AeroFarms SPAC Presentation Deck

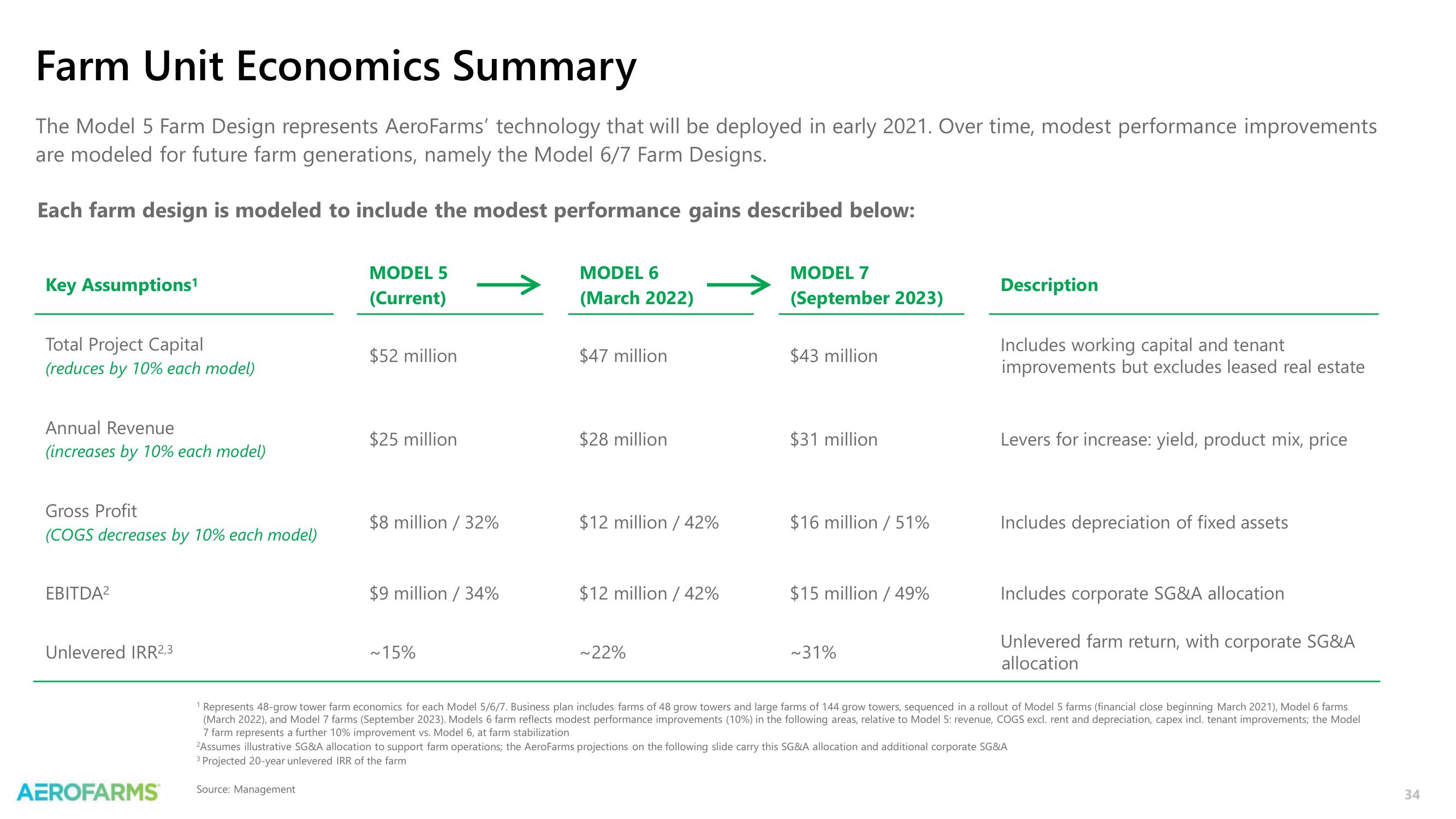

Farm Unit Economics Summary

The Model 5 Farm Design represents AeroFarms' technology that will be deployed in early 2021. Over time, modest performance improvements

are modeled for future farm generations, namely the Model 6/7 Farm Designs.

Each farm design is modeled to include the modest performance gains described below:

Key Assumptions¹

Total Project Capital

(reduces by 10% each model)

Annual Revenue

(increases by 10% each model)

Gross Profit

(COGS decreases by 10% each model)

EBITDA²

Unlevered IRR2,3

AEROFARMS

MODEL 5

(Current)

$52 million

$25 million

$8 million / 32%

$9 million / 34%

~15%

MODEL 6

(March 2022)

$47 million

$28 million

$12 million / 42%

$12 million / 42%

~22%

MODEL 7

(September 2023)

$43 million

$31 million

$16 million / 51%

$15 million / 49%

~31%

Description

Includes working capital and tenant

improvements but excludes leased real estate

Levers for increase: yield, product mix, price

Includes depreciation of fixed assets

Includes corporate SG&A allocation

Unlevered farm return, with corporate SG&A

allocation

¹ Represents 48-grow tower farm economics for each Model 5/6/7. Business plan includes farms of 48 grow towers and large farms of 144 grow towers, sequenced in a rollout of Model 5 farms (financial close beginning March 2021), Model 6 farms

(March 2022), and Model 7 farms (September 2023). Models 6 farm reflects modest performance improvements (10%) in the following areas, relative to Model 5: revenue, COGS excl. rent and depreciation, capex incl. tenant improvements; the Model

7 farm represents a further 10% improvement vs. Model 6, at farm stabilization

²Assumes illustrative SG&A allocation to support farm operations; the AeroFarms projections on the following slide carry this SG&A allocation and additional corporate SG&A

3 Projected 20-year unlevered IRR of the farm

Source: Management

34View entire presentation