Credit Suisse Investment Banking Pitch Book

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

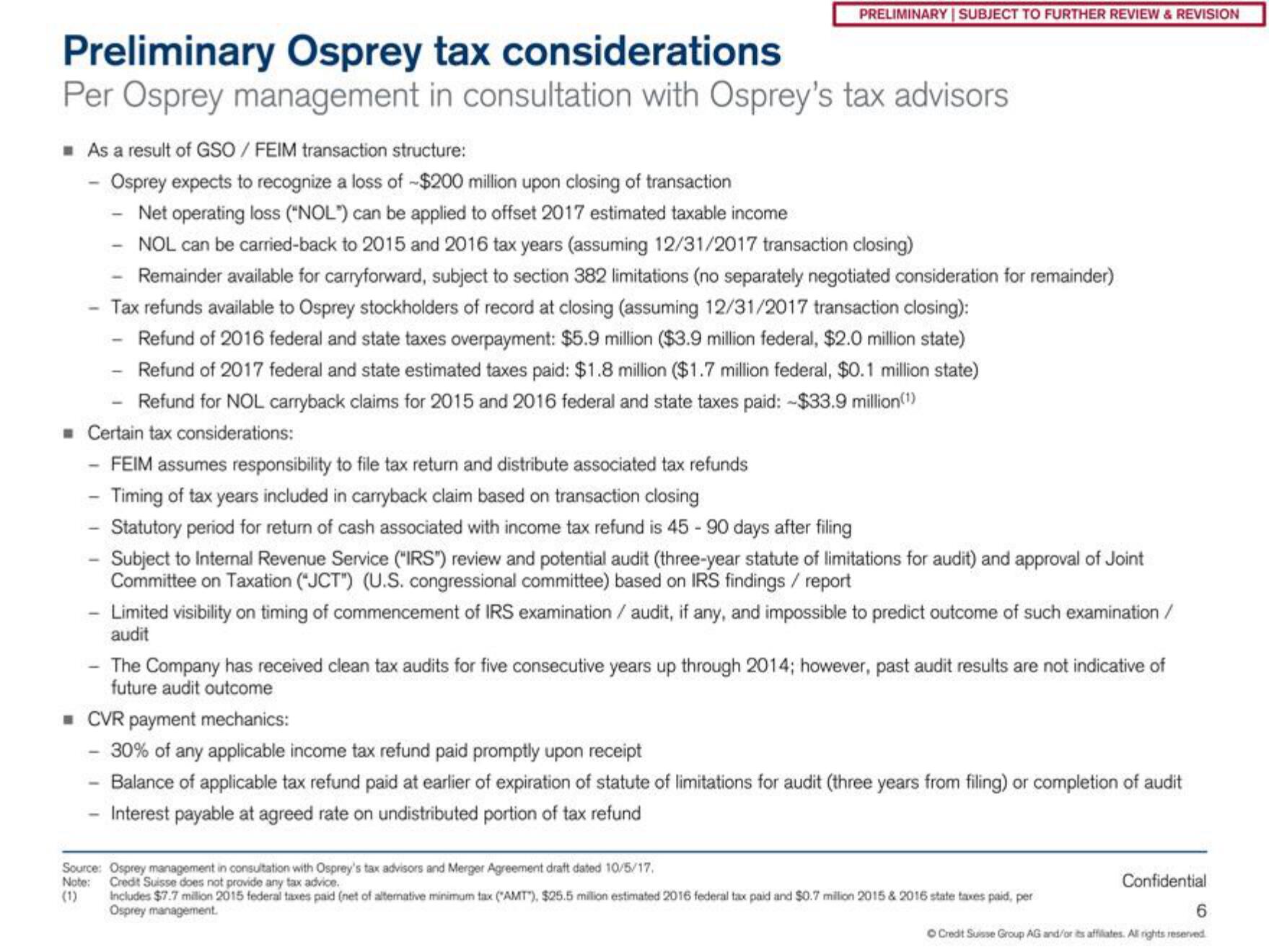

Preliminary Osprey tax considerations

Per Osprey management in consultation with Osprey's tax advisors

■ As a result of GSO / FEIM transaction structure:

- Osprey expects to recognize a loss of -$200 million upon closing of transaction

Net operating loss ("NOL") can be applied to offset 2017 estimated taxable income

- NOL can be carried-back to 2015 and 2016 tax years (assuming 12/31/2017 transaction closing)

Remainder available for carryforward, subject to section 382 limitations (no separately negotiated consideration for remainder)

Tax refunds available to Osprey stockholders of record at closing (assuming 12/31/2017 transaction closing):

Refund of 2016 federal and state taxes overpayment: $5.9 million ($3.9 million federal, $2.0 million state)

- Refund of 2017 federal and state estimated taxes paid: $1.8 million ($1.7 million federal, $0.1 million state)

Refund for NOL carryback claims for 2015 and 2016 federal and state taxes paid: -$33.9 million(¹)

Certain tax considerations:

- FEIM assumes responsibility to file tax return and distribute associated tax refunds

- Timing of tax years included in carryback claim based on transaction closing

- Statutory period for return of cash associated with income tax refund is 45 - 90 days after filing

Subject to Internal Revenue Service ("IRS") review and potential audit (three-year statute of limitations for audit) and approval of Joint

Committee on Taxation (JCT") (U.S. congressional committee) based on IRS findings / report

Limited visibility on timing of commencement of IRS examination / audit, if any, and impossible to predict outcome of such examination /

audit

- The Company has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of

future audit outcome

CVR payment mechanics:

- 30% of any applicable income tax refund paid promptly upon receipt

- Balance of applicable tax refund paid at earlier of expiration of statute of limitations for audit (three years from filing) or completion of audit

Interest payable at agreed rate on undistributed portion of tax refund

Source: Osprey management in consultation with Osprey's tax advisors and Merger Agreement draft dated 10/5/17.

Credit Suisse does not provide any tax advice.

Note:

(1)

Includes $7.7 million 2015 federal taxes paid (net of alternative minimum tax (AMT), $25.5 million estimated 2016 federal tax paid and $0.7 million 2015 & 2016 state taxes paid, per

Osprey management.

Confidential

6

Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation