Rocket Companies Investor Presentation Deck

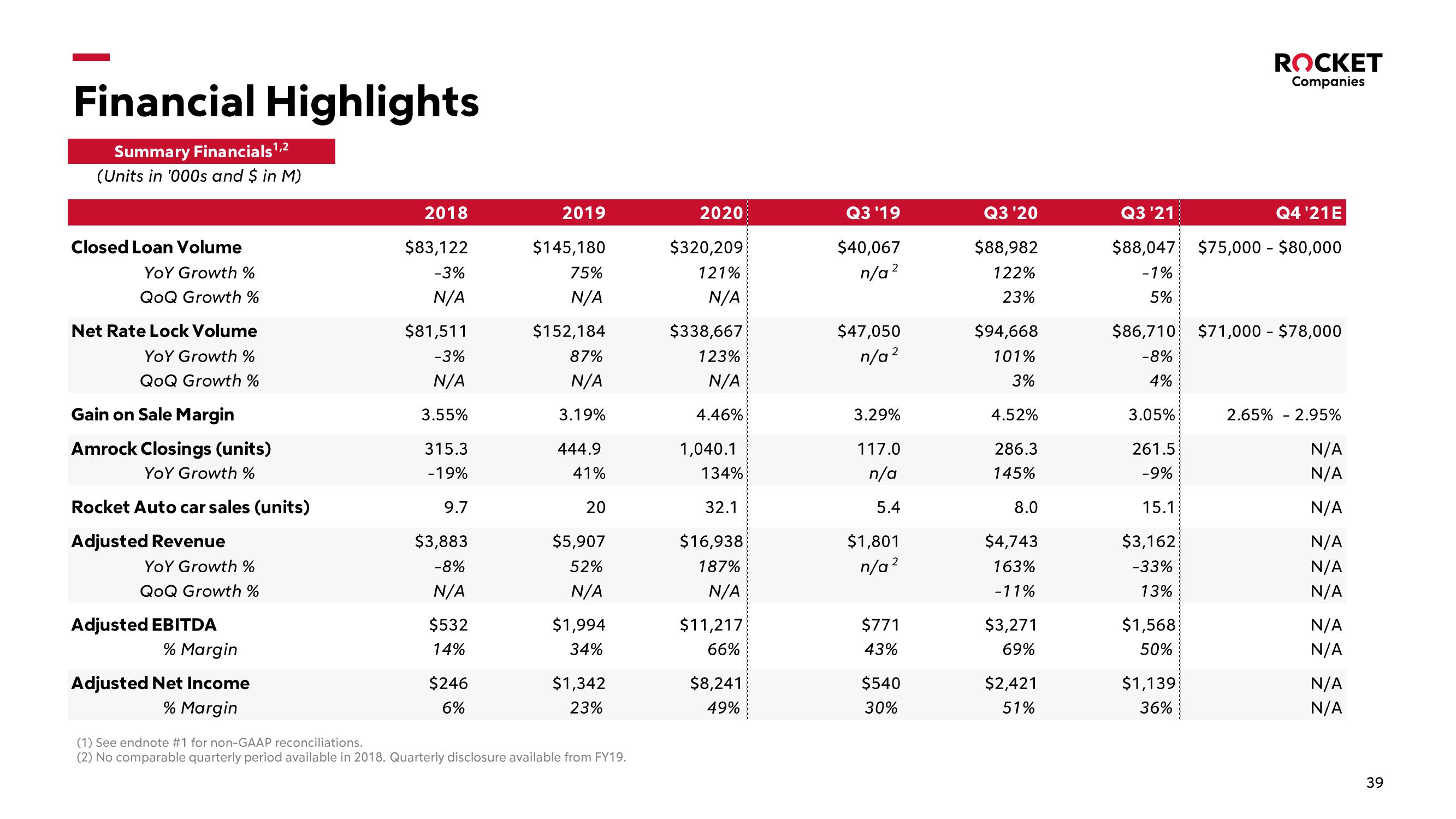

Financial Highlights

Summary Financials ¹,²

(Units in '000s and $ in M)

Closed Loan Volume

YOY Growth %

QoQ Growth %

Net Rate Lock Volume

YOY Growth %

QoQ Growth %

Gain on Sale Margin

Amrock Closings (units)

YOY Growth %

Rocket Auto car sales (units)

Adjusted Revenue

YOY Growth %

QoQ Growth

Adjusted EBITDA

% Margin

Adjusted Net Income

% Margin

2018

$83,122

-3%

N/A

$81,511

-3%

N/A

3.55%

315.3

-19%

9.7

$3,883

-8%

N/A

$532

14%

$246

6%

2019

$145,180

75%

N/A

$152,184

87%

N/A

3.19%

444.9

41%

20

$5,907

52%

N/A

$1,994

34%

$1,342

23%

(1) See endnote #1 for non-GAAP reconciliations.

(2) No comparable quarterly period available in 2018. Quarterly disclosure available from FY19.

2020

$320,209

121%

N/A

$338,667

123%

N/A

4.46%

1,040.1

134%

32.1

$16,938

187%

N/A

$11,217

66%

$8,241

49%

Q3 '19

$40,067

2

n/a ²

$47,050

n/a ²

3.29%

117.0

n/a

5.4

$1,801

2

n/a ²

$771

43%

$540

30%

Q3 '20

$88,982

122%

23%

$94,668

101%

3%

4.52%

286.3

145%

8.0

$4,743

163%

-11%

$3,271

69%

$2,421

51%

Q3 '21

Q4 '21E

$88,047 $75,000 - $80,000

-1%

5%

$86,710 $71,000 - $78,000

-8%

4%

3.05%

261.5

-9%

15.1

$3,162

-33%

13%

ROCKET

Companies

$1,568

50%

$1,139

36%

2.65% 2.95%

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

39View entire presentation