Arrival SPAC Presentation Deck

INTRODUCTION

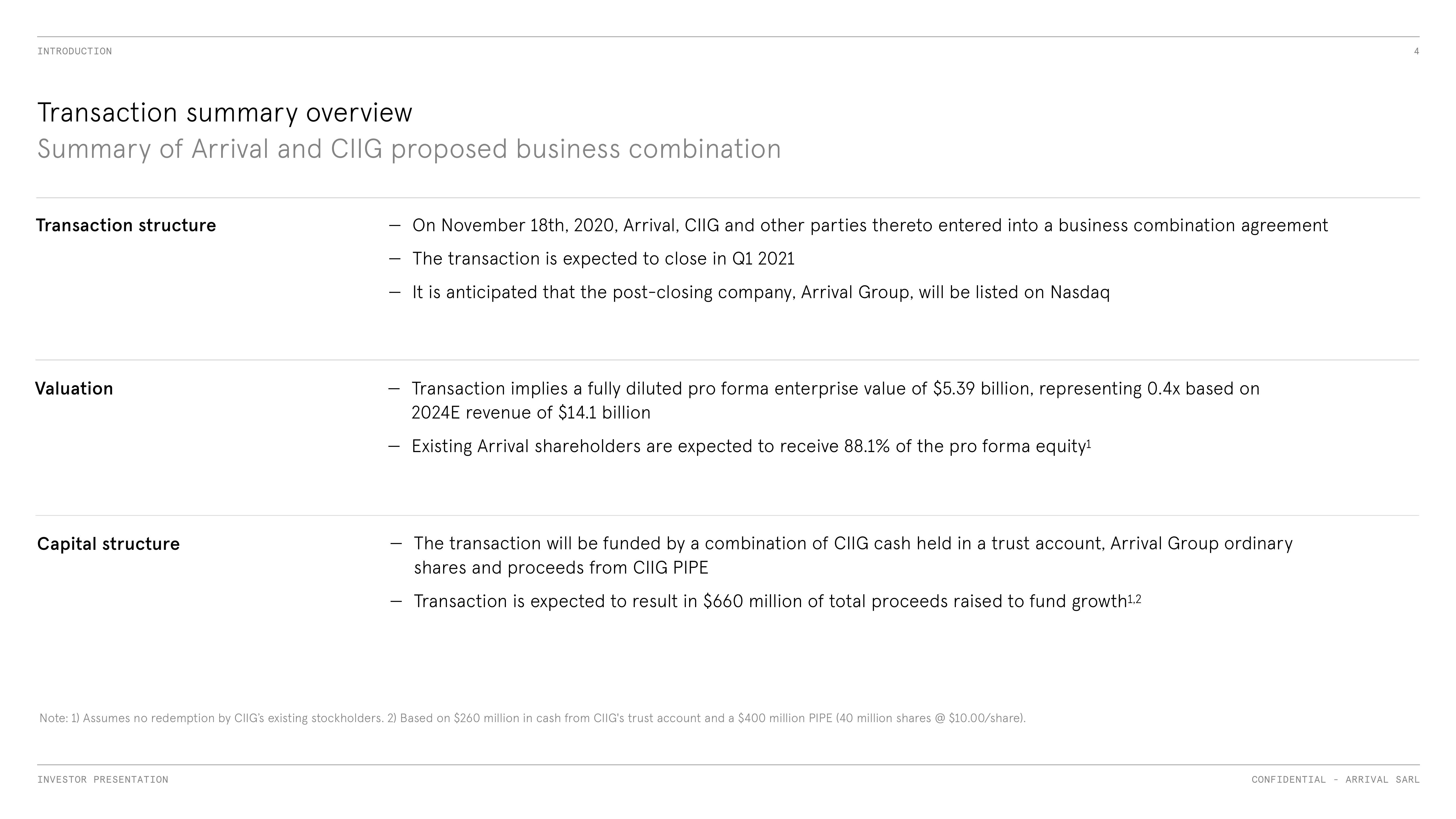

Transaction summary overview

Summary of Arrival and CIIG proposed business combination

Transaction structure

Valuation

Capital structure

On November 18th, 2020, Arrival, CIIG and other parties thereto entered into a business combination agreement

The transaction is expected to close in Q1 2021

- It is anticipated that the post-closing company, Arrival Group, will be listed on Nasdaq

INVESTOR PRESENTATION

-

Transaction implies a fully diluted pro forma enterprise value of $5.39 billion, representing 0.4x based on

2024E revenue of $14.1 billion

Existing Arrival shareholders are expected to receive 88.1% of the pro forma equity¹

The transaction will be funded by a combination of CIIG cash held in a trust account, Arrival Group ordinary

shares and proceeds from CIIG PIPE

Transaction is expected to result in $660 million of total proceeds raised to fund growth¹,2

Note: 1) Assumes no redemption by CIIG's existing stockholders. 2) Based on $260 million in cash from CIIG's trust account and a $400 million PIPE (40 million shares @ $10.00/share).

CONFIDENTIAL - ARRIVAL SARLView entire presentation