Sonder Investor Presentation Deck

Non-GAAP Reconciliations

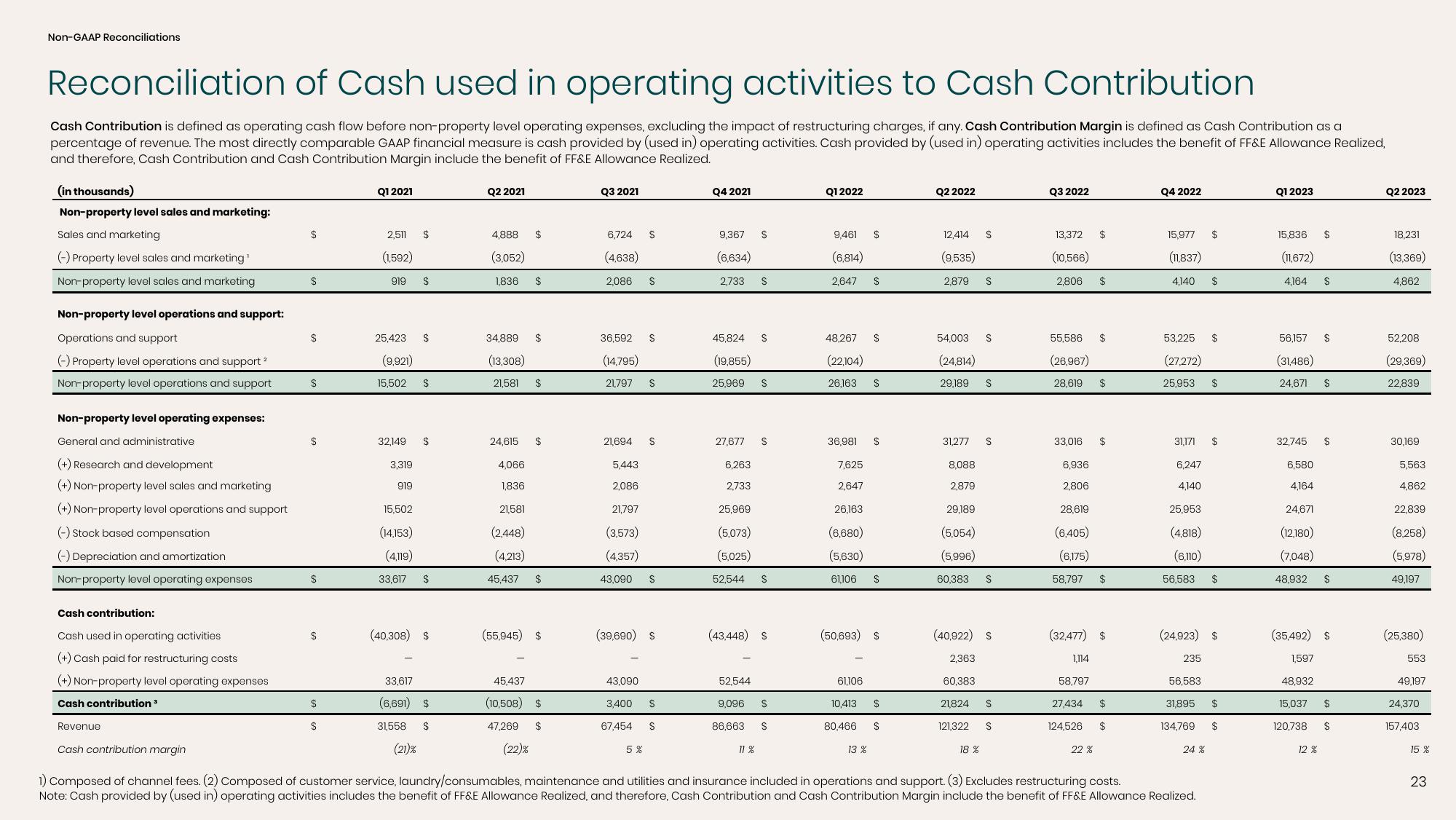

Reconciliation of Cash used in operating activities to Cash Contribution

Cash Contribution is defined as operating cash flow before non-property level operating expenses, excluding the impact of restructuring charges, if any. Cash Contribution Margin is defined as Cash Contribution as a

percentage of revenue. The most directly comparable GAAP financial measure is cash provided by (used in) operating activities. Cash provided by (used in) operating activities includes the benefit of FF&E Allowance Realized,

and therefore, Cash Contribution and Cash Contribution Margin include the benefit of FF&E Allowance Realized.

(in thousands)

Non-property level sales and marketing:

Sales and marketing

(-) Property level sales and marketing¹

Non-property level sales and marketing

Non-property level operations and support:

Operations and support

(-) Property level operations and support ²

Non-property level operations and support

Non-property level operating expenses:

General and administrative

(+) Research and development

(+) Non-property level sales and marketing

(+) Non-property level operations and support

(-) Stock based compensation

(-) Depreciation and amortization

Non-property level operating expenses

Cash contribution:

Cash used in operating activities

(+) Cash paid for restructuring costs

(+) Non-property level operating expenses

Cash contribution ³

Revenue

S

S

S

S

S

S

S

S

S

Q1 2021

2,511

(1,592)

919

25,423

32,149

3,319

919

$

(9,921)

15,502 $

15.502

$

$

$

(14,153)

(4,119)

33,617 $

(40,308) $

33,617

(6,691) $

31,558 $

(21)%

Q2 2021

4,888

(3,052)

1,836

24,615

$

34,889

(13,308)

21,581 $

4,066

1,836

$

$

$

21,581

(2,448)

(4,213)

45,437 $

(55,945) $

45,437

(10,508) $

47,269 $

(22)%

Q3 2021

6,724

(4,638)

2,086 $

36,592

(14,795)

21,797

21,694

5,443

2,086

21,797

(3,573)

(4,357)

43,090

43,090

$

3,400

$

$

(39,690) $

5%

$

$

$

67,454 $

Q4 2021

9,367

(6,634)

2,733 $

45,824 $

(19,855)

25,969 $

27,677

$

6,263

2,733

$

25,969

(5,073)

(5,025)

52,544 $

(43,448) $

52,544

9,096 $

86,663 $

11%

Q1 2022

9,461

(6,814)

2,647

36,981

48,267 S

(22,104)

26,163

7,625

2,647

26,163

(6,680)

(5,630)

61,106

S

61,106

S

$

13 %

S

(50,693) S

S

10,413 $

80,466 S

Q2 2022

12,414

(9,535)

2,879

31,277

8,088

2,879

54,003

(24,814)

29,189 $

$

2,363

$

60,383

$

29,189

(5,054)

(5,996)

60,383 $

(40,922) $

$

18 %

21,824 $

121,322 $

Q3 2022

13,372

(10,566)

2,806

55,586

(26,967)

28,619

33,016

6,936

2,806

28,619

(6,405)

(6,175)

58,797

1,114

58,797

27,434

124,526

$

$

(32,477) $

22 %

$

$

$

$

$

$

Q4 2022

15,977

(11,837)

4,140

31,171

53,225 $

(27,272)

25,953

6,247

4,140

25,953

(4,818)

(6,110)

56,583

Cash contribution margin

1) Composed of channel fees. (2) Composed of customer service, laundry/consumables, maintenance and utilities and insurance included in operations and support. (3) Excludes restructuring costs.

Note: Cash provided by (used in) operating activities includes the benefit of FF&E Allowance Realized, and therefore, Cash Contribution and Cash Contribution Margin include the benefit of FF&E Allowance Realized.

235

56,583

31,895

134,769

$

$

(24,923) $

24 %

$

$

$

$

$

Q1 2023

15,836

(11,672)

4,164

56,157

(31,486)

24,671

32,745

6,580

4,164

24,671

(12,180)

(7,048)

48,932

48,932

15,037

120,738

$

12 %

$

$

$

(35,492) $

1,597

$

$

$

$

Q2 2023

18,231

(13,369)

4,862

52,208

(29,369)

22,839

30,169

5,563

4,862

22,839

(8,258)

(5,978)

49,197

(25,380)

553

49,197

24,370

157,403

15 %

23View entire presentation