2nd Quarter 2021 Investor Presentation

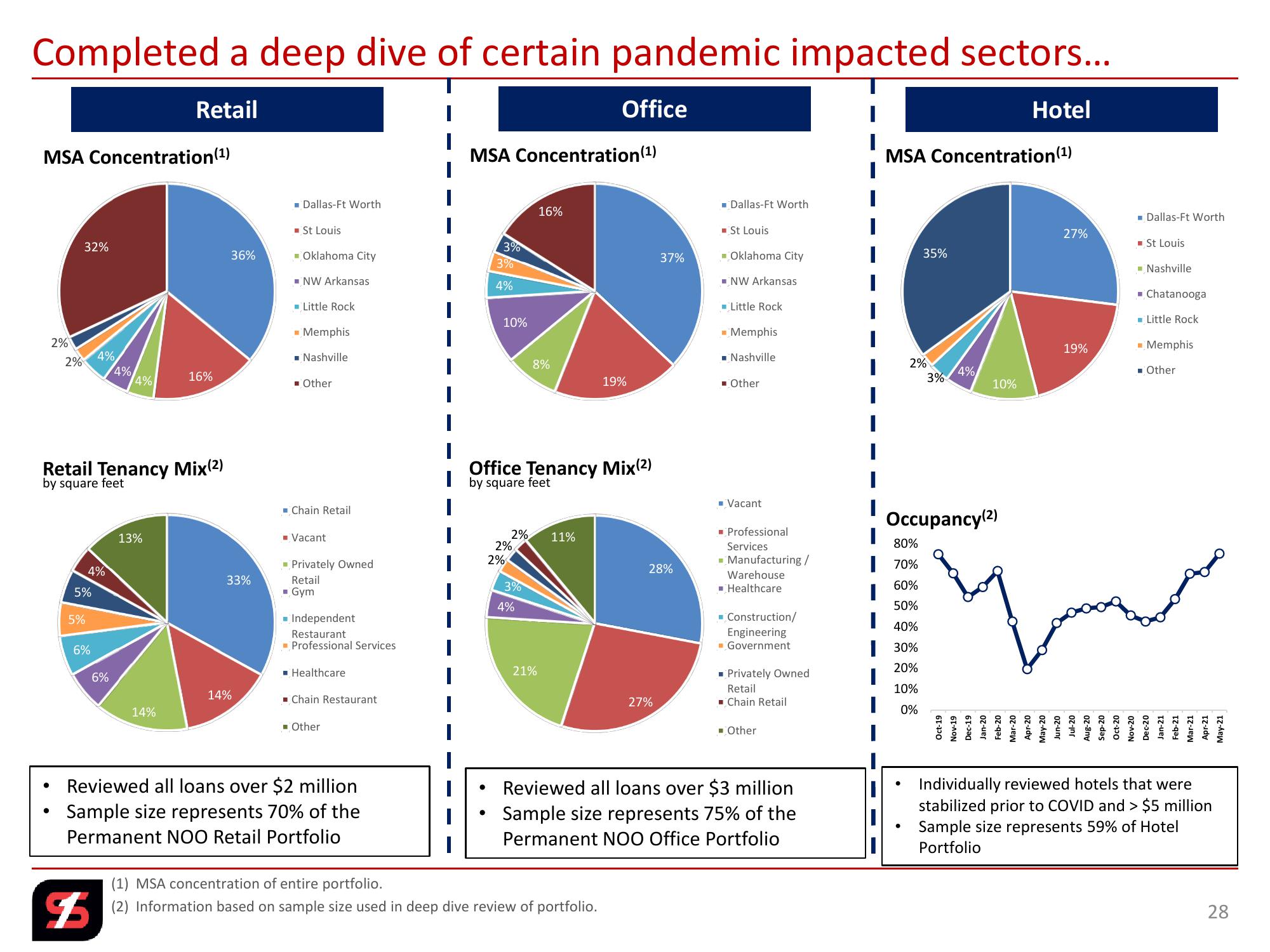

Completed a deep dive of certain pandemic impacted sectors...

Retail

MSA Concentration (1)

Office

MSA Concentration (1)

Hotel

MSA Concentration (1)

2%

Dallas-Ft Worth

■ St Louis

3%

32%

36%

Oklahoma City

3%

NW Arkansas

4%

■Little Rock

4%

2%

4% 4%

16%

Retail Tenancy Mix(2)

by square feet

■Memphis

■Nashville

Other

|

10%

16%

■Dallas-Ft Worth

■ St Louis

27%

37%

Oklahoma City

35%

■NW Arkansas

Little Rock

Memphis

■ Nashville

2%

8%

4%

3%

19%

Other

10%

Office Tenancy Mix(2)

by square feet

■Chain Retail

2%

13%

■ Vacant

11%

2%

Privately Owned

2%

28%

4%

33%

Retail

3%

5%

■Gym

4%

5%

■ Independent

Restaurant

Professional Services

6%

■ Healthcare

21%

6%

14%

Chain Restaurant

14%

■ Other

|

■ Vacant

Occupancy (2)

■ Professional

Services

|

80%

■Manufacturing /

70%

Warehouse

Healthcare

60%

|

50%

■ Construction/

Engineering

■Government

40%

| 30%

Privately Owned

20%

27%

Retail

Chain Retail

■ Other

10%

0%

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

•

Reviewed all loans over $2 million

Sample size represents 70% of the

Permanent NOO Retail Portfolio

F

(1) MSA concentration of entire portfolio.

Reviewed all loans over $3 million

Sample size represents 75% of the

Permanent NOO Office Portfolio

(2) Information based on sample size used in deep dive review of portfolio.

•

•

07-unr

19%

Dallas-Ft Worth

■ St Louis

Nashville

■ Chatanooga

■Little Rock

■Memphis

■ Other

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Individually reviewed hotels that were

stabilized prior to COVID and > $5 million

Sample size represents 59% of Hotel

Portfolio

28View entire presentation