Blackwells Capital Activist Presentation Deck

BUSINESS OVERVIEW

WPT Industrial REIT is an ...

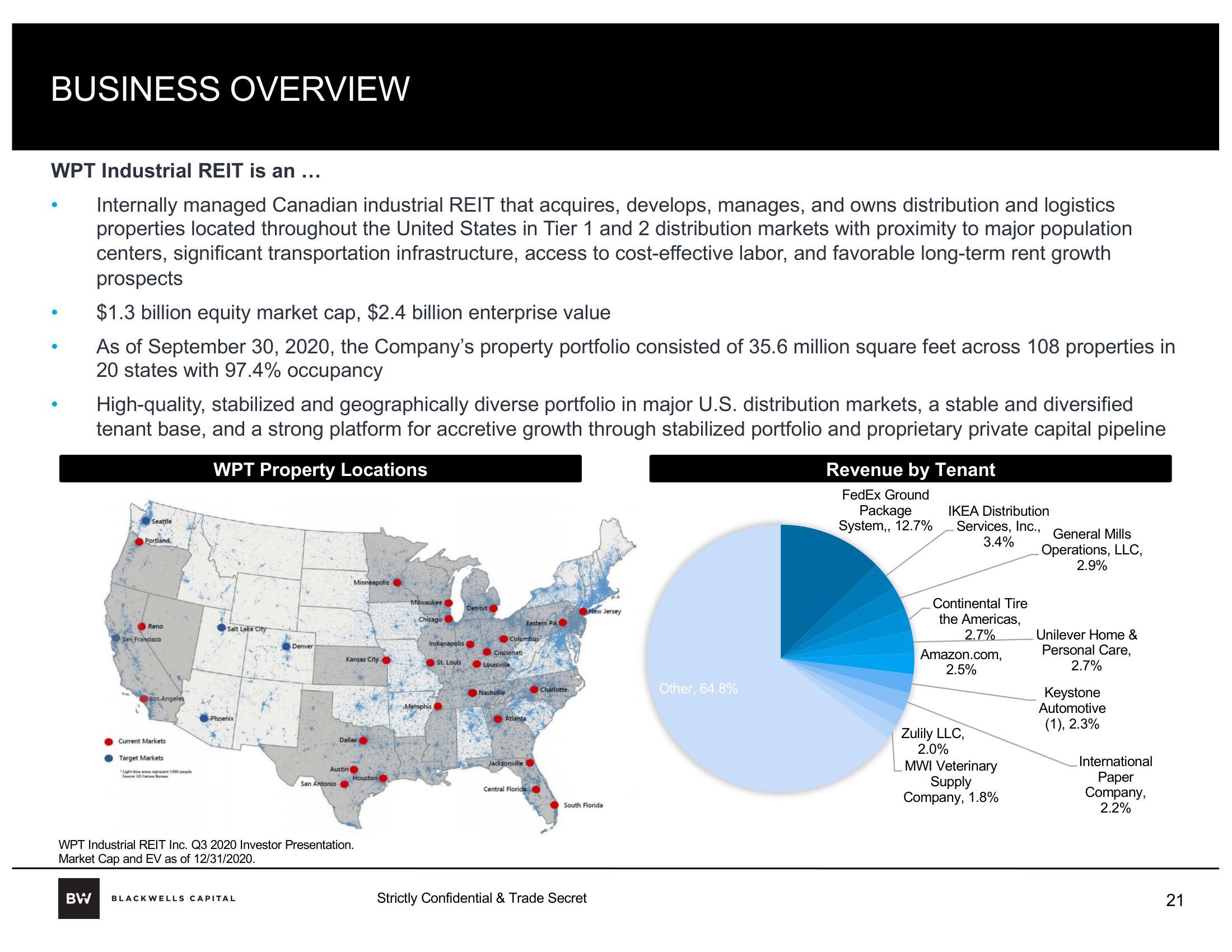

Internally managed Canadian industrial REIT that acquires, develops, manages, and owns distribution and logistics

properties located throughout the United States in Tier 1 and 2 distribution markets with proximity to major population

centers, significant transportation infrastructure, access to cost-effective labor, and favorable long-term rent growth

prospects

$1.3 billion equity market cap, $2.4 billion enterprise value

As of September 30, 2020, the Company's property portfolio consisted of 35.6 million square feet across 108 properties in

20 states with 97.4% occupancy

BW

High-quality, stabilized and geographically diverse portfolio in major U.S. distribution markets, a stable and diversified

tenant base, and a strong platform for accretive growth through stabilized portfolio and proprietary private capital pipeline

WPT Property Locations

Seattle

Portland

Reno

San Francisco

Los Angeles

Current Markets

Target Markets

Light blue areas represent 1,000 people

Source: US Cenau Bur

Salt Lake City

Phoenix

Denver

BLACKWELLS CAPITAL

San Antonio

Minneapolis

Kansas City.

Austin

Dallas

WPT Industrial REIT Inc. Q3 2020 Investor Presentation.

Market Cap and EV as of 12/31/2020.

Houston

Milwaukee

Chicago

Indianapolis

Memphis

St. Louis

Detroit

Cincinnati

Louisville

Nashville

Columbus

Eastern PA

Atlanta

Jacksonville

Central Florida

Charlotte

New Jersey

South Florida

Strictly Confidential & Trade Secret

Other, 64.8%

Revenue by Tenant

FedEx Ground

Package

System,, 12.7%

IKEA Distribution

Services, Inc.,

3.4%

Continental Tire

the Americas,

2.7%

Amazon.com,

2.5%

Zulily LLC,

2.0%

MWI Veterinary

Supply

Company, 1.8%

General Mills

Operations, LLC,

2.9%

Unilever Home &

Personal Care,

2.7%

Keystone

Automotive

(1), 2.3%

International

Paper

Company,

2.2%

21View entire presentation