First-Quarter 2023 Earnings Presentation

Significant Improvement in Earnings Profile

1

3

$1.50

$1.15

$0.80

ī

$0.45

30%

20%

10%

0%

$0.46 $0.52

2%

3Q20 4020 1Q21

2019

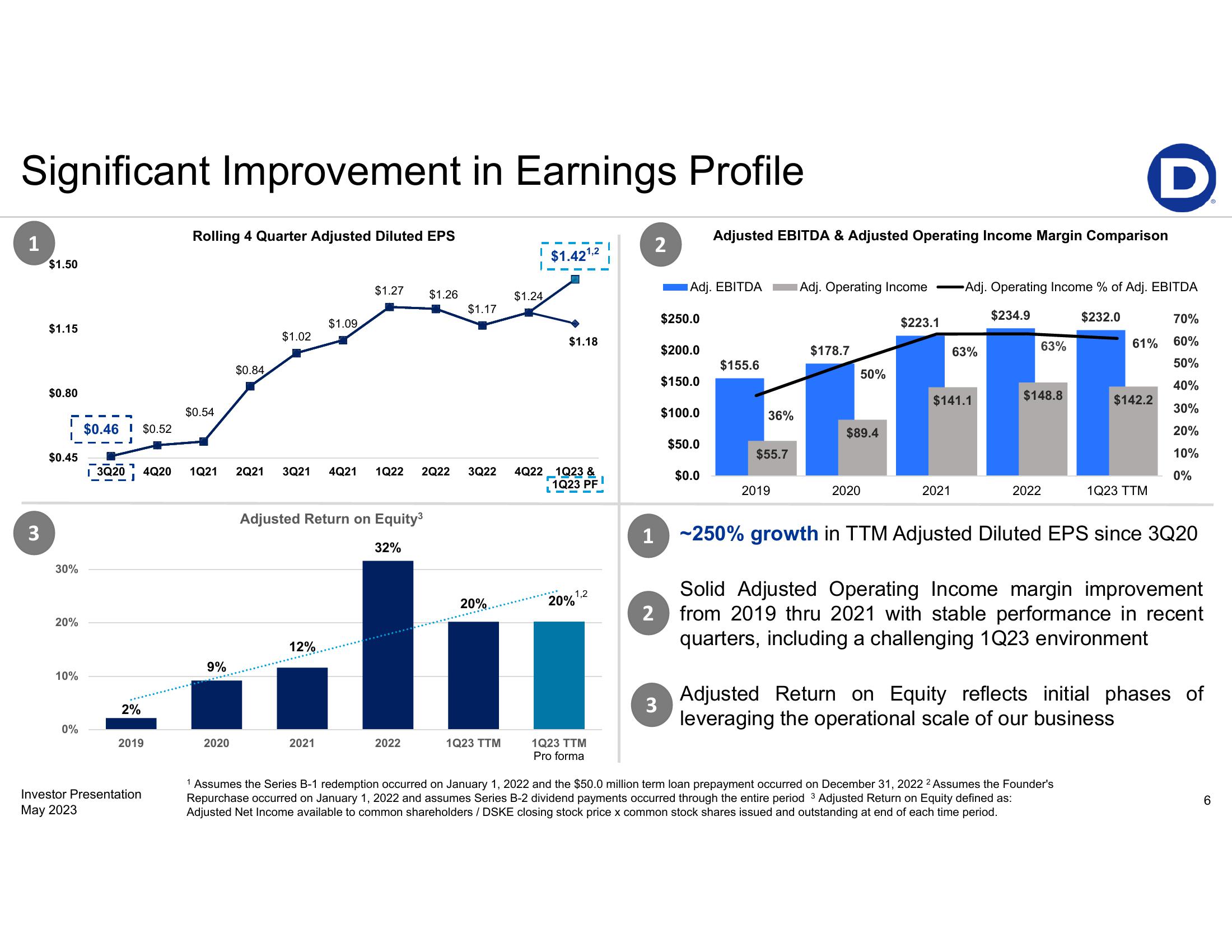

Rolling 4 Quarter Adjusted Diluted EPS

Investor Presentation

May 2023

$0.54

9%

2020

$0.84

$1.02

$1.09.

12%

$1.27

Adjusted Return on Equity³

32%

2021

2Q21 3Q21 4Q21 1Q22 2Q22 3Q22

$1.26

2022

$1.17

20%

1Q23 TTM

T

$1.24

$1.421,2

$1.18

4Q22 1Q23 &

1Q23 PF

LEE'-

1,2

20%

1Q23 TTM

Pro forma

2

1

3

Adj. EBITDA

$250.0

$200.0

$150.0

$100.0

$50.0

$0.0

Adjusted EBITDA & Adjusted Operating Income Margin Comparison

$155.6

36%

$55.7

2019

Adj. Operating Income Adj. Operating Income % of Adj. EBITDA

$234.9

$232.0

$178.7

50%

$89.4

2020

$223.1

63%

$141.1

2021

63%

$148.8

2022

D

70%

61% 60%

50%

40%

30%

20%

10%

0%

$142.2

1Q23 TTM

1 Assumes the Series B-1 redemption occurred on January 1, 2022 and the $50.0 million term loan prepayment occurred on December 31, 2022 2 Assumes the Founder's

Repurchase occurred on January 1, 2022 and assumes Series B-2 dividend payments occurred through the entire period 3 Adjusted Return on Equity defined as:

Adjusted Net Income available to common shareholders / DSKE closing stock price x common stock shares issued and outstanding at end of each time period.

~250% growth in TTM Adjusted Diluted EPS since 3Q20

Solid Adjusted Operating Income margin improvement

2 from 2019 thru 2021 with stable performance in recent

quarters, including a challenging 1Q23 environment

Adjusted Return on Equity reflects initial phases of

leveraging the operational scale of our business

6View entire presentation