Intertek Results Presentation Deck

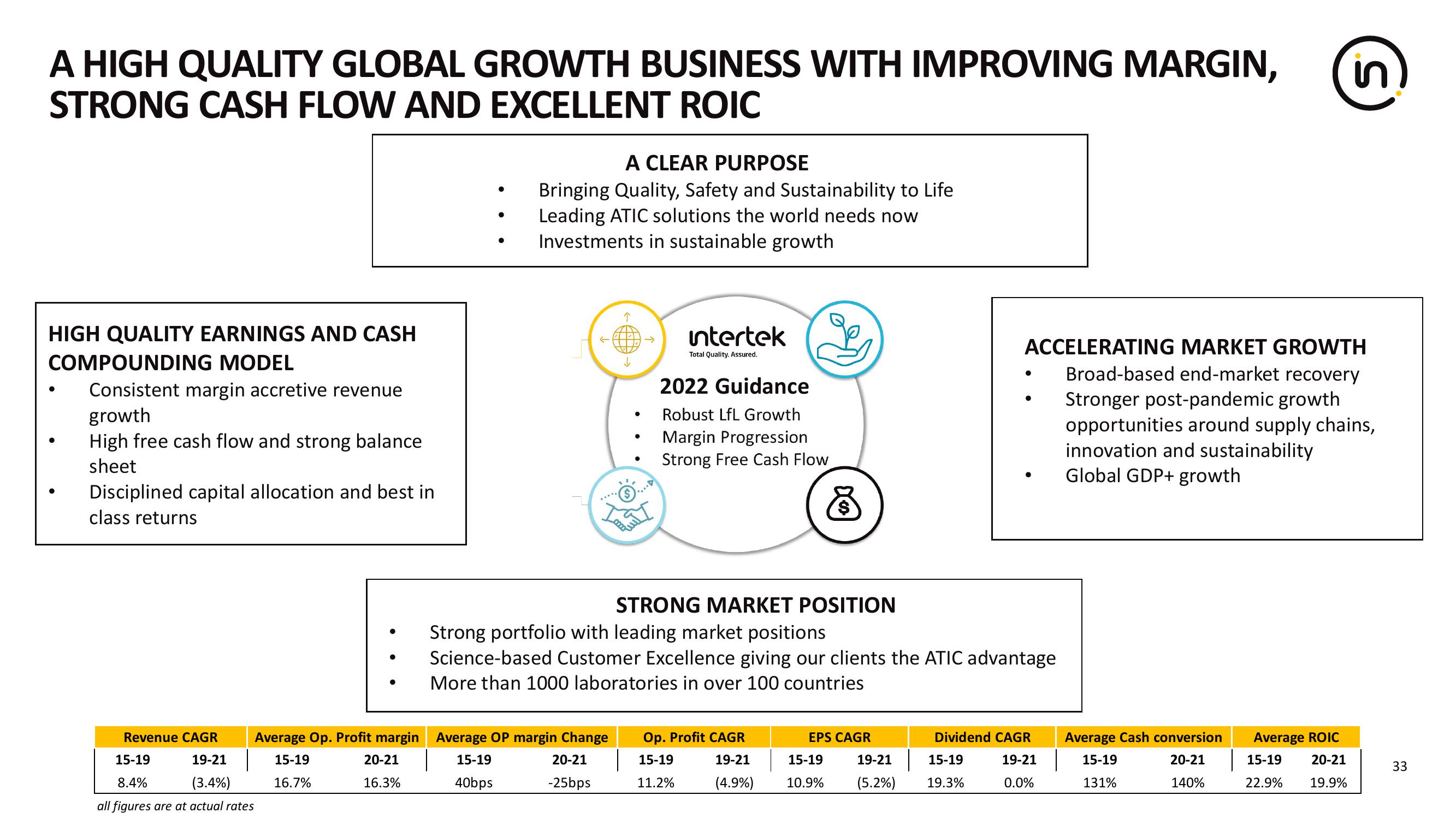

A HIGH QUALITY GLOBAL GROWTH BUSINESS WITH IMPROVING MARGIN,

STRONG CASH FLOW AND EXCELLENT ROIC

HIGH QUALITY EARNINGS AND CASH

COMPOUNDING MODEL

Consistent margin accretive revenue

growth

High free cash flow and strong balance

sheet

Disciplined capital allocation and best in

class returns

Revenue CAGR

Average Op. Profit margin

15-19

16.7%

15-19

19-21

8.4%

(3.4%)

all figures are at actual rates

20-21

16.3%

●

A CLEAR PURPOSE

Bringing Quality, Safety and Sustainability to Life

Leading ATIC solutions the world needs now

Investments in sustainable growth

↑

↓

●

T

interteke

Total Quality. Assured.

2022 Guidance

Robust LfL Growth

Margin Progression

Strong Free Cash Flow

8

STRONG MARKET POSITION

Average OP margin Change Op. Profit CAGR

15-19

| 15-19

20-21

-25bps

19-21

(4.9%)

40bps

11.2%

Strong portfolio with leading market positions

Science-based Customer Excellence giving our clients the ATIC advantage

More than 1000 laboratories in over 100 countries

ACCELERATING MARKET GROWTH

Broad-based end-market recovery

Stronger post-pandemic growth

opportunities around supply chains,

innovation and sustainability

Global GDP+ growth

EPS CAGR

Dividend CAGR

15-19 19-21 15-19

19-21

10.9% (5.2%) 19.3%

0.0%

in

Average Cash conversion

15-19

20-21

140%

131%

S

Average ROIC

15-19 20-21

22.9% 19.9%

33View entire presentation