Bakkt SPAC Presentation Deck

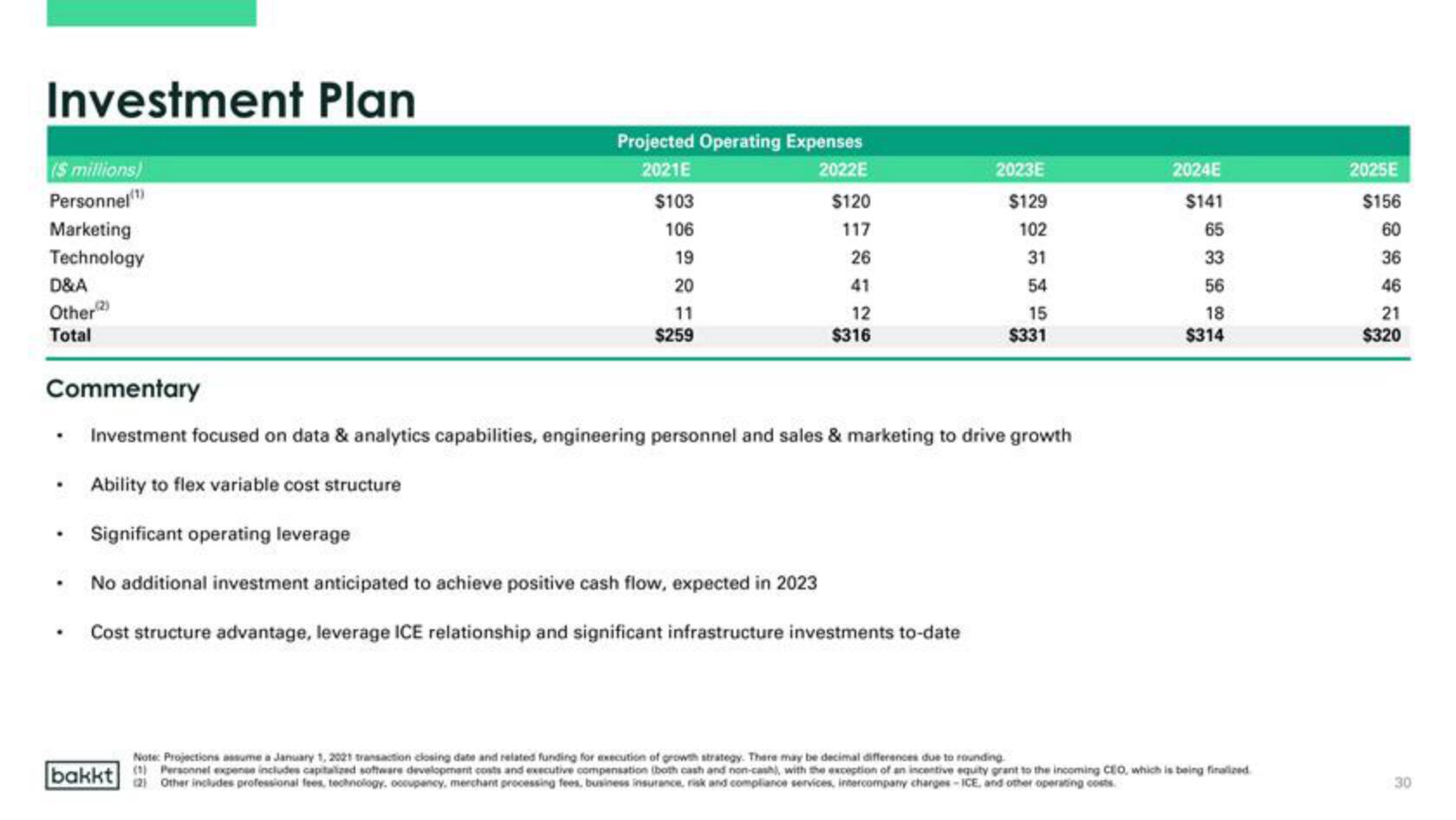

Investment Plan

($ millions)

Personnel(¹)

Marketing

Technology

D&A

Other (2)

Total

.

.

.

.

Commentary

Investment focused on data & analytics capabilities, engineering personnel and sales & marketing to drive growth

Ability to flex variable cost structure

Significant operating leverage

.

Projected Operating Expenses

2021E

2022E

$103

106

19

bakkt

20

11

$259

$120

117

26

41

12

$316

No additional investment anticipated to achieve positive cash flow, expected in 2023

Cost structure advantage, leverage ICE relationship and significant infrastructure investments to-date

2023E

$129

102

31

54

15

$331

2024E

$141

65

33

56

18

$314

Note: Projections assume a January 1, 2021 transaction closing date and related funding for execution of growth strategy. There may be decimal differences due to rounding

(1) Personnel expense includes capitalized software development costs and executive compensation (both cash and non-cash), with the exception of an incentive equity grant to the incoming CEO, which is being finalized

(2) Other includes professional fees, technology, occupancy, merchant processing fees, business insurance, risk and compliance services, intercompany charges-ICE, and other operating costs

2025E

$156

60

36

46

21

$320

30View entire presentation