J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

NON-GAAP FINANCIAL MEASURES

JPMORGAN CHASE & CO.

Non-GAAP Financial Measures

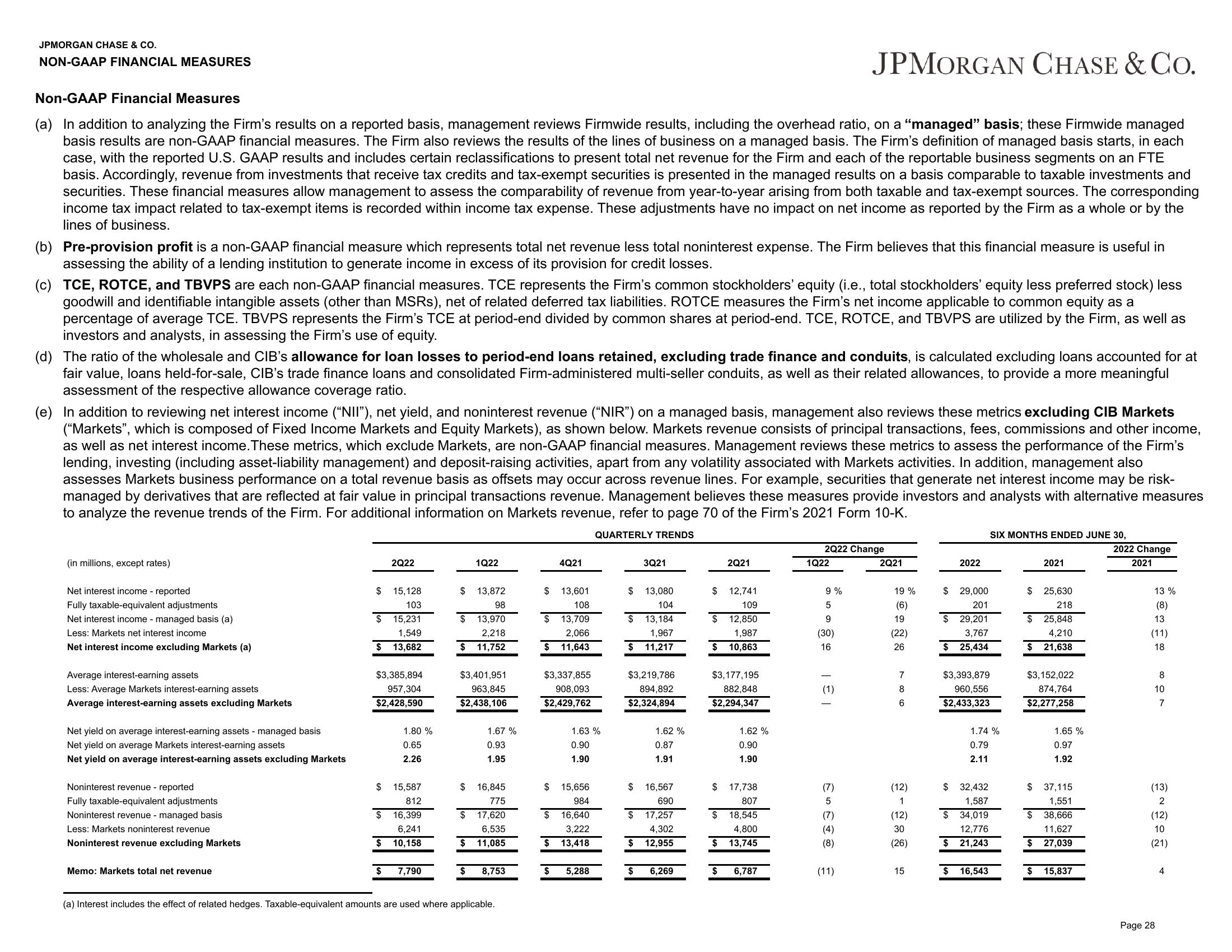

(a) In addition to analyzing the Firm's results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a "managed" basis; these Firmwide managed

basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. The Firm's definition of managed basis starts, in each

case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm and each of the reportable business segments on an FTE

basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and

securities. These financial measures allow management to assess the comparability of revenue from year-to-year arising from both taxable and tax-exempt sources. The corresponding

income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the

lines of business.

(b) Pre-provision profit is a non-GAAP financial measure which represents total net revenue less total noninterest expense. The Firm believes that this financial measure is useful in

assessing the ability of a lending institution to generate income in excess of its provision for credit losses.

(c)

TCE, ROTCE, and TBVPS are each non-GAAP financial measures. TCE represents the Firm's common stockholders' equity (i.e., total stockholders' equity less preferred stock) less

goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm's net income applicable to common equity as a

percentage of average TCE. TBVPS represents the Firm's TCE at period-end divided by common shares at period-end. TCE, ROTCE, and TBVPS are utilized by the Firm, as well as

investors and analysts, in assessing the Firm's use of equity.

(d) The ratio of the wholesale and CIB's allowance for loan losses to period-end loans retained, excluding trade finance and conduits, is calculated excluding loans accounted for at

fair value, loans held-for-sale, CIB's trade finance loans and consolidated Firm-administered multi-seller conduits, as well as their related allowances, to provide a more meaningful

assessment of the respective allowance coverage ratio.

(e) In addition to reviewing net interest income ("NII"), net yield, and noninterest revenue ("NIR") on a managed basis, management also reviews these metrics excluding CIB Markets

("Markets", which is composed of Fixed Income Markets and Equity Markets), as shown below. Markets revenue consists of principal transactions, fees, commissions and other income,

as well as net interest income. These metrics, which exclude Markets, are non-GAAP financial measures. Management reviews these metrics to assess the performance of the Firm's

lending, investing (including asset-liability management) and deposit-raising activities, apart from any volatility associated with Markets activities. In addition, management also

assesses Markets business performance on a total revenue basis as offsets may occur across revenue lines. For example, securities that generate net interest income may be risk-

managed by derivatives that are reflected at fair value in principal transactions revenue. Management believes these measures provide investors and analysts with alternative measures

to analyze the revenue trends of the Firm. For additional information on Markets revenue, refer to page 70 of the Firm's 2021 Form 10-K.

QUARTERLY TRENDS

(in millions, except rates)

Net interest income - reported

Fully taxable-equivalent adjustments

Net interest income - managed basis (a)

Less: Markets net interest income

Net interest income excluding Markets (a)

Average interest-earning assets

Less: Average Markets interest-earning assets

Average interest-earning assets excluding Markets

Net yield on average interest-earning assets - managed basis

Net yield on average Markets interest-earning assets

Net yield on average interest-earning assets excluding Markets

Noninterest revenue - reported

Fully taxable-equivalent adjustments

Noninterest revenue - managed basis

Less: Markets noninterest revenue

Noninterest revenue excluding Markets

Memo: Markets total net revenue

$

$

$

2Q22

15,128

103

15,231

1,549

13,682

$3,385,894

957,304

$2,428,590

1.80 %

0.65

2.26

$ 15,587

812

$ 16,399

6,241

$ 10,158

$ 7,790

$ 13,872

98

$ 13,970

2,218

$ 11,752

1Q22

$3,401,951

963,845

$2,438,106

$ 16,845

775

$

1.67 %

0.93

1.95

$ 17,620

6,535

11,085

$

8,753

(a) Interest includes the effect of related hedges. Taxable-equivalent amounts are used where applicable.

4Q21

$ 13,601

108

$ 13,709

2,066

$ 11,643

$3,337,855

908,093

$2,429,762

$

1.63 %

0.90

1.90

$ 15,656

984

$ 16,640

3,222

$ 13,418

5,288

$ 13,080

104

13,184

1,967

$ 11,217

$

3Q21

$3,219,786

894,892

$2,324,894

$

1.62 %

0.87

1.91

16,567

690

$ 17,257

4,302

$ 12,955

$ 6,269

$ 12,741

109

12,850

1,987

$ 10,863

$

2Q21

$3,177,195

882,848

$2,294,347

$

$

1.62%

0.90

1.90

17,738

807

$ 18,545

4,800

$ 13,745

6,787

2Q22 Change

1Q22

9%

5

9

(30)

16

1 1

(1)

(7)

5

(7)

(4)

(8)

(11)

2Q21

19%

(6)

19

(22)

26

7

8

6

(12)

1

(12)

30

(26)

15

$

2022

29,000

201

29,201

3,767

$ 25,434

$

$3,393,879

960,556

$2,433,323

1.74 %

0.79

2.11

$ 32,432

1,587

$ 34,019

12,776

$ 21,243

SIX MONTHS ENDED JUNE 30,

$ 16,543

$

2021

25,630

218

$ 25,848

4,210

$ 21,638

$3,152,022

874,764

$2,277,258

1.65%

0.97

1.92

$ 37,115

1,551

$38,666

11,627

$ 27,039

$ 15,837

2022 Change

2021

13 %

(8)

13

(11)

18

8

10

7

(13)

2

(12)

10

(21)

Page 28

4View entire presentation