Synchrony Financial Results Presentation Deck

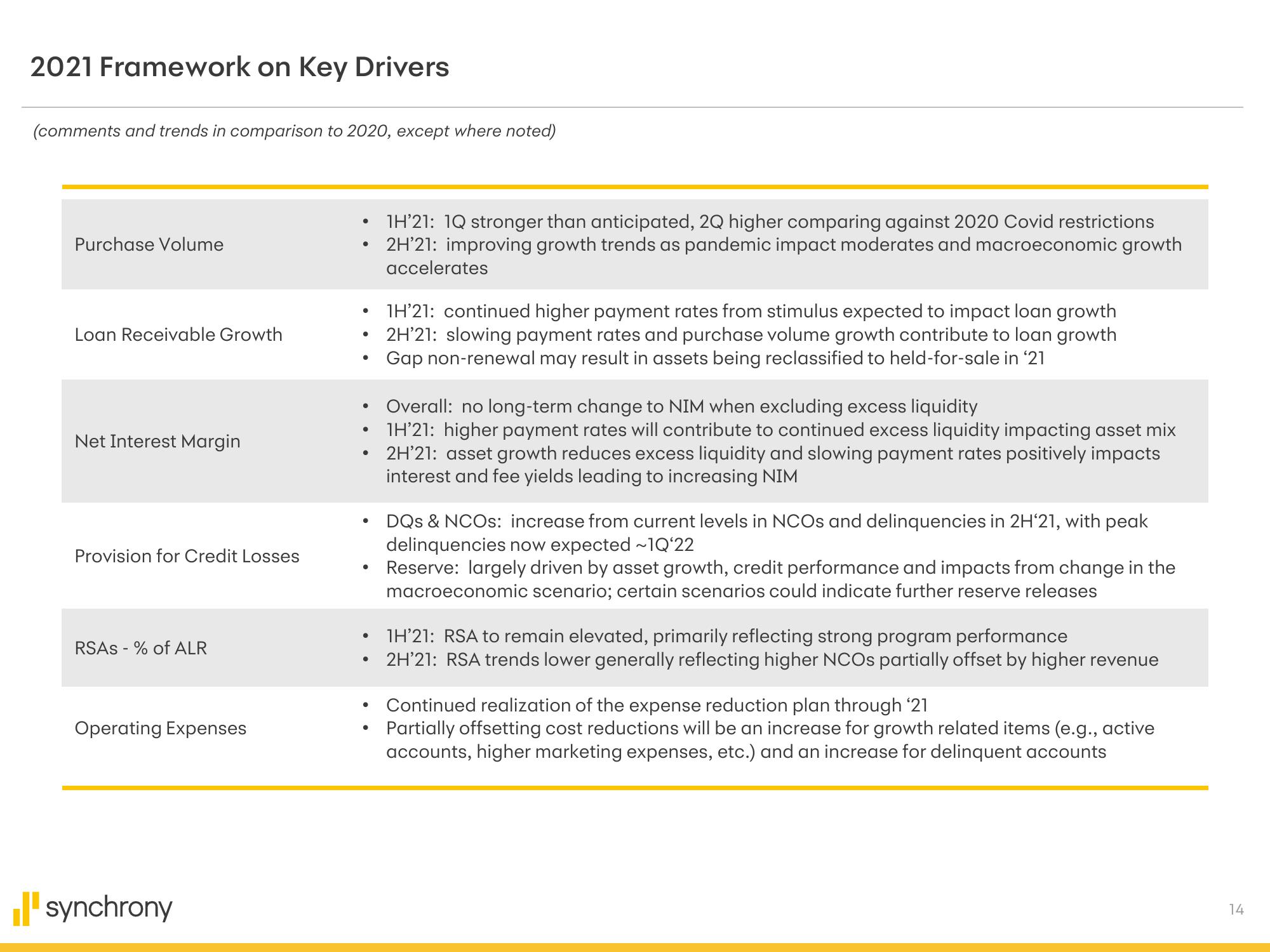

2021 Framework on Key Drivers

(comments and trends in comparison to 2020, except where noted)

Purchase Volume

Loan Receivable Growth

Net Interest Margin

Provision for Credit Losses

RSAS - % of ALR

Operating Expenses

synchrony

●

●

●

●

●

●

●

●

●

●

●

1H'21: 1Q stronger than anticipated, 2Q higher comparing against 2020 Covid restrictions

2H'21: improving growth trends as pandemic impact moderates and macroeconomic growth

accelerates

1H'21: continued higher payment rates from stimulus expected to impact loan growth

2H'21: slowing payment rates and purchase volume growth contribute to loan growth

Gap non-renewal may result in assets being reclassified to held-for-sale in '21

Overall: no long-term change to NIM when excluding excess liquidity

1H'21: higher payment rates will contribute to continued excess liquidity impacting asset mix

2H'21: asset growth reduces excess liquidity and slowing payment rates positively impacts

interest and fee yields leading to increasing NIM

DQs & NCOS: increase from current levels in NCOs and delinquencies in 2H'21, with peak

delinquencies now expected ~1Q'22

Reserve: largely driven by asset growth, credit performance and impacts from change in the

macroeconomic scenario; certain scenarios could indicate further reserve releases

1H'21: RSA to remain elevated, primarily reflecting strong program performance

2H'21: RSA trends lower generally reflecting higher NCOs partially offset by higher revenue

Continued realization of the expense reduction plan through '21

Partially offsetting cost reductions will be an increase for growth related items (e.g., active

accounts, higher marketing expenses, etc.) and an increase for delinquent accounts

14View entire presentation