Lyft Investor Presentation Deck

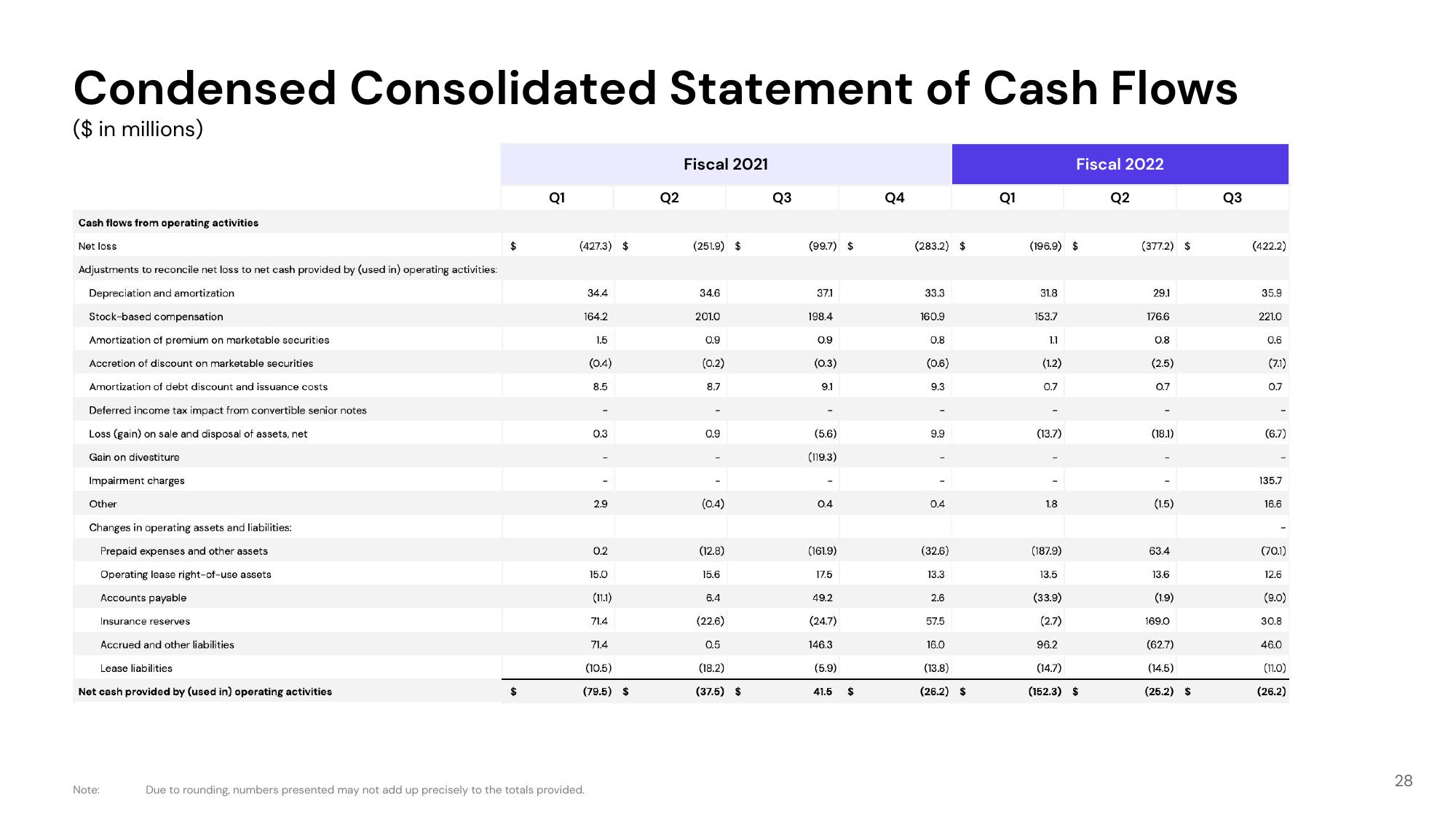

Condensed Consolidated Statement of Cash Flows

($ in millions)

Cash flows from operating activities

Net loss.

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Depreciation and amortization

Stock-based compensation

Amortization of premium on marketable securities

Accretion of discount on marketable securities

Amortization of debt discount and issuance costs

Deferred income tax impact from convertible senior notes

Loss (gain) on sale and disposal of assets, net

Gain on divestiture

Impairment charges

Other

Changes in operating assets and liabilities:

Prepaid expenses and other assets

Operating lease right-of-use assets

Accounts payable

Insurance reserves

Accrued and other liabilities

Lease liabilities

Net cash provided by (used in) operating activities

Note:

$

$

Q1

(427.3) $

34.4

164.2

Due to rounding, numbers presented may not add up precisely to the totals provided.

1.5

(0.4)

8.5

0.3

2.9

0.2

15.0

(11.1)

71.4

71.4

(10.5)

(79.5) $

Q2

Fiscal 2021

(251.9) $

34.6

201.0

0.9

(0.2)

8.7

0.9

(0.4)

(12.8)

15.6

6.4

(22.6)

0.5

(18.2)

(37.5) $

Q3

(99.7) $

37.1

198.4

0.9

(0.3)

9.1

(5.6)

(119.3)

0.4

(161.9)

17.5

49.2

(24.7)

146.3

(5.9)

41.5

$

Q4

(283.2) $

33.3

160.9

0.8

(0.6)

9.3

9.9

0.4

(32.6)

13.3

2.6

57.5

16.0

(13.8)

(26.2) $

Q1

(196.9) $

31.8

153.7

1.1

(1.2)

0.7

(13.7)

1.8

(187.9)

13.5

(33.9)

(2.7)

Fiscal 2022

96.2

(14.7)

(152.3) $

Q2

(377.2) $

29.1

176.6

0.8

(2.5)

0.7

(18.1)

(1.5)

63.4

13.6

(1.9)

169.0

(62.7)

(14.5)

(25.2) $

Q3

(422.2)

35.9

221.0

0.6

(7.1)

0.7

(6.7)

135.7

16.6

(70.1)

12.6

(9.0)

30.8

46.0

(11.0)

(26.2)

28View entire presentation