DrivenBrands Results Presentation Deck

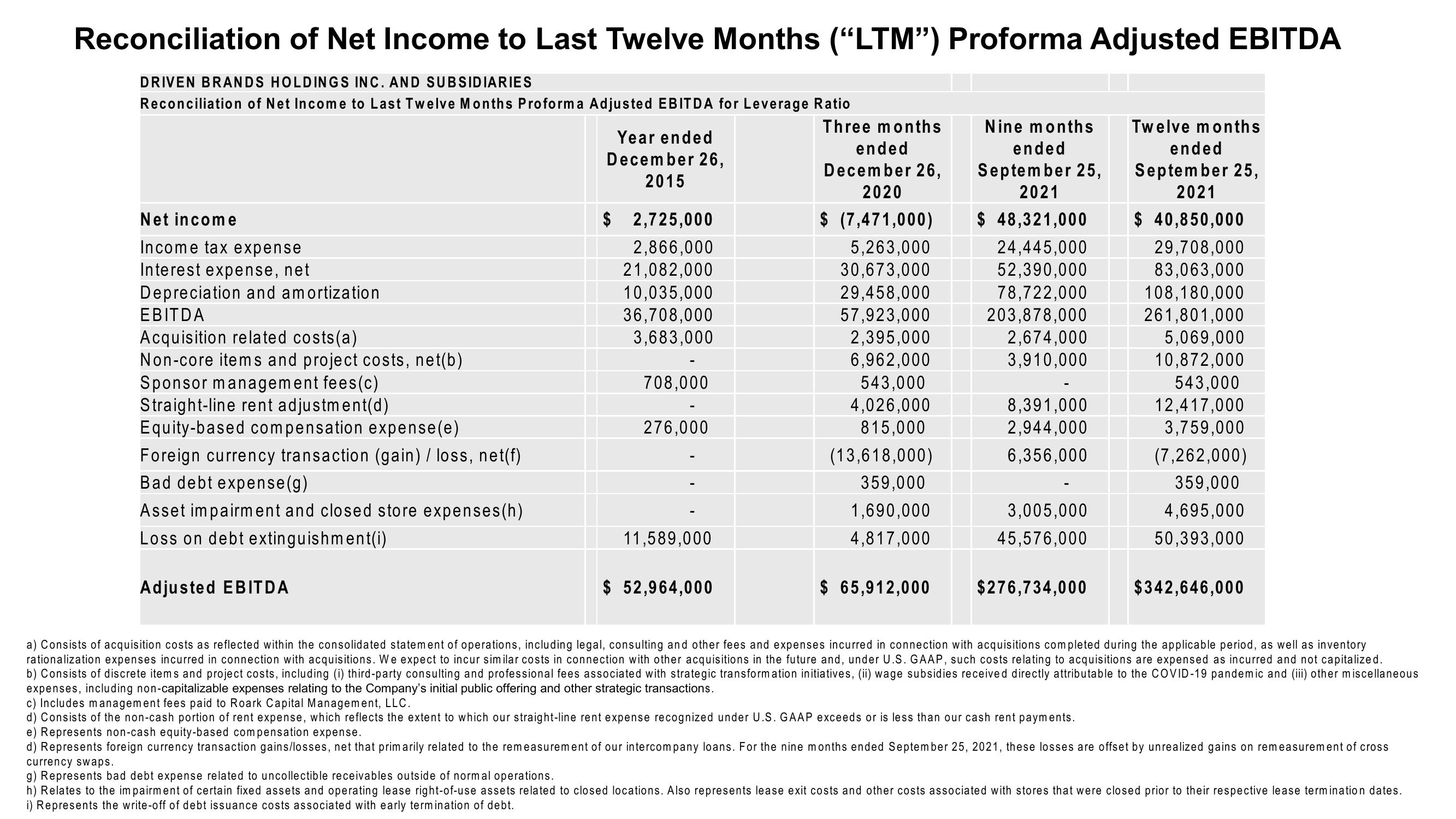

Reconciliation of Net Income to Last Twelve Months ("LTM") Proforma Adjusted EBITDA

DRIVEN BRANDS HOLDINGS INC. AND SUBSIDIARIES

Reconciliation of Net Income to Last Twelve Months Proforma Adjusted EBITDA for Leverage Ratio

Net income

Income tax expense

Interest expense, net

Depreciation and amortization

EBITDA

Acquisition related costs(a)

Non-core items and project costs, net(b)

Sponsor management fees (c)

Straight-line rent adjustment(d)

Equity-based compensation expense(e)

Foreign currency transaction (gain) / loss, net(f)

Bad debt expense(g)

Asset impairment and closed store expenses(h)

Loss on debt extinguishment(i)

Adjusted EBITDA

Year ended

December 26,

2015

$ 2,725,000

2,866,000

21,082,000

10,035,000

36,708,000

3,683,000

708,000

276,000

11,589,000

$ 52,964,000

Three months

ended

December 26,

2020

$ (7,471,000)

5,263,000

30,673,000

29,458,000

57,923,000

2,395,000

6,962,000

543,000

4,026,000

815,000

(13,618,000)

359,000

1,690,000

4,817,000

$ 65,912,000

Nine months

ended

September 25,

2021

$ 48,321,000

24,445,000

52,390,000

78,722,000

203,878,000

2,674,000

3,910,000

8,391,000

2,944,000

6,356,000

3,005,000

45,576,000

$276,734,000

Twelve months

ended

September 25,

2021

$ 40,850,000

29,708,000

83,063,000

108,180,000

261,801,000

5,069,000

10,872,000

543,000

12,417,000

3,759,000

(7,262,000)

359,000

4,695,000

50,393,000

$342,646,000

a) Consists of acquisition costs as reflected within the consolidated statement of operations, including legal, consulting and other fees and expenses incurred in connection with acquisitions completed during the applicable period, as well as inventory

rationalization expenses incurred in connection with acquisitions. We expect to incur similar costs in connection with other acquisitions in the future and, under U.S. GAAP, such costs relating to acquisitions are expensed as incurred and not capitalized.

b) Consists of discrete items and project costs, including (i) third-party consulting and professional fees associated with strategic transformation initiatives, (ii) wage subsidies received directly attributable to the COVID-19 pandemic and (iii) other miscellaneous

expenses, including non-capitalizable expenses relating to the Company's initial public offering and other strategic transactions.

c) Includes management fees paid to Roark Capital Management, LLC.

d) Consists of the non-cash portion of rent expense, which reflects the extent to which our straight-line rent expense recognized under U.S. GAAP exceeds or is less than our cash rent payments.

e) Represents non-cash equity-based compensation expense.

d) Represents foreign currency transaction gains/losses, net that primarily related to the remeasurement of our intercompany loans. For the nine months ended September 25, 2021, these losses are offset by unrealized gains on remeasurement of cross

currency swaps.

g) Represents bad debt expense related to uncollectible receivables outside of normal operations.

h) Relates to the impairment of certain fixed assets and operating lease right-of-use assets related to closed locations. Also represents lease exit costs and other costs associated with stores that were closed prior to their respective lease termination dates.

i) Represents the write-off of debt issuance costs associated with early termination of debt.View entire presentation