Credit Suisse Investment Banking Pitch Book

Preliminary illustrative Maine royalty sensitivity analysis

Summary

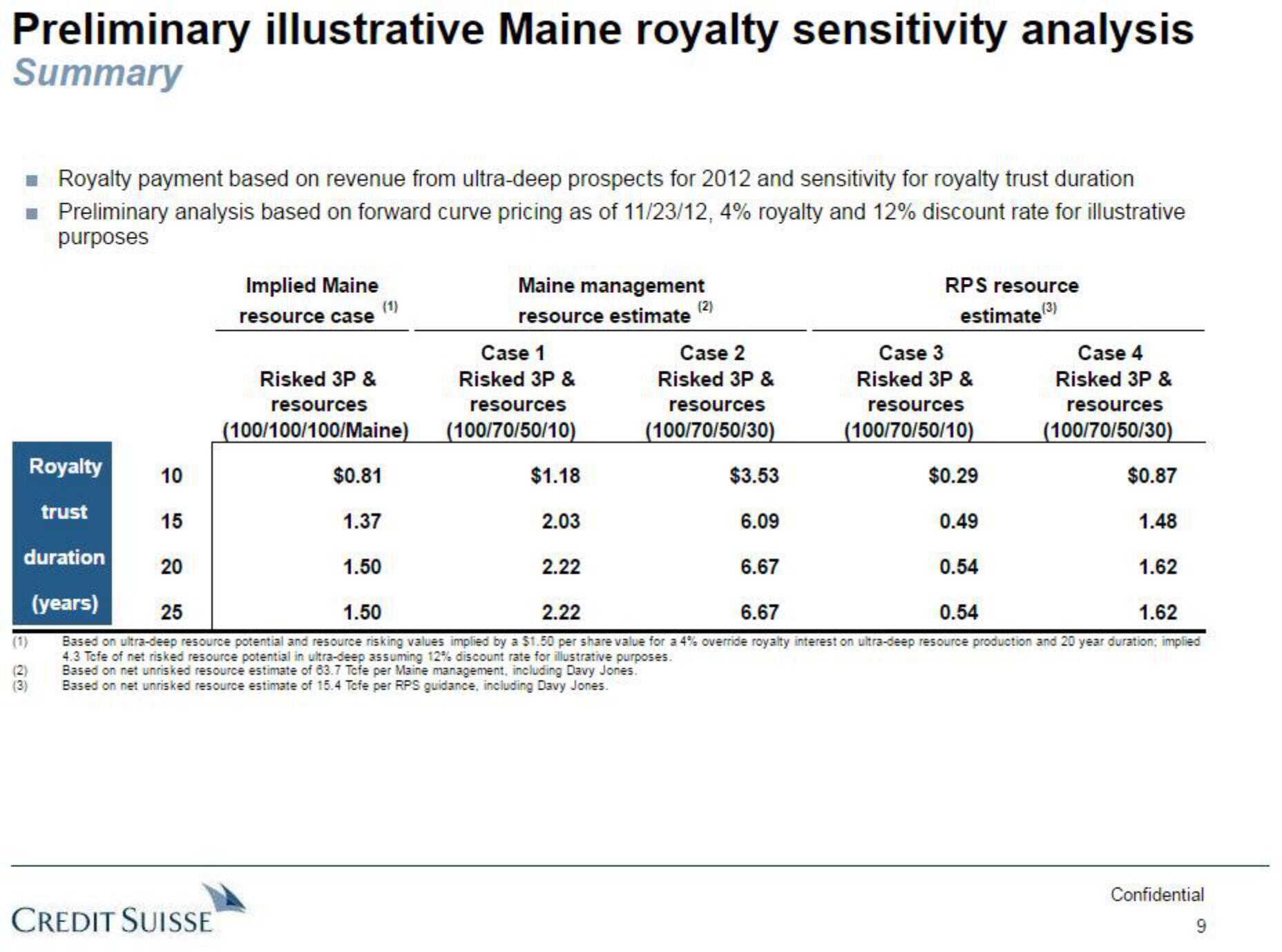

Royalty payment based on revenue from ultra-deep prospects for 2012 and sensitivity for royalty trust duration

Preliminary analysis based on forward curve pricing as of 11/23/12, 4% royalty and 12% discount rate for illustrative

purposes

(3)

20

Implied Maine

resource case

CREDIT SUISSE

Risked 3P &

resources

(100/100/100/Maine)

$0.81

1.37

Maine management

resource estimate

1.50

Case 1

Risked 3P &

resources

(100/70/50/10)

$1.18

Royalty 10

$0.87

trust

15

1.48

duration

1.62

(years)

25

1.50

2.22

6.67

0.54

1.62

Based on ultra-deep resource potential and resource risking values implied by a $1.50 per share value for a 4% override royalty interest on ultra-deep resource production and 20 year duration; implied

4.3 Tofe of net risked resource potential in ultra-deep assuming 12% discount rate for illustrative purposes.

Based on net unrisked resource estimate of 83.7 Tofe per Maine management, including Davy Jones.

Based on net unrisked resource estimate of 15.4 Tcfe per RPS guidance, including Davy Jones.

2.03

(2)

2.22

Case 2

Risked 3P &

resources

(100/70/50/30)

$3.53

6.09

RPS resource

estimate (3)

6.67

Case 3

Risked 3P &

resources

(100/70/50/10)

$0.29

0.49

Case 4

Risked 3P &

0.54

resources

(100/70/50/30)

Confidential

9View entire presentation