Uber Results Presentation Deck

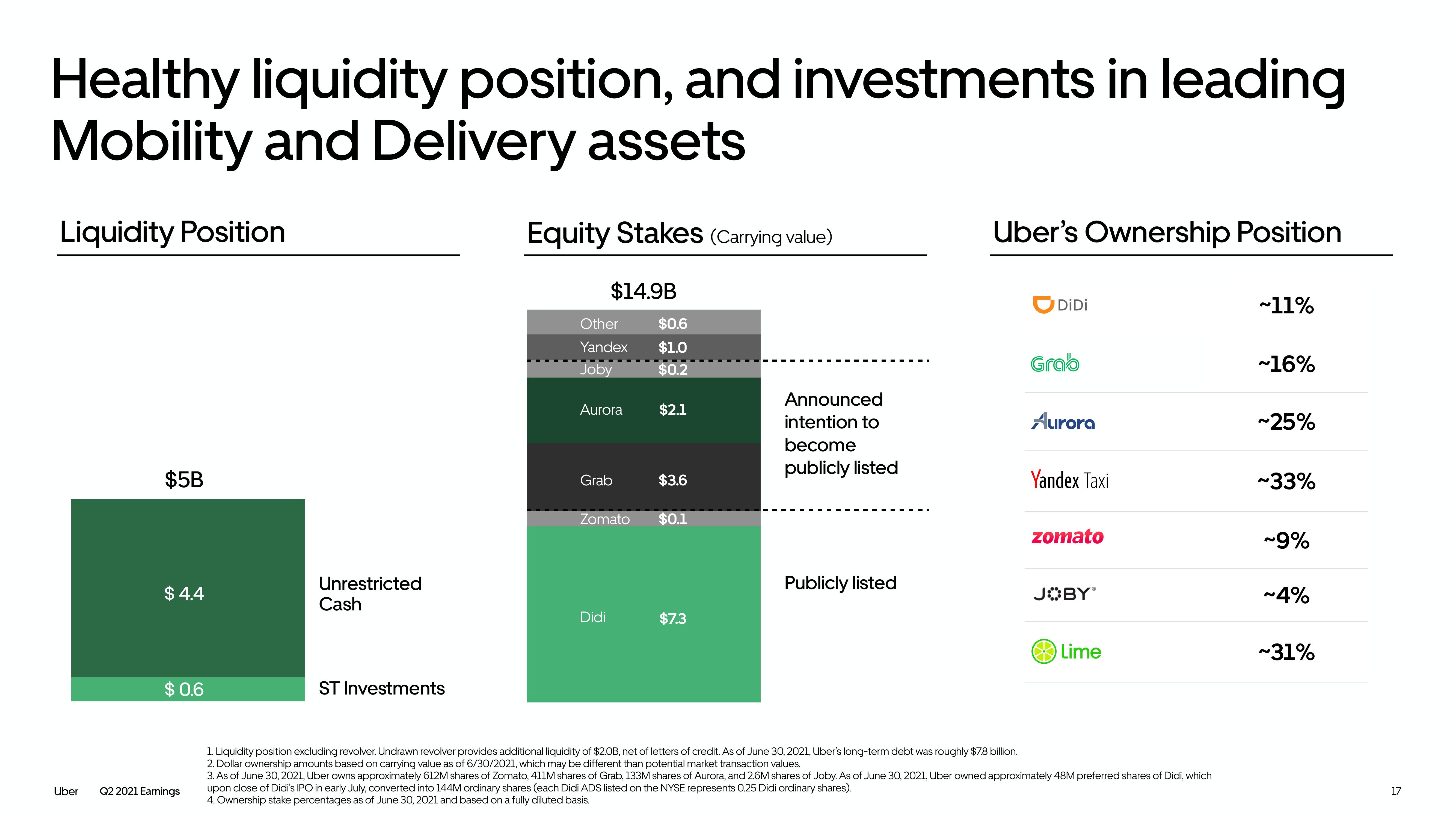

Healthy liquidity position, and investments in leading

Mobility and Delivery assets

Liquidity Position

Uber

$5B

$ 4.4

$ 0.6

Q2 2021 Earnings

Unrestricted

Cash

ST Investments

Equity Stakes (Carrying value)

$14.9B

Other

$0.6

Yandex $1.0

Joby

$0.2

Aurora

Grab

Didi

$2.1

$3.6

Zomato $0.1

$7.3

Announced

intention to

become

publicly listed

Publicly listed

Uber's Ownership Position

1. Liquidity position excluding revolver. Undrawn revolver provides additional liquidity of $2.0B, net of letters of credit. As of June 30, 2021, Uber's long-term debt was roughly $7.8 billion.

2. Dollar ownership amounts based on carrying value as of 6/30/2021, which may be different than potential market transaction values.

DiDi

Grab

Aurora

Yandex Taxi

zomato

JOBYⓇ

Lime

3. As of June 30, 2021, Uber owns approximately 612M shares of Zomato, 411M shares of Grab, 133M shares of Aurora, and 2.6M shares of Joby. As of June 30, 2021, Uber owned approximately 48M preferred shares of Didi, which

upon close of Didi's IPO in early July, converted into 144M ordinary shares (each Didi ADS listed on the NYSE represents 0.25 Didi ordinary shares).

4. Ownership stake percentages as of June 30, 2021 and based on a fully diluted basis.

~11%

~16%

~25%

~33%

~9%

~4%

~31%

17View entire presentation