J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

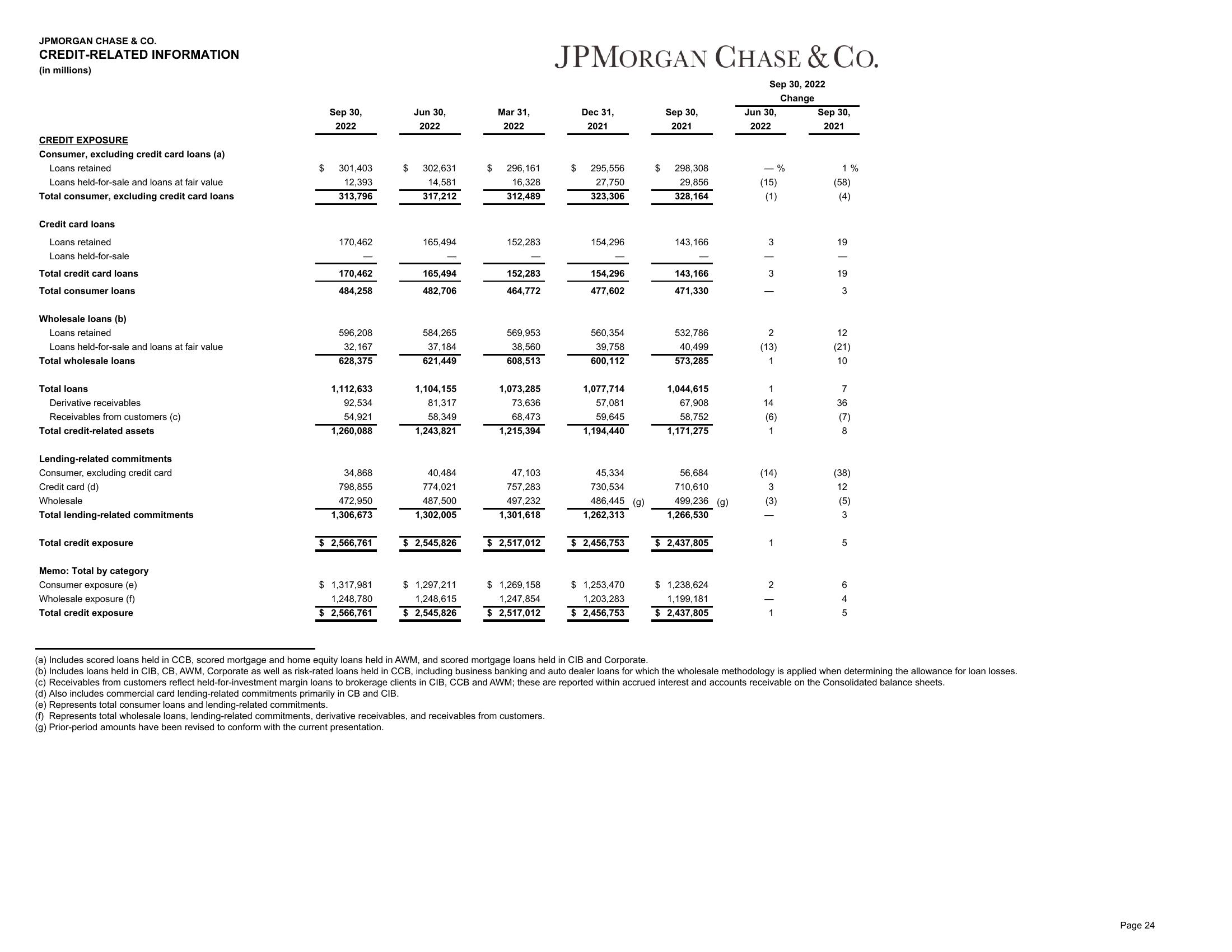

CREDIT-RELATED INFORMATION

(in millions)

CREDIT EXPOSURE

Consumer, excluding credit card loans (a)

Loans retained

Loans held-for-sale and loans at fair value

Total consumer, excluding credit card loans

Credit card loans

Loans retained

Loans held-for-sale

Total credit card loans

Total consumer loans

Wholesale loans (b)

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale loans

Total loans

Derivative receivables

Receivables from customers (c)

Total credit-related assets

Lending-related commitments

Consumer, excluding credit card

Credit card (d)

Wholesale

Total lending-related commitments

Total credit exposure

Memo: Total by category

Consumer exposure (e)

Wholesale exposure (f)

Total credit exposure

$

Sep 30,

2022

301,403

12,393

313,796

170,462

170,462

484,258

596,208

32,167

628,375

1,112,633

92,534

54,921

1,260,088

34,868

798,855

472,950

1,306,673

$ 2,566,761

$1,317,981

1,248,780

$ 2,566,761

Jun 30,

2022

$ 302,631

14,581

317,212

165,494

165,494

482,706

584,265

37,184

621,449

1,104,155

81,317

58,349

1,243,821

40,484

774,021

487,500

1,302,005

$ 2,545,826

$1,297,211

1,248,615

$ 2,545,826

$

Mar 31,

2022

296,161

16,328

312,489

152,283

152,283

464,772

569,953

38,560

608,513

1,073,285

73,636

68,473

1,215,394

47,103

757,283

497,232

1,301,618

$ 2,517,012

$ 1,269,158

1,247,854

$ 2,517,012

JPMORGAN CHASE & CO.

Sep 30, 2022

Change

Dec 31,

2021

295,556

27,750

323,306

154,296

154,296

477,602

560,354

39,758

600,112

1,077,714

57,081

59,645

1,194,440

45,334

730,534

486,445 (g)

1,262,313

$ 2,456,753

$1,253,470

1,203,283

$ 2,456,753

$

Sep 30,

2021

298,308

29,856

328,164

143,166

143,166

471,330

532,786

40,499

573,285

1,044,615

67,908

58,752

1,171,275

56,684

710,610

499,236 (g)

1,266,530

$ 2,437,805

$1,238,624

1,199,181

$ 2,437,805

Jun 30,

2022

- %

(15)

(1)

I w I w

2

(13)

1

1

14

(6)

1

(14)

3

(3)

1

2

1

Sep 30,

2021

1%

(58)

(4)

19

19

3

12

(21)

10

7

36

(7)

8

(38)

12

(5)

3

5

6

4

5

(a) Includes scored loans held in CCB, scored mortgage and home equity loans held in AWM, and scored mortgage loans held in CIB and Corporate.

(b) Includes loans held in CIB, CB, AWM, Corporate as well as risk-rated loans held in CCB, including business banking and auto dealer loans for which the wholesale methodology is applied when determining the allowance for loan losses.

(c) Receivables from customers reflect held-for-investment margin loans to brokerage clients in CIB, CCB and AWM; these are reported within accrued interest and accounts receivable on the Consolidated balance sheets.

(d) Also includes commercial card lending-related commitments primarily in CB and CIB.

(e) Represents total consumer loans and lending-related commitments.

(f) Represents total wholesale loans, lending-related commitments, derivative receivables, and receivables from customers.

(g) Prior-period amounts have been revised to conform with the current presentation.

Page 24View entire presentation