Arrival SPAC Presentation Deck

FINANCIALS AND TRANSACTION OVERVIEW

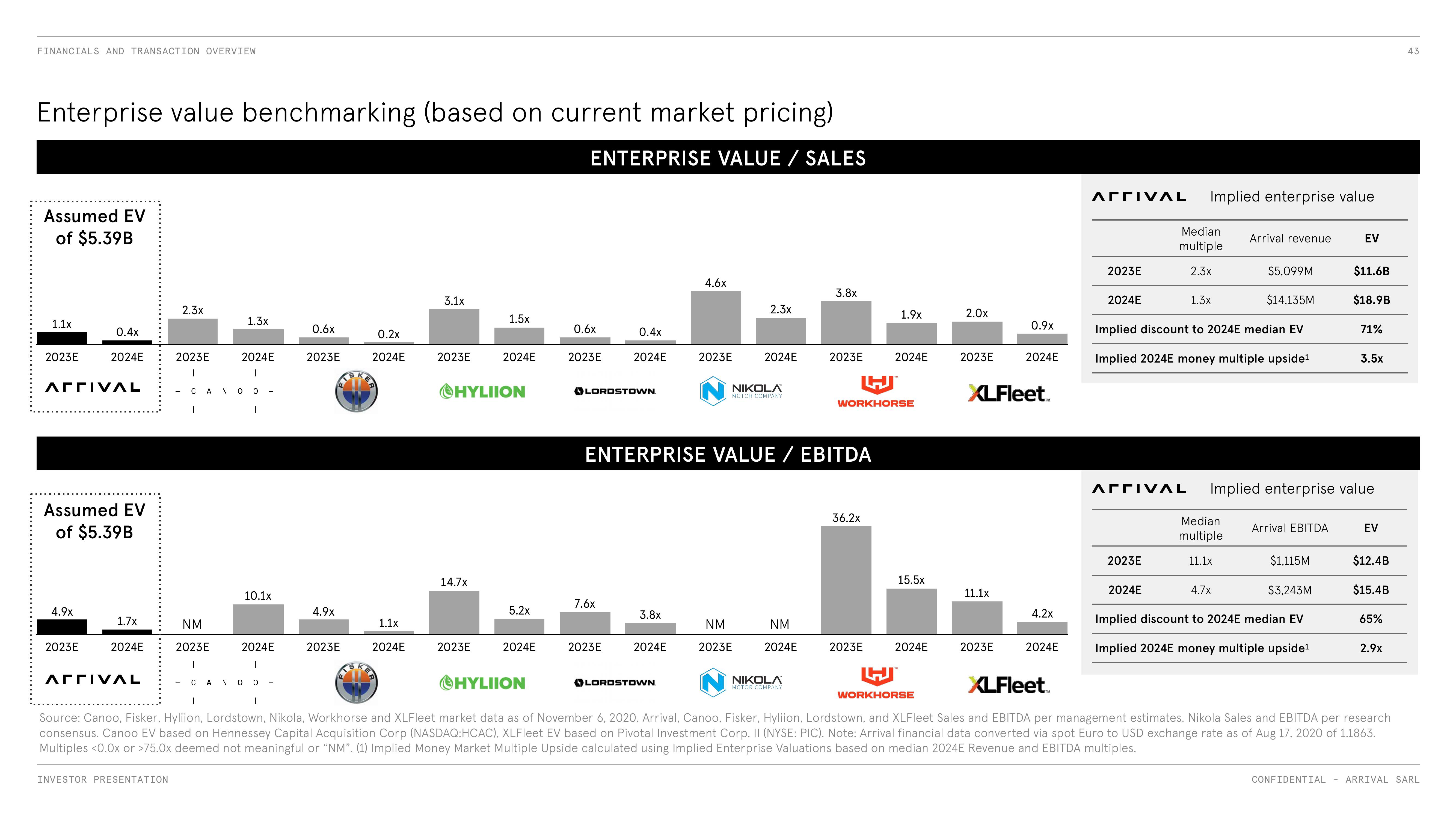

Enterprise value benchmarking (based on current market pricing)

ENTERPRISE VALUE / SALES

Assumed EV

of $5.39B

1.1x

2023E

ΑΓΓΙVAL

0.4x

2024E

Assumed EV

of $5.39B

4.9x

2023E

1.7x

2024E

ΑΓΓΙVAL

2.3x

INVESTOR PRESENTATION

2023E

I

I

1.3x

CANO 0

NM

2023E

I

2024E

I

1

10.1x

2024E

I

CANO 0

I

0.6x

-

2023E

4.9x

2023E

0.2x

2024E

1.1x

2024E

3.1x

2023E

14.7x

1.5x

ⒸHYLIION

2023E

2024E

5.2x

2024E

0.6x

2023E

LORDSTOWN

0.4x

2024E

7.6x

2023E

3.8x

2024E

4.6x

2023E

LORDSTOWN

2.3x

ENTERPRISE VALUE / EBITDA

2024E

NIKOLA

MOTOR COMPANY

NM

2023E

NM

2024E

3.8x

NIKOLA

MOTOR COMPANY

2023E

WORKHORSE

36.2x

1.9x

2023E

2024E

15.5x

2024E

L

WORKHORSE

2.0x

2023E

11.1x

0.9x

XLFleet

2023E

2024E

4.2x

2024E

ΑΓΓΙVAL

2023E

2024E

ΑΓΓΙVAL

2023E

Implied enterprise value

Median

multiple

2.3x

2024E

1.3x

Implied discount to 2024E median EV

Implied 2024E money multiple upside¹

Arrival revenue

Median

multiple

11.1x

$5,099M

4.7x

$14,135M

Arrival EBITDA

$3,243M

Implied discount to 2024E median EV

Implied 2024E money multiple upside¹

$1,115M

EV

Implied enterprise value

$11.6B

$18.9B

71%

3.5x

EV

ⒸHYLIION

XLFleet

|

Source: Canoo, Fisker, Hyliion, Lordstown, Nikola, Workhorse and XLFleet market data as of November 6, 2020. Arrival, Canoo, Fisker, Hyliion, Lordstown, and XLFleet Sales and EBITDA per management estimates. Nikola Sales and EBITDA per research

consensus. Canoo EV based on Hennessey Capital Acquisition Corp (NASDAQ:HCAC), XLFleet EV based on Pivotal Investment Corp. II (NYSE: PIC). Note: Arrival financial data converted via spot Euro to USD exchange rate as of Aug 17, 2020 of 1.1863.

Multiples <0.0x or >75.0x deemed not meaningful or "NM". (1) Implied Money Market Multiple Upside calculated using Implied Enterprise Valuations based on median 2024E Revenue and EBITDA multiples.

$12.4B

$15.4B

65%

2.9x

43

CONFIDENTIAL - ARRIVAL SARLView entire presentation