Bird SPAC Presentation Deck

Detailed transaction overview

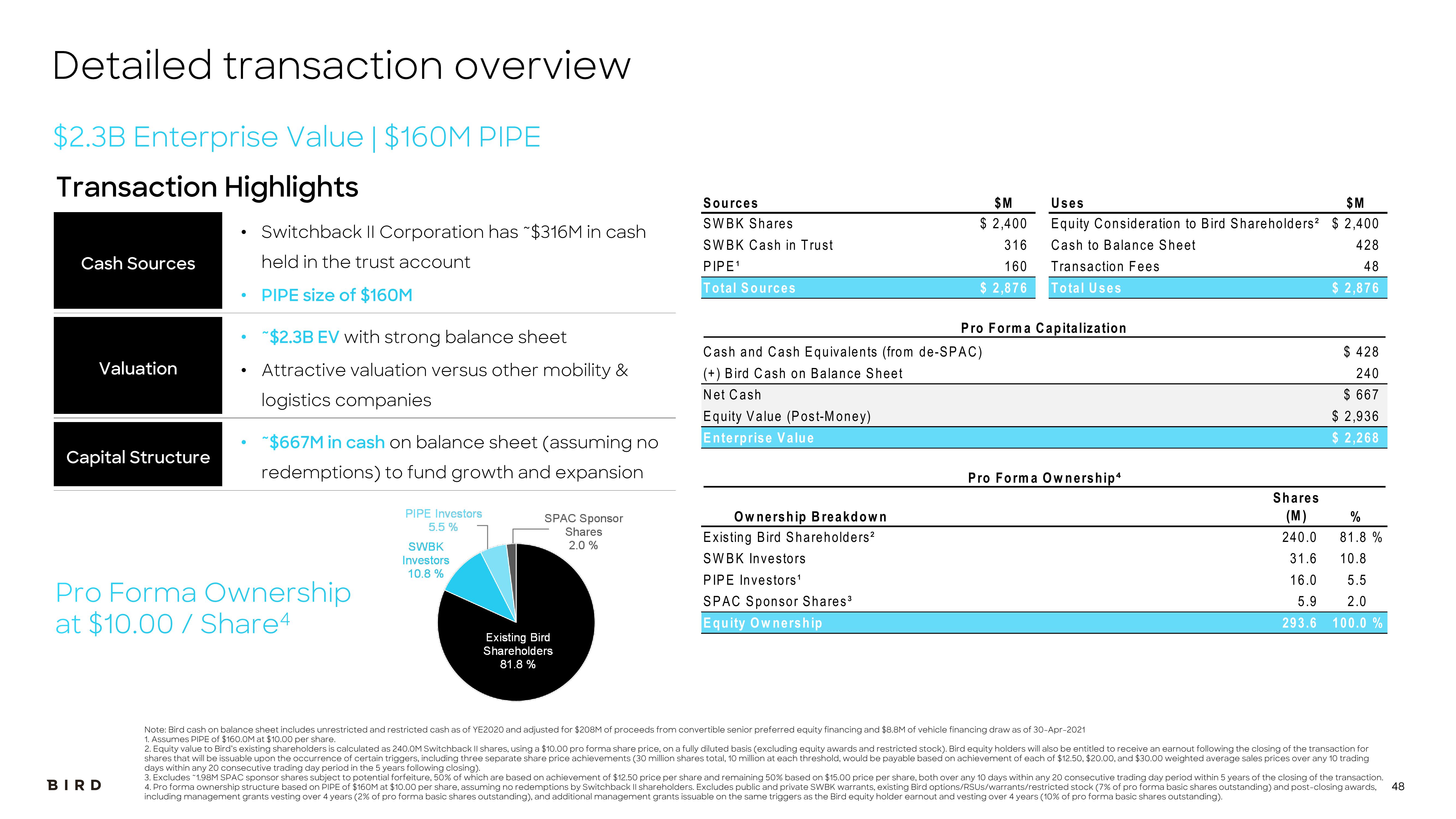

$2.3B Enterprise Value | $160M PIPE

Transaction Highlights

Cash Sources

Valuation

Capital Structure

•

BIRD

Switchback II Corporation has ~$316M in cash

held in the trust account

PIPE size of $160M

~$2.3B EV with strong balance she

Attractive valuation versus other mobility &

logistics companies

"$667M in cash on balance sheet (assuming no

redemptions) to fund growth and expansion

Pro Forma Ownership

at $10.00/Share4

PIPE Investors

5.5%

SWBK

Investors

10.8 %

SPAC Sponsor

Shares

2.0 %

Existing Bird

Shareholders

81.8%

Sources

SWBK Shares

SWBK Cash in Trust

PIPE¹

Total Sources

$M

$ 2,400

316

160

$ 2,876

Ownership Breakdown

Existing Bird Shareholders²

SWBK Investors

PIPE Investors¹

SPAC Sponsor Shares³

Equity Ownership

Cash and Cash Equivalents (from de-SPAC)

(+) Bird Cash on Balance Sheet

Net Cash

Equity Value (Post-Money)

Enterprise Value

Uses

$M

Equity Consideration to Bird Shareholders2 $2,400

Cash to Balance Sheet

Transaction Fees

Total Uses

Pro Forma Capitalization

Pro Forma Ownership4

Note: Bird cash on balance sheet includes unrestricted and restricted cash as of YE2020 and adjusted for $208M of proceeds from convertible senior preferred equity financing and $8.8M of vehicle financing draw as of 30-Apr-2021

1. Assumes PIPE of $160.0M at $10.00 per share.

428

48

$ 2,876

$ 428

240

$ 667

$ 2,936

$2,268

Shares

(M)

240.0

31.6

%

81.8%

10.8

16.0

5.5

5.9

2.0

293.6 100.0 %

2. Equity value to Bird's existing shareholders is calculated as 240.0M Switchback II shares, using a $10.00 pro forma share price, on a fully diluted basis (excluding equity awards and restricted stock). Bird equity holders will also be entitled to receive an earnout following the closing of the transaction for

shares that will be issuable upon the occurrence of certain triggers, including three separate share price achievements (30 million shares total, 10 million at each threshold, would be payable based on achievement of each of $12.50, $20.00, and $30.00 weighted average sales prices over any 10 trading

days within any 20 consecutive trading day period in the 5 years following closing).

3. Excludes *1.98M SPAC sponsor shares subject to potential forfeiture, 50% of which are based on achievement of $12.50 price per share and remaining 50% based on $15.00 price per share, both over any 10 days within any 20 consecutive trading day period within 5 years of the closing of the transaction.

4. Pro forma ownership structure based on PIPE of $160M at $10.00 per share, assuming no redemptions by Switchback II shareholders. Excludes public and private SWBK warrants, existing Bird options/RSUS/warrants/restricted stock (7% of pro forma basic shares outstanding) and post-closing awards,

I

including management grants vesting over 4 years (2% of pro forma basic shares outstanding), and additional management grants issuable on the same triggers as the Bird equity holder earnout and vesting over 4 years (10% of pro forma basic shares outstanding).

48View entire presentation