Bank of America Results Presentation Deck

Global Wealth & Investment Management

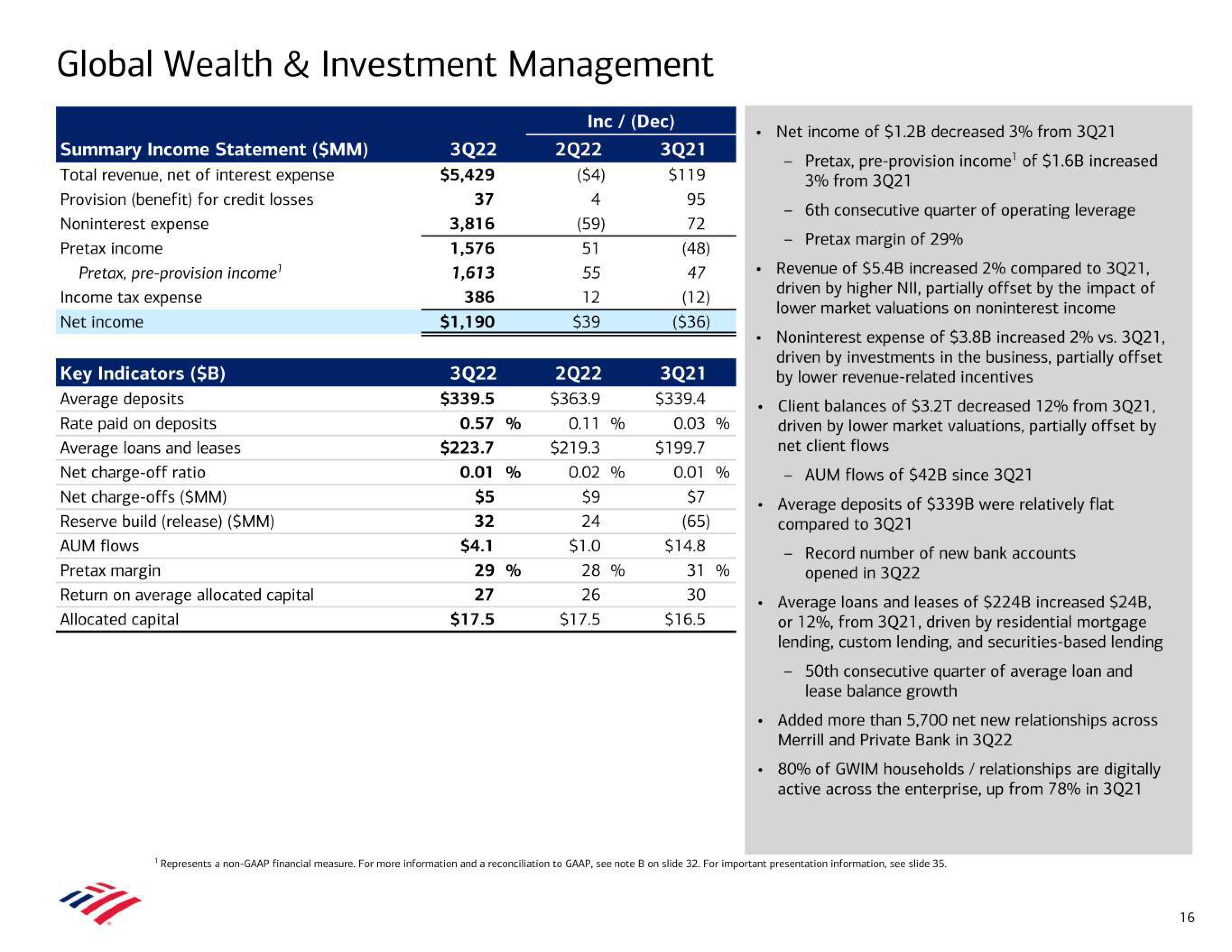

Summary Income Statement ($MM)

Total revenue, net of interest expense

Provision (benefit) for credit losses

Noninterest expense

Pretax income

Pretax, pre-provision income¹

Income tax expense

Net income

Key Indicators ($B)

Average deposits

Rate paid on deposits

Average loans and leases

Net charge-off ratio

Net charge-offs ($MM)

Reserve build (release) ($MM)

AUM flows

Pretax margin

Return on average allocated capital

Allocated capital

All

3Q22

$5,429

37

3,816

1,576

1,613

386

$1,190

3Q22

$339.5

0.57 %

$223.7

0.01 %

$5

32

$4.1

29 %

27

$17.5

Inc / (Dec)

2Q22

($4)

4

(59)

51

55

12

$39

2Q22

$363.9

0.11 %

$219.3

0.02 %

$9

24

$1.0

28 %

26

$17.5

3Q21

$119

95

72

(48)

47

(12)

($36)

3Q21

$339.4

0.03 %

$199.7

0.01 %

$7

(65)

$14.8

31 %

30

$16.5

.

.

.

Net income of $1.2B decreased 3% from 3Q21

Pretax, pre-provision income of $1.6B increased

3% from 3Q21

6th consecutive quarter of operating leverage

Pretax margin of 29%

Revenue of $5.4B increased 2% compared to 3Q21,

driven by higher NII, partially offset by the impact of

lower market valuations on noninterest income

Noninterest expense of $3.8B increased 2% vs. 3Q21,

driven by investments in the business, partially offset

by lower revenue-related incentives

Client balances of $3.2T decreased 12% from 3Q21,

driven by lower market valuations, partially offset by

net client flows

AUM flows of $42B since 3Q21

Average deposits of $339B were relatively flat

compared to 3Q21

Record number of new bank accounts

opened in 3Q22

Average loans and leases of $224B increased $24B,

or 12%, from 3Q21, driven by residential mortgage

lending, custom lending, and securities-based lending

-

50th consecutive quarter of average loan and

lease balance growth

Added more than 5,700 net new relationships across

Merrill and Private Bank in 3Q22

80% of GWIM households / relationships are digitally

active across the enterprise, up from 78% in 3Q21

Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note B on slide 32. For important presentation information, see slide 35.

16View entire presentation