Citi Investment Banking Pitch Book

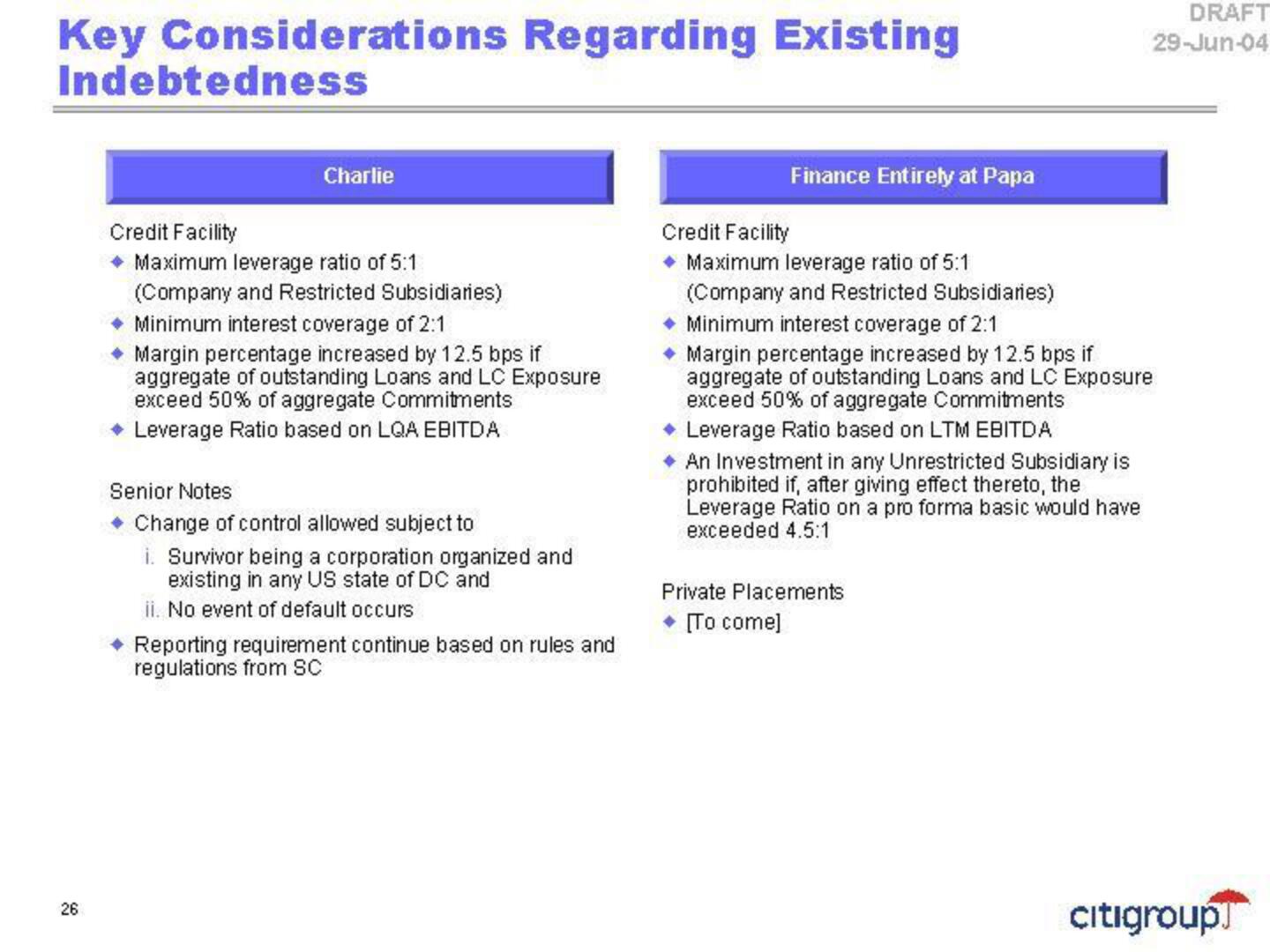

Key Considerations Regarding Existing

Indebtedness

26

Charlie

Credit Facility

◆ Maximum leverage ratio of 5:1

(Company and Restricted Subsidiaries)

◆ Minimum interest coverage of 2:1

◆ Margin percentage increased by 12.5 bps if

aggregate of outstanding Loans and LC Exposure

exceed 50% of aggregate Commitments

◆ Leverage Ratio based on LQA EBITDA

Senior Notes

◆ Change of control allowed subject to

i. Survivor being a corporation organized and

existing in any US state of DC and

ii. No event of default occurs

◆ Reporting requirement continue based on rules and

regulations from SC

Finance Entirely at Papa

Credit Facility

◆ Maximum leverage ratio of 5:1

(Company and Restricted Subsidiaries)

DRAFT

29-Jun-04

◆ Minimum interest coverage of 2:1

◆ Margin percentage increased by 12.5 bps if

aggregate of outstanding Loans and LC Exposure

exceed 50% of aggregate Commitments

◆ Leverage Ratio based on LTM EBITDA

◆ An Investment in any Unrestricted Subsidiary is

prohibited if, after giving effect thereto, the

Leverage Ratio on a pro forma basic would have

exceeded 4.5:1

Private Placements

◆ [To come]

citigroup]View entire presentation