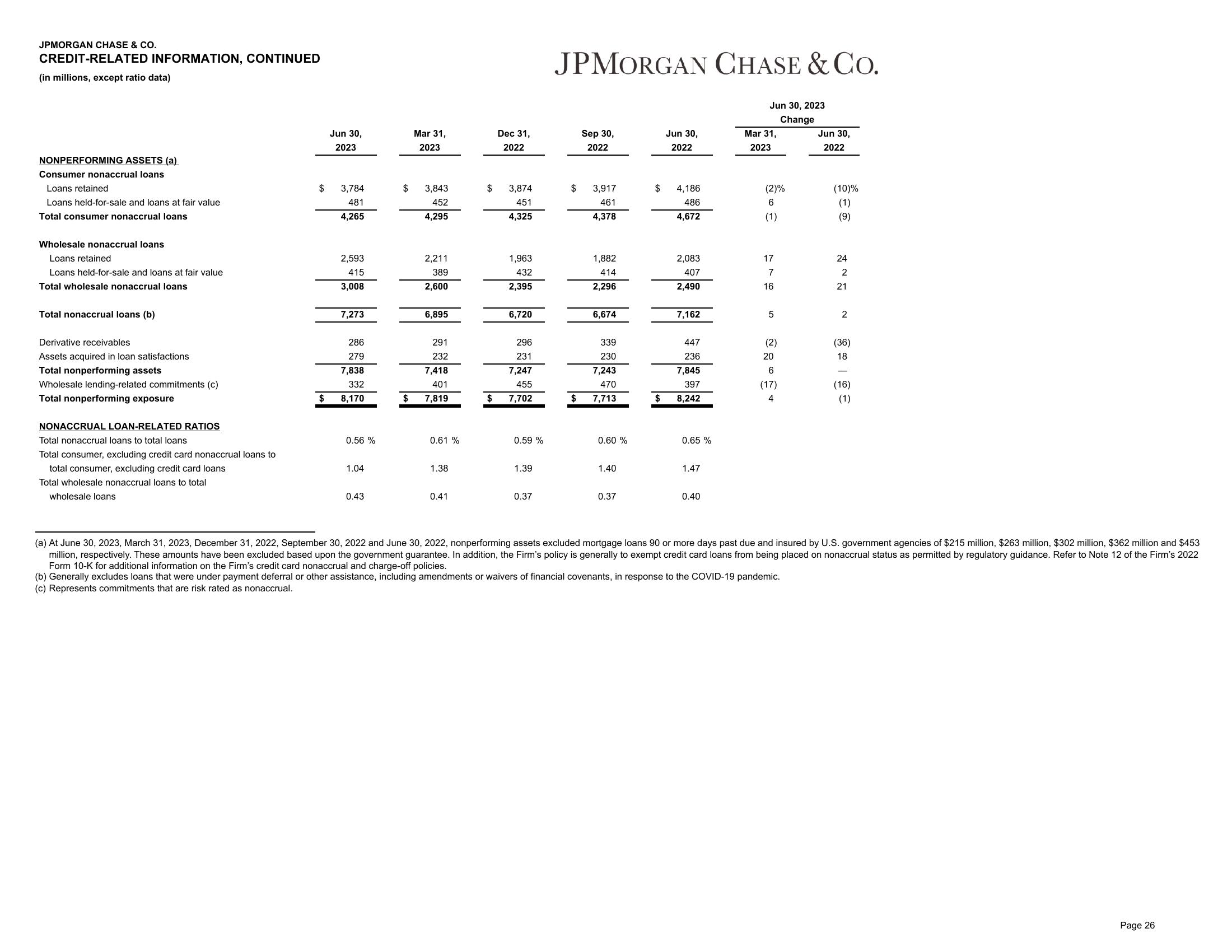

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

NONPERFORMING ASSETS (a)

Consumer nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total consumer nonaccrual loans

Wholesale nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale nonaccrual loans

Total nonaccrual loans (b)

Derivative receivables

Assets acquired in loan satisfactions

Total nonperforming assets

Wholesale lending-related commitments (c)

Total nonperforming exposure

NONACCRUAL LOAN-RELATED RATIOS

Total nonaccrual loans to total loans

Total consumer, excluding credit card nonaccrual loans to

total consumer, excluding credit card loans

Total wholesale nonaccrual loans to total

wholesale loans

$

$

Jun 30,

2023

3,784

481

4,265

2,593

415

3,008

7,273

286

279

7,838

332

8,170

0.56%

1.04

0.43

$

Mar 31,

2023

3,843

452

4,295

2,211

389

2,600

6,895

291

232

7,418

401

$ 7,819

0.61 %

1.38

0.41

$

Dec 31,

2022

3,874

451

4,325

1,963

432

2,395

6,720

296

231

7,247

455

$ 7,702

0.59%

1.39

0.37

JPMORGAN CHASE & CO.

$

Sep 30,

2022

3,917

461

4,378

1,882

414

2,296

6,674

339

230

7,243

470

$ 7,713

0.60%

1.40

0.37

$

$

Jun 30,

2022

4,186

486

4,672

2,083

407

2,490

7,162

447

236

7,845

397

8,242

0.65 %

1.47

0.40

Jun 30, 2023

Change

Mar 31,

2023

(2)%

6

(1)

17

7

16

5

(2)

20

6

(17)

4

Jun 30,

2022

(10)%

(1)

(9)

24

2

21

2

(36)

18

(16)

(1)

(a) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, nonperforming assets excluded mortgage loans 90 or more days past due and insured by U.S. government agencies of $215 million, $263 million, $302 million, $362 million and $453

million, respectively. These amounts have been excluded based upon the government guarantee. In addition, the Firm's policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance. Refer to Note 12 of the Firm's 2022

Form 10-K for additional information on the Firm's credit card nonaccrual and charge-off policies.

(b) Generally excludes loans that were under payment deferral or other assistance, including amendments or waivers of financial covenants, in response to the COVID-19 pandemic.

(c) Represents commitments that are risk rated as nonaccrual.

Page 26View entire presentation