Bank of America Investment Banking Pitch Book

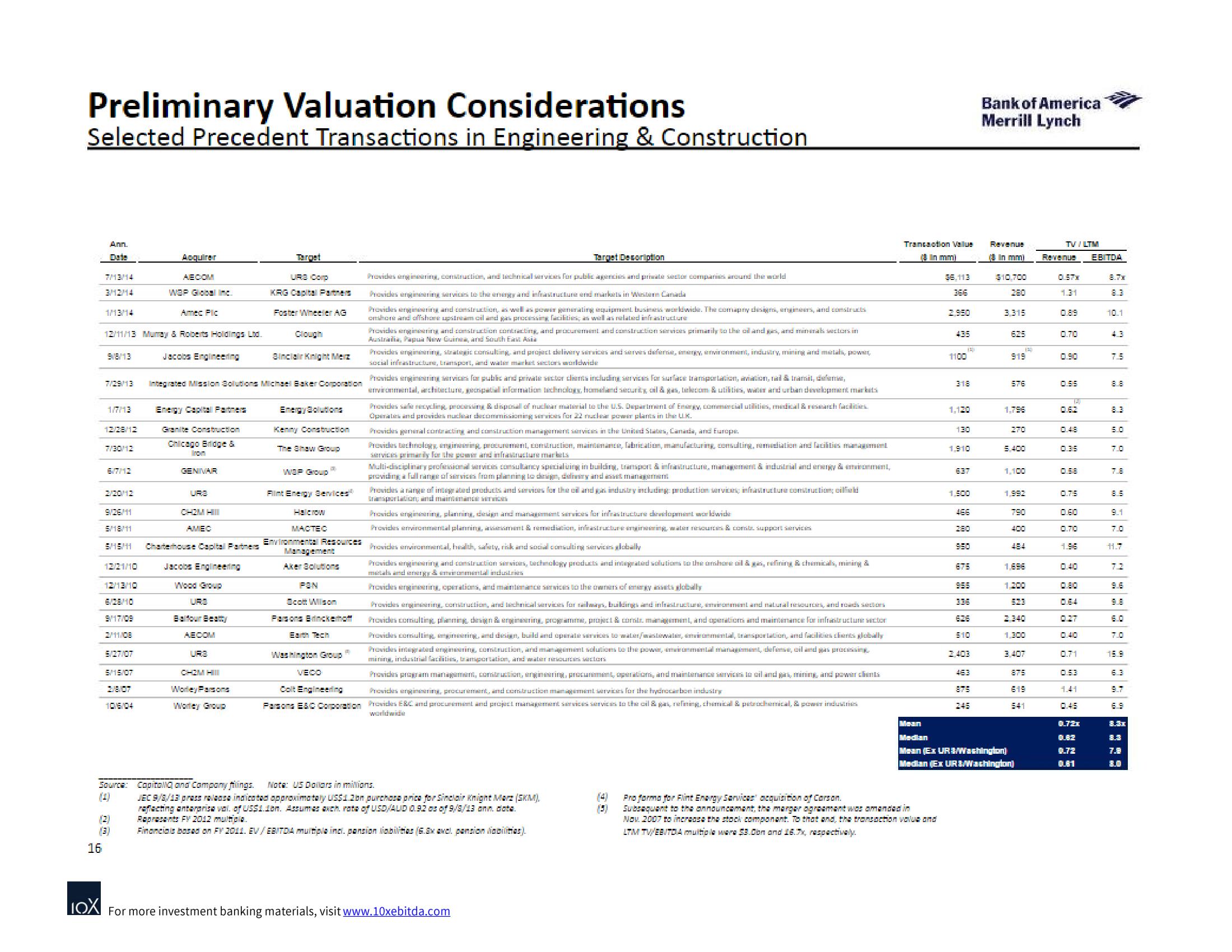

Preliminary Valuation Considerations

Selected Precedent Transactions in Engineering & Construction

Ann.

Date

7/13/14

3/12/14

16

1/13/14

12/11/13 Muray & Roberts Holdings Ltd.

9/8/13

7/29/13

1/7/13

12/28/12

7/30/12

6/7/12

12/21/10

12/13/10

6/28/10

9/17/08

2/11/08

5/27/07

Acquirer

AECOM

War Global Inc.

Amec Fic

5/15/07

2/8/07

10/6/04

(2)

(3)

Jacobs Engineering

9/26/11

5/18/11

5/718/11 Charterhouse Capital Partners

Energy Capital Partners

Granite Construction

Chicago Bridge &

Iron

GENIVAR

URB

Integrated Mission Solutions Michael Baker Corporation

CH2M HIll

AMEC

Jacobs Engineering

Wood Group

URA

Balfour Beatt

ABCOM

Target

CH2M Hill

Worley Parsons

Worley Group

URB Corp

KRG Capital Partners

Foster Wheeler AG

Sinclair Knight Merz

Energy Solutions

Kenny Construction

The Shaw Group

W&P Group

Fint Energy Services

Halcrow

MACTEC

Environmental Resources

Management

Aker Solutions

Scott Wilson

Parsons Brinckemo

Earth Tech

Washington Group

VECO

4

Colt Engineering

Parsons E&C Corporation

Target Decoription

Provides angaring, construction, and technical services for public agencies and private sector companies around the world

Provides engineering services to the energy and instructure and markets in Western Canada

Provides animaring and construction, as well as power generating equipment busintis worldwide. The comapny design, engineers, and constructs

ombone and offshore upstream cil and gas processing facilities, as well as related infrastructure

Provides engineering and construction contracting, and procurement and construction services primarily to the land gan, and mineral sectors in

Australia, Papua New Guinea, and South East Asia

Provides engineering, strategic consulting, and project delivery services and serves defense, emergy, environment, industry, mining and metals, power,

social infrastructure, transport, and water market sectors worldwide

Provides animating services for public and private sector dlients including services for surface Tramportation, aviation, rail & tramit, defami

environmental architecture, peripatall information technology, homeland security oil & gas, telecom & utilities, water and urban development märkets

Provides sale recycling, processing & disposall of nuclear material to the U.S. Department of Energy, commercial utilities, medical & research facilities.

Openales and provides nuclear decommissioning services for 22 nuclear power plants in the UK.

Provides general contracting and construction management services in the United States, Canada, and Europe.

Provides technology engineering, procurement, construction, maintenance, fabrication, manufacturing, consulting, remediation and facilities management.

services primarily for the power and infrastructure markets

Multi-disciplinary professional services consultancy specializing in building, transport & infrastructure, management & industrial and energy & embomment,

providing a full range of services from planning to dig, delivery and asset management

Prev sa range of integrated products

transportation and maintenance SEVICES

I services for the oil and gas industry including production services; infrastructure construction; cild

Provides engineering, planning, design and management services for infrastructure development worldwide

Provises environmental planning, andesment & remediation, infrastructure engineering, water resources & comb, support services

Provides environmental, health, safety, risk and social consulting services globally

Provides engineering and construction services, Dechnology products and integrated solutions to the onshore oil & gas, refining & chemicals, mining &

metalandergy & environmental industries

Provides engineering, operations, and maintenance services to the owners of energy assets globally

Source: CapitoNG anal Campanytings.

Note: US Dollars in milions.

(4)

JEC 9/8/13 press release indicated approximately US$1.2on purchase price for Sinclair Knight More (SKM),

reflecting enterprise val. of US$1.1on. Assumes auch. rate of USD/AUID 0.92 as of 9/9/13 onn. dota.

Represents FV 2012 multila

Financials based on FY 2011. EV/EBITDA multiple inc. pansion abilities (6.8x avd. pansion Viacilities).

Provides engineering, construction, and technical services for railways, buildings and infrastructure, mairement and natural resources, and roads sections

Provide comulting, planning, design & engineering, programme, project & constr, management, and operation and maintenance for infrastructure sector

Provides comulting, engineering, and design, build and operate services to water/wastewater, environmental, transportation, and facilities clients globally

Provides integrated engineering, construction, and management solutions to the power, minumental management, defense, oil and gas processing

mining, industrial facilition, transportation, and water nimicurten sections

Providen program management, combruction, engineering, procurement, operation, and maintenance services to oil and gas, mining, and power chants

Provics engineering, procurement, and construction management services for the hydrocarbon industry

Provides ERC and procurement and project management services services to the oil & gas, refining, chemical & petrochemical, & power industries

worldwide

IOX For more investment banking materials, visit www.10xebitda.com

(4)

Transaction Value

(8 mm)

36,113

366

Pro forma for Flint Energy Services' acquisition of Carson.

Subsequent to the announcement, the merger agreement was amanded in

Nov. 2007 to increase the stock component. To that and, the transaction value and

LTM TV/EB/TDA multiple were $3.com and 16.7x, respectively.

1100

1200

318

1,120

130

1,910

6:37

1,500

46.6

880

678

388

510

875

248

Bank of America

Merrill Lynch

Revenue

TV / LTM

In mmi Revenue EBITDA

$10.700

3.315

919

1,796

1,100

1,992

790

484

1.686

E

5:23

2.340

1,300

3.407

Mein

Median

Mesin (Ex URB/Washington)

Median (Ex URS/Wachington)

875

619

541

131

0.710

0.48

0.5.8

060

1.98

0.27

0.71

1.41

0.72x

0.72

CUCH

8.7x

10.1

00

85

9.1

11.7

7.2

7.0

15.9

8.3x

7.8

BLOView entire presentation