Allwyn Results Presentation Deck

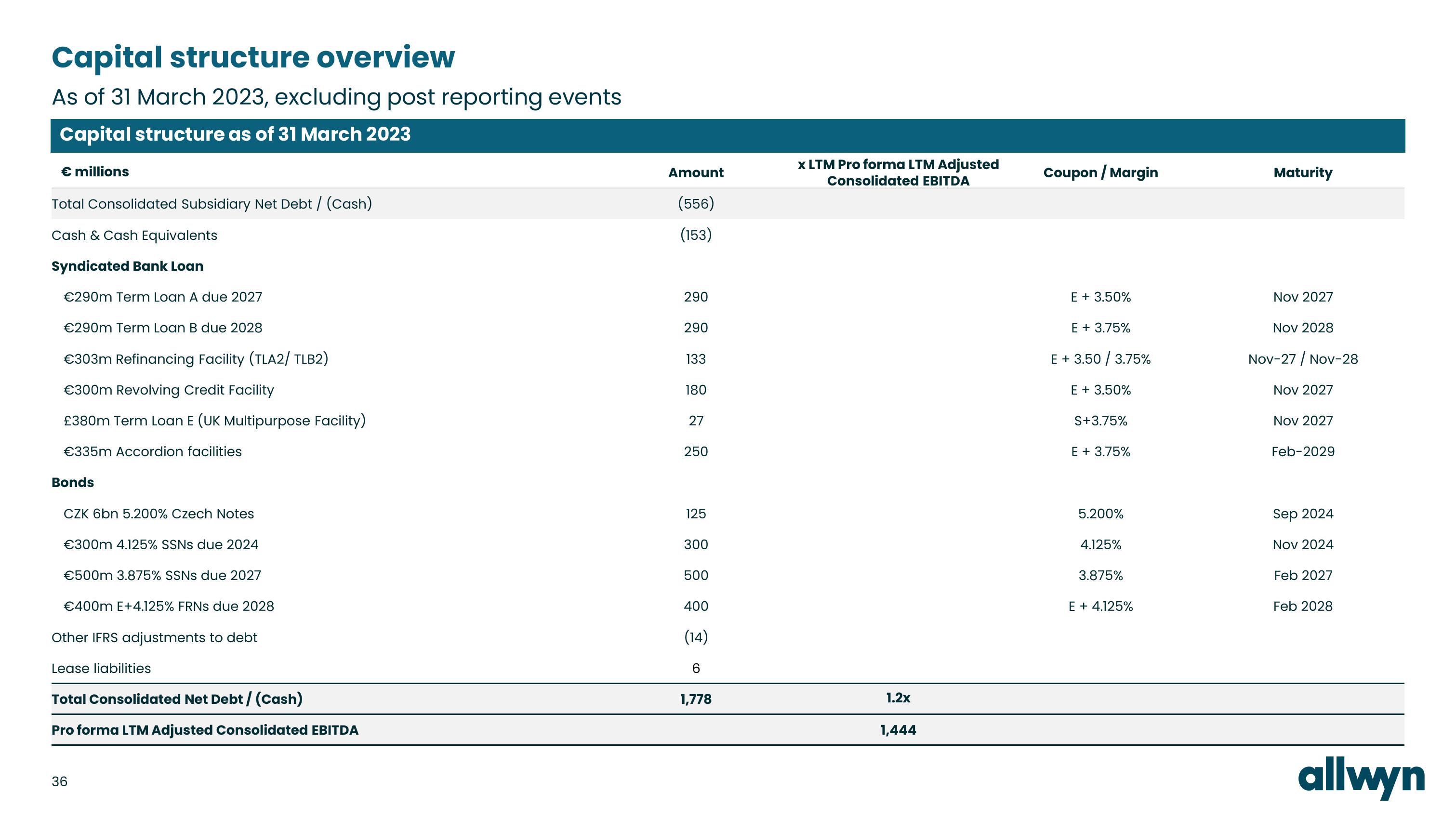

Capital structure overview

As of 31 March 2023, excluding post reporting events

Capital structure as of 31 March 2023

€ millions

Total Consolidated Subsidiary Net Debt / (Cash)

Cash & Cash Equivalents

Syndicated Bank Loan

€290m Term Loan A due 2027

€290m Term Loan B due 2028

€303m Refinancing Facility (TLA2/ TLB2)

€300m Revolving Credit Facility

£380m Term Loan E (UK Multipurpose Facility)

€335m Accordion facilities

Bonds

CZK 6bn 5.200% Czech Notes

€300m 4.125% SSNS due 2024

€500m 3.875% SSNS due 2027

€400m E+4.125% FRNS due 2028

Other IFRS adjustments to debt

Lease liabilities

Total Consolidated Net Debt / (Cash)

Pro forma LTM Adjusted Consolidated EBITDA

36

Amount

(556)

(153)

290

290

133

180

27

250

125

300

500

400

(14)

6

1,778

x LTM Pro forma LTM Adjusted

Consolidated EBITDA

1.2x

1,444

Coupon / Margin

E + 3.50%

E + 3.75%

E +3.50 / 3.75%

E + 3.50%

S+3.75%

E + 3.75%

5.200%

4.125%

3.875%

E + 4.125%

Maturity

Nov 2027

Nov 2028

Nov-27 / Nov-28

Nov 2027

Nov 2027

Feb-2029

Sep 2024

Nov 2024

Feb 2027

Feb 2028

allwynView entire presentation