Nauticus SPAC Presentation Deck

TRANSACTION STRUCTURE DETAIL

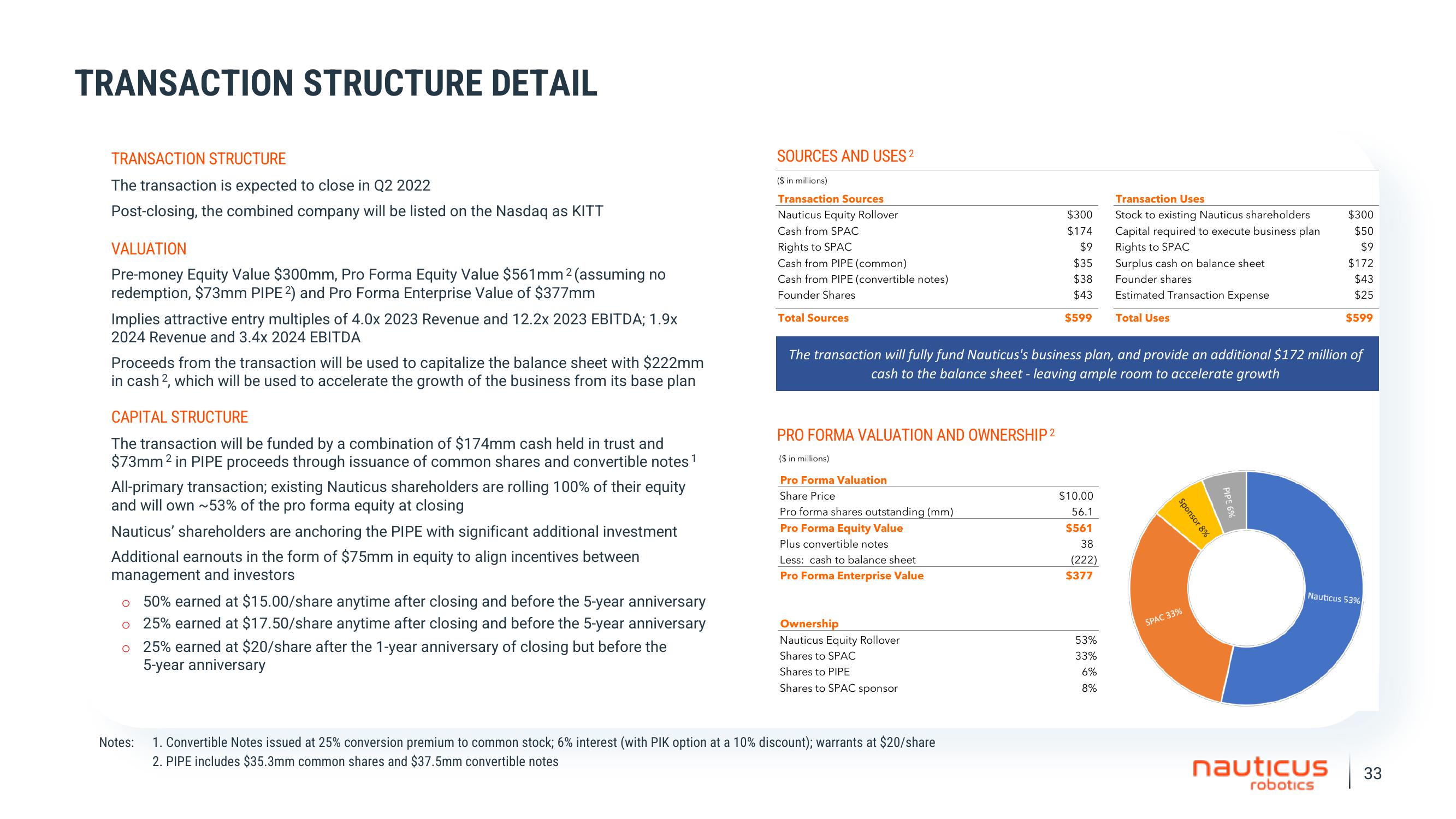

TRANSACTION STRUCTURE

The transaction is expected to close in Q2 2022

Post-closing, the combined company will be listed on the Nasdaq as KITT

VALUATION

Pre-money Equity Value $300mm, Pro Forma Equity Value $561mm ² (assuming no

redemption, $73mm PIPE 2) and Pro Forma Enterprise Value of $377mm

Implies attractive entry multiples of 4.0x 2023 Revenue and 12.2x 2023 EBITDA; 1.9x

2024 Revenue and 3.4x 2024 EBITDA

Proceeds from the transaction will be used to capitalize the balance sheet with $222mm

in cash 2, which will be used to accelerate the growth of the business from its base plan

CAPITAL STRUCTURE

1

The transaction will be funded by a combination of $174mm cash held in trust and

$73mm² in PIPE proceeds through issuance of common shares and convertible notes

All-primary transaction; existing Nauticus shareholders are rolling 100% of their equity

and will own ~53% of the pro forma equity at closing

Nauticus' shareholders are anchoring the PIPE with significant additional investment

Additional earnouts the form of $75mm in equity to align incentives between

management and investors

50% earned at $15.00/share anytime after closing and before the 5-year anniversary

O 25% earned at $17.50/share anytime after closing and before the 5-year anniversary

O 25% earned at $20/share after the 1-year anniversary of closing but before the

5-year anniversary

Notes:

SOURCES AND USES ²

($ in millions)

Transaction Sources

Nauticus Equity Rollover

Cash from SPAC

Rights to SPAC

Cash from PIPE (common)

Cash from PIPE (convertible notes)

Founder Shares

Total Sources

PRO FORMA VALUATION AND OWNERSHIP 2

($ in millions)

Pro Forma Valuation

Share Price

Pro forma shares outstanding (mm)

Pro Forma Equity Value

Plus convertible notes

Less: cash to balance sheet

Pro Forma Enterprise Value

Ownership

Nauticus Equity Rollover

Shares to SPAC

Shares to PIPE

Shares to SPAC sponsor

$300

$174

$9

$35

$38

$43

$599

1. Convertible Notes issued at 25% conversion premium to common stock; 6% interest (with PIK option at a 10% discount); warrants at $20/share

2. PIPE includes $35.3mm common shares and $37.5mm convertible notes

The transaction will fully fund Nauticus's business plan, and provide an additional $172 million of

cash to the balance sheet - leaving ample room to accelerate growth

$10.00

56.1

$561

38

(222)

$377

Transaction Uses

Stock to existing Nauticus shareholders

Capital required to execute business plan

Rights to SPAC

53%

33%

6%

8%

Surplus cash on balance sheet

Founder shares

Estimated Transaction Expense

Total Uses

Sponsor 8%

SPAC 33%

PIPE 6%

$300

$50

$9

$172

$43

$25

$599

Nauticus 53%

nauticus

robotics

33View entire presentation