Bank of America Investment Banking Pitch Book

Introduction

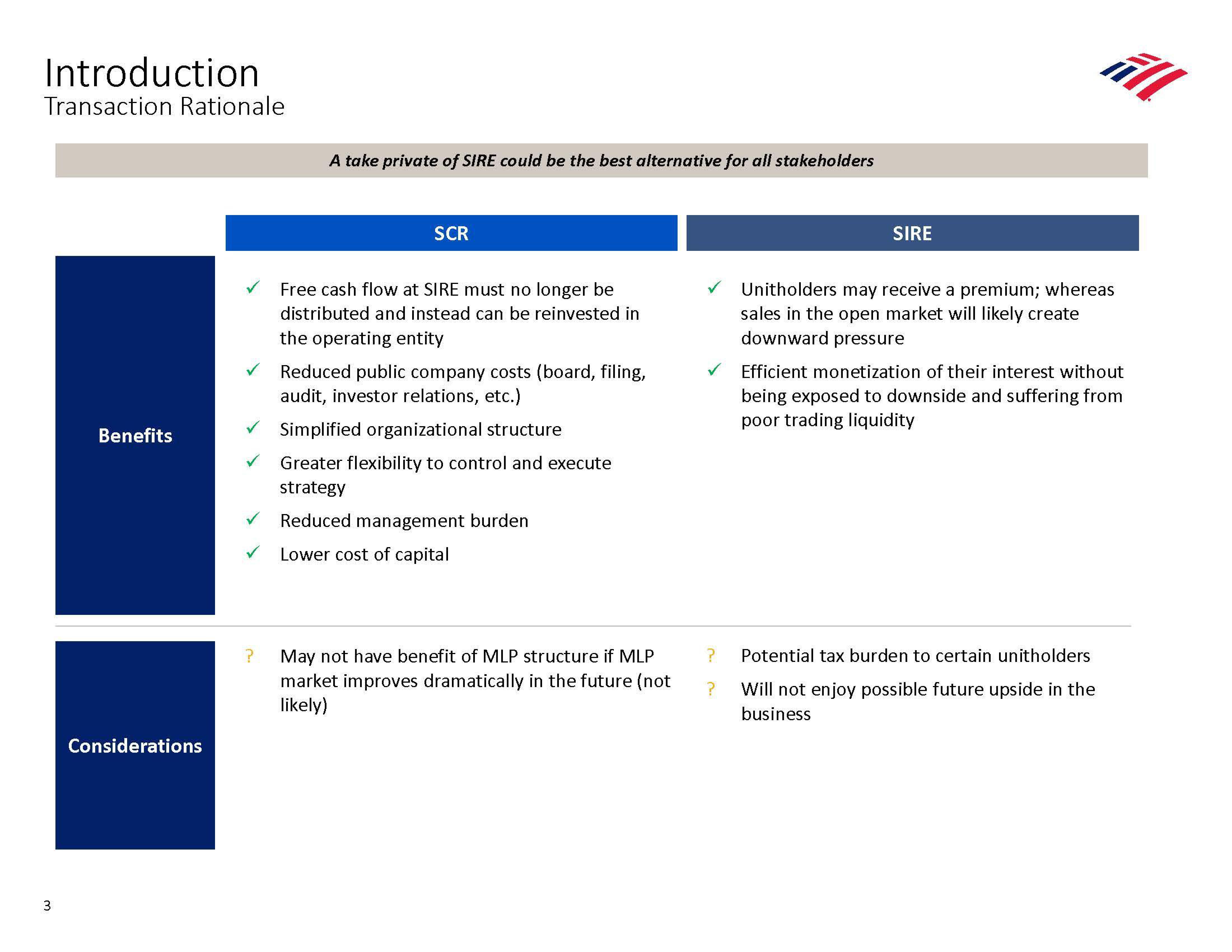

Transaction Rationale

3

Benefits

Considerations

?

A take private of SIRE could be the best alternative for all stakeholders

SCR

Free cash flow at SIRE must no longer be

distributed and instead can be reinvested in

the operating entity

Reduced public company costs (board, filing,

audit, investor relations, etc.)

Simplified organizational structure

Greater flexibility to control and execute

strategy

Reduced management burden

Lower cost of capital

May not have benefit of MLP structure if MLP

market improves dramatically in the future (not

likely)

?

?

SIRE

Unitholders may receive a premium; whereas

sales in the open market will likely create

downward pressure

Efficient monetization of their interest without

being exposed to downside and suffering from

poor trading liquidity

Potential tax burden to certain unitholders

Will not enjoy possible future upside in the

business

illView entire presentation