Repay SPAC

Key Highlights

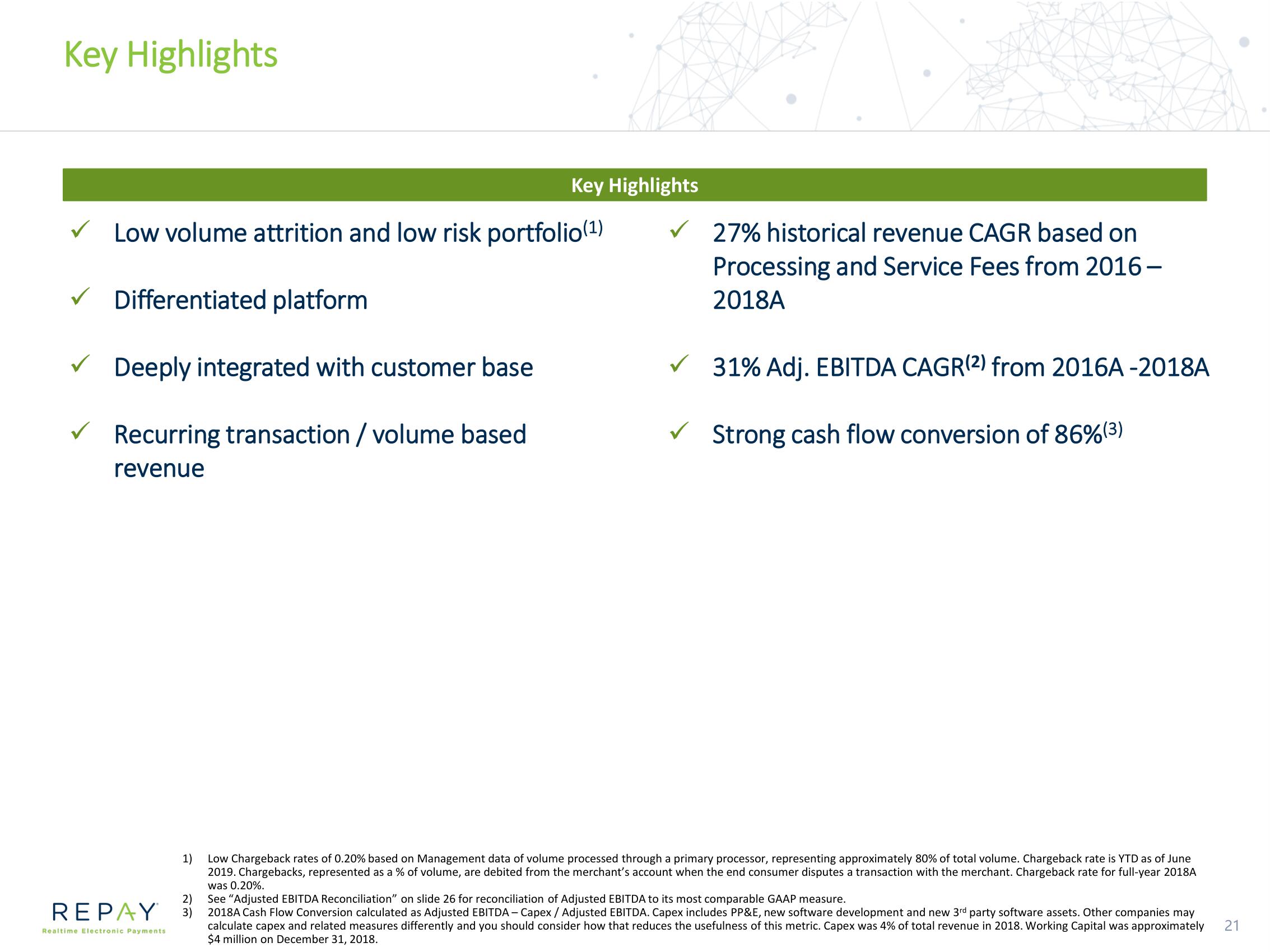

✓ Low volume attrition and low risk portfolio(¹)

✓ Differentiated platform

✓

Deeply integrated with customer base

Recurring transaction / volume based

revenue

Key Highlights

2)

REPAY 3)

Realtime Electronic Payments

27% historical revenue CAGR based on

Processing and Service Fees from 2016-

2018A

✓ 31% Adj. EBITDA CAGR(2) from 2016A-2018A

✓ Strong cash flow conversion of 86% (3)

1)

Low Chargeback rates of 0.20% based on Management data of volume processed through a primary processor, representing approximately 80% of total volume. Chargeback rate is YTD as of June

2019. Chargebacks, represented as a % of volume, are debited from the merchant's account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-year 2018A

was 0.20%.

See "Adjusted EBITDA Reconciliation" on slide 26 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure.

2018A Cash Flow Conversion calculated as Adjusted EBITDA-Capex / Adjusted EBITDA. Capex includes PP&E, new software development and new 3rd party software assets. Other companies may

calculate capex and related measures differently and you should consider how that reduces the usefulness of this metric. Capex was 4% of total revenue in 2018. Working Capital was approximately

$4 million on December 31, 2018.

21View entire presentation