Moelis & Company Investor Presentation Deck

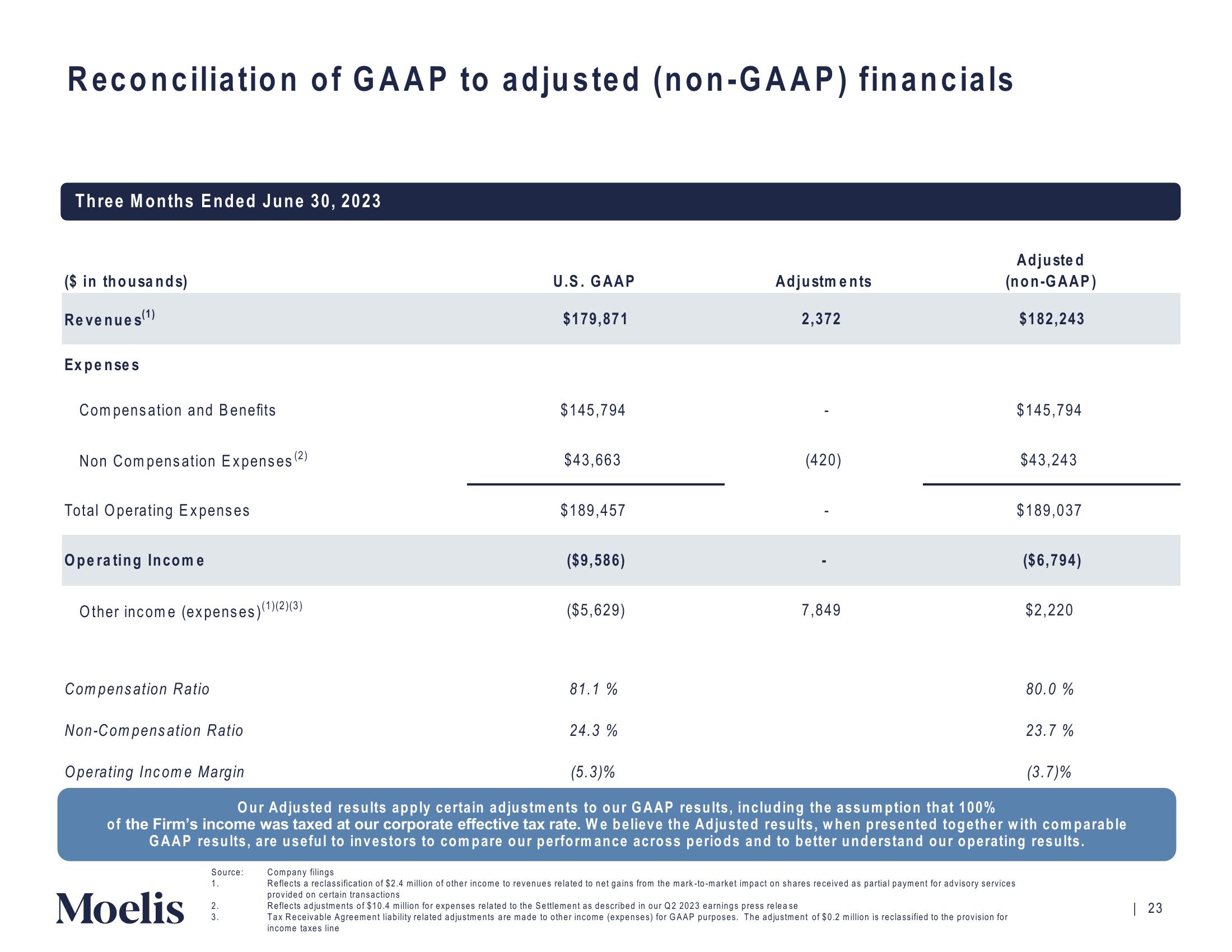

Reconciliation of GAAP to adjusted (non-GAAP) financials

Three Months Ended June 30, 2023

($ in thousands)

Revenues (1)

Expenses

Compensation and Benefits

Non Compensation Expenses (²)

Total Operating Expenses

Operating Income

Other income (expenses) (¹)

Compensation Ratio

Non-Compensation Ratio

Operating Income Margin

(1)(2)(3)

Source:

1.

Moelis 3

2.

3.

U.S. GAAP

$179,871

$145,794

$43,663

$189,457

($9,586)

($5,629)

81.1 %

24.3%

Adjustments

2,372

(420)

7,849

Adjuste d

(non-GAAP)

$182,243

Company filings

Reflects a reclassification of $2.4 million of other income to revenues related to net gains from the mark-to-market impact on shares received as partial payment for advisory services

provided on certain transactions

$145,794

Reflects adjustments of $10.4 million for expenses related to the Settlement as described in our Q2 2023 earnings press release

Tax Receivable Agreement liability related adjustments are made to other income (expenses) for GAAP purposes. The adjustment of $0.2 million is reclassified to the provision for

income taxes line

$43,243

$189,037

($6,794)

$2,220

80.0 %

(5.3)%

Our Adjusted results apply certain adjustments to our GAAP results, including the assumption that 100%

of the Firm's income was taxed at our corporate effective tax rate. We believe the Adjusted results, when presented together with comparable

GAAP results, are useful to investors to compare our performance across periods and to better understand our operating results.

23.7%

(3.7)%

| 23View entire presentation