Apollo Global Management Investor Day Presentation Deck

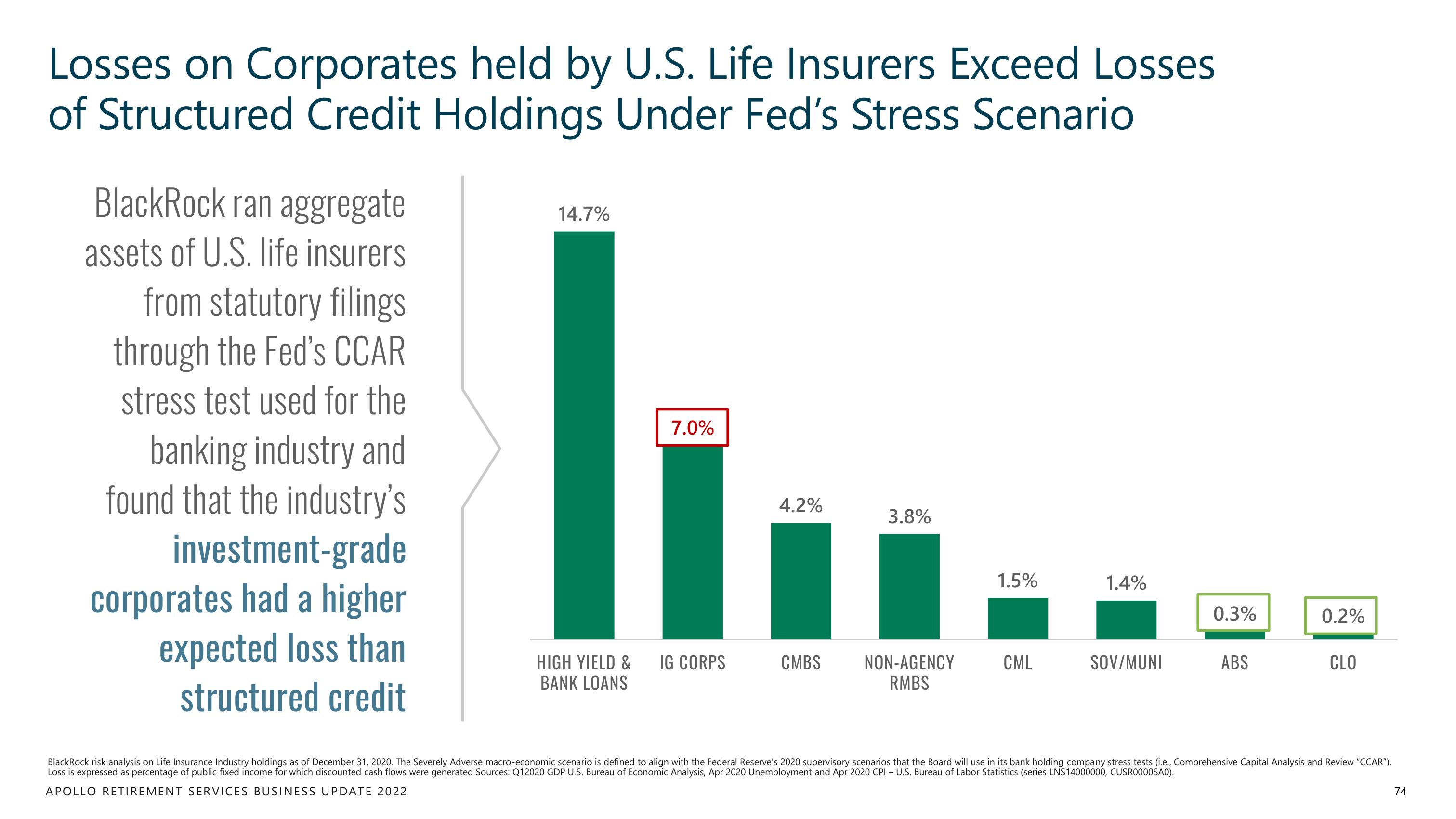

Losses on Corporates held by U.S. Life Insurers Exceed Losses

of Structured Credit Holdings Under Fed's Stress Scenario

BlackRock ran aggregate

assets of U.S. life insurers

from statutory filings

through the Fed's CCAR

stress test used for the

banking industry and

found that the industry's

investment-grade

corporates had a higher

expected loss than

structured credit

14.7%

7.0%

HIGH YIELD & IG CORPS

BANK LOANS

4.2%

CMBS

3.8%

NON-AGENCY

RMBS

1.5%

CML

1.4%

SOV/MUNI

0.3%

ABS

0.2%

CLO

BlackRock risk analysis on Life Insurance Industry holdings as of December 31, 2020. The Severely Adverse macro-economic scenario is defined to align with the Federal Reserve's 2020 supervisory scenarios that the Board will use in its bank holding company stress tests (i.e., Comprehensive Capital Analysis and Review "CCAR").

Loss is expressed as percentage of public fixed income for which discounted cash flows were generated Sources: Q12020 GDP U.S. Bureau of Economic Analysis, Apr 2020 Unemployment and Apr 2020 CPI - U.S. Bureau of Labor Statistics (series LNS14000000, CUSR0000SAO).

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

74View entire presentation