First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

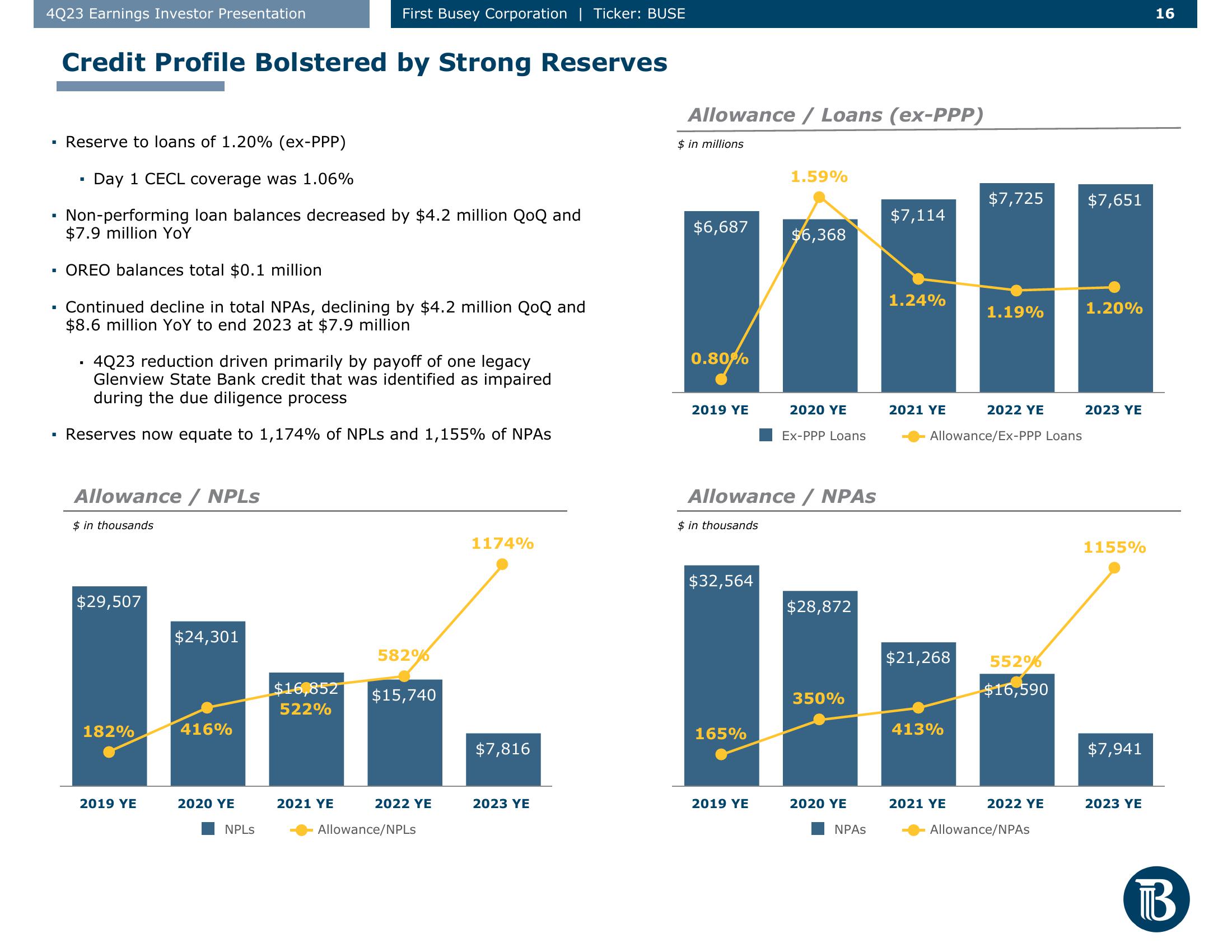

Credit Profile Bolstered by Strong Reserves

Reserve to loans of 1.20% (ex-PPP)

Day 1 CECL coverage was 1.06%

I

Non-performing loan balances decreased by $4.2 million QoQ and

$7.9 million YoY

OREO balances total $0.1 million

Continued decline in total NPAs, declining by $4.2 million QoQ and

$8.6 million YoY to end 2023 at $7.9 million

4Q23 reduction driven primarily by payoff of one legacy

Glenview State Bank credit that was identified as impaired

during the due diligence process

Reserves now equate to 1,174% of NPLs and 1,155% of NPAs

■

Allowance / NPLs

$ in thousands

$29,507

182%

2019 YE

$24,301

416%

2020 YE

First Busey Corporation | Ticker: BUSE

NPLs

$16,852

522%

2021 YE

582%

$15,740

2022 YE

Allowance/NPLs

1174%

$7,816

2023 YE

Allowance / Loans (ex-PPP)

$ in millions

$6,687

0.80%

2019 YE

$32,564

165%

1.59%

Allowance / NPAS

$ in thousands

2019 YE

$6,368

2020 YE

Ex-PPP Loans

$28,872

350%

2020 YE

NPAS

$7,114

1.24%

2021 YE

$21,268

413%

$7,725

2021 YE

1.19%

Allowance/Ex-PPP Loans

2022 YE

552%

$16,590

2022 YE

Allowance/NPAs

$7,651

L

1.20%

2023 YE

1155%

$7,941

2023 YE

16

BView entire presentation