Spotify Results Presentation Deck

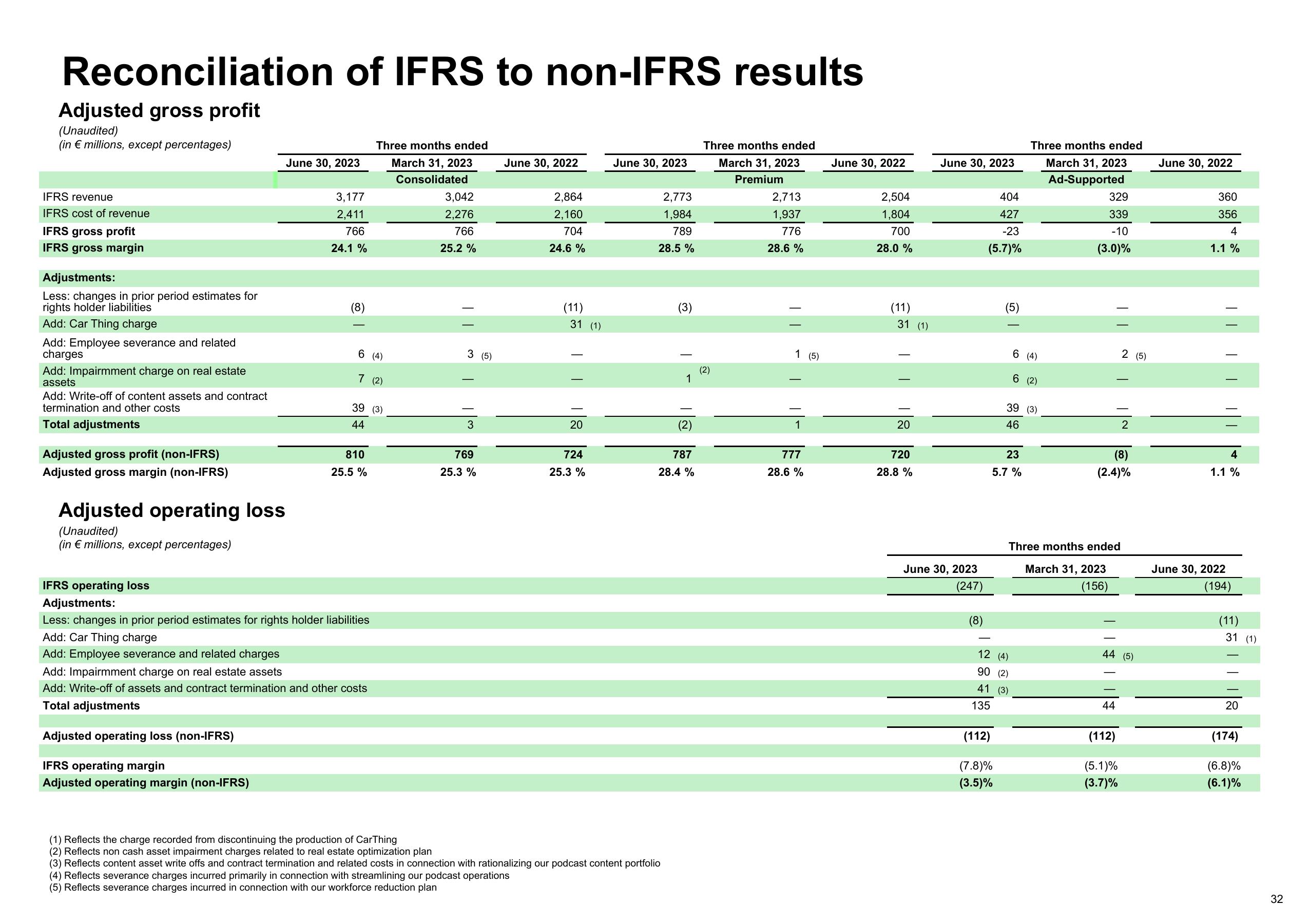

Reconciliation of IFRS to non-IFRS results

Adjusted gross profit

(Unaudited)

(in € millions, except percentages)

IFRS revenue

IFRS cost of revenue

IFRS gross profit

IFRS gross margin

Adjustments:

Less: changes in prior period estimates for

rights holder liabilities

Add: Car Thing charge

Add: Employee severance and related

charges

Add: Impairmment charge on real estate

assets

Add: Write-off of content assets and contract

termination and other costs

Total adjustments

Adjusted gross profit (non-IFRS)

Adjusted gross margin (non-IFRS)

Adjusted operating loss

(Unaudited)

(in € millions, except percentages)

June 30, 2023

3,177

2,411

766

24.1%

6 (4)

7

810

25.5%

Three months ended

March 31, 2023

Consolidated

39 (3)

44

IFRS operating loss

Adjustments:

Less: changes in prior period estimates for rights holder liabilities

Add: Car Thing charge

Add: Employee severance and related charges

Add: Impairmment charge on real estate assets

Add: Write-off of assets and contract termination and other costs

Total adjustments

Adjusted operating loss (non-IFRS)

IFRS operating margin

Adjusted operating margin (non-IFRS)

(2)

3,042

2,276

766

25.2 %

3 (5)

3

769

25.3%

June 30, 2022

2,864

2,160

704

24.6%

(11)

31 (1)

20

724

25.3 %

June 30, 2023

2,773

1,984

789

28.5 %

(3)

(1) Reflects the charge recorded from discontinuing the production of CarThing

(2) Reflects non cash asset impairment charges related to real estate optimization plan

(3) Reflects content asset write offs and contract termination and related costs in connection with rationalizing our podcast content portfolio

(4) Reflects severance charges incurred primarily in connection with streamlining our podcast operations

(5) Reflects severance charges incurred in connection with our workforce reduction plan

1

(2)

787

28.4 %

Three months ended

March 31, 2023

Premium

(2)

2,713

1,937

776

28.6 %

||||

1

1

777

28.6 %

(5)

June 30, 2022

2,504

1,804

700

28.0%

(11)

31 (1)

20

720

28.8 %

June 30, 2023

June 30, 2023

(247)

(8)

404

427

-23

(5.7)%

135

51

(112)

(7.8)%

(3.5)%

23

5.7 %

12 (4)

90 (2)

41 (3)

Three months ended

March 31, 2023

Ad-Supported

6 (4)

6 (2)

39 (3)

46

329

339

-10

(3.0)%

N|N||

Three months ended

March 31, 2023

(156)

(8)

(2.4)%

44

2 (5)

44 (5)

(112)

(5.1)%

(3.7)%

June 30, 2022

360

356

4

1.1 %

4

1.1 %

June 30, 2022

(194)

(11)

३ ल । । ।।8

31 (1)

20

(174)

(6.8)%

(6.1)%

32View entire presentation