Maersk Investor Presentation Deck

●

●

●

Key statements

Highlights for Q2 2020

Continued improvement in profitability and solid free cash flow

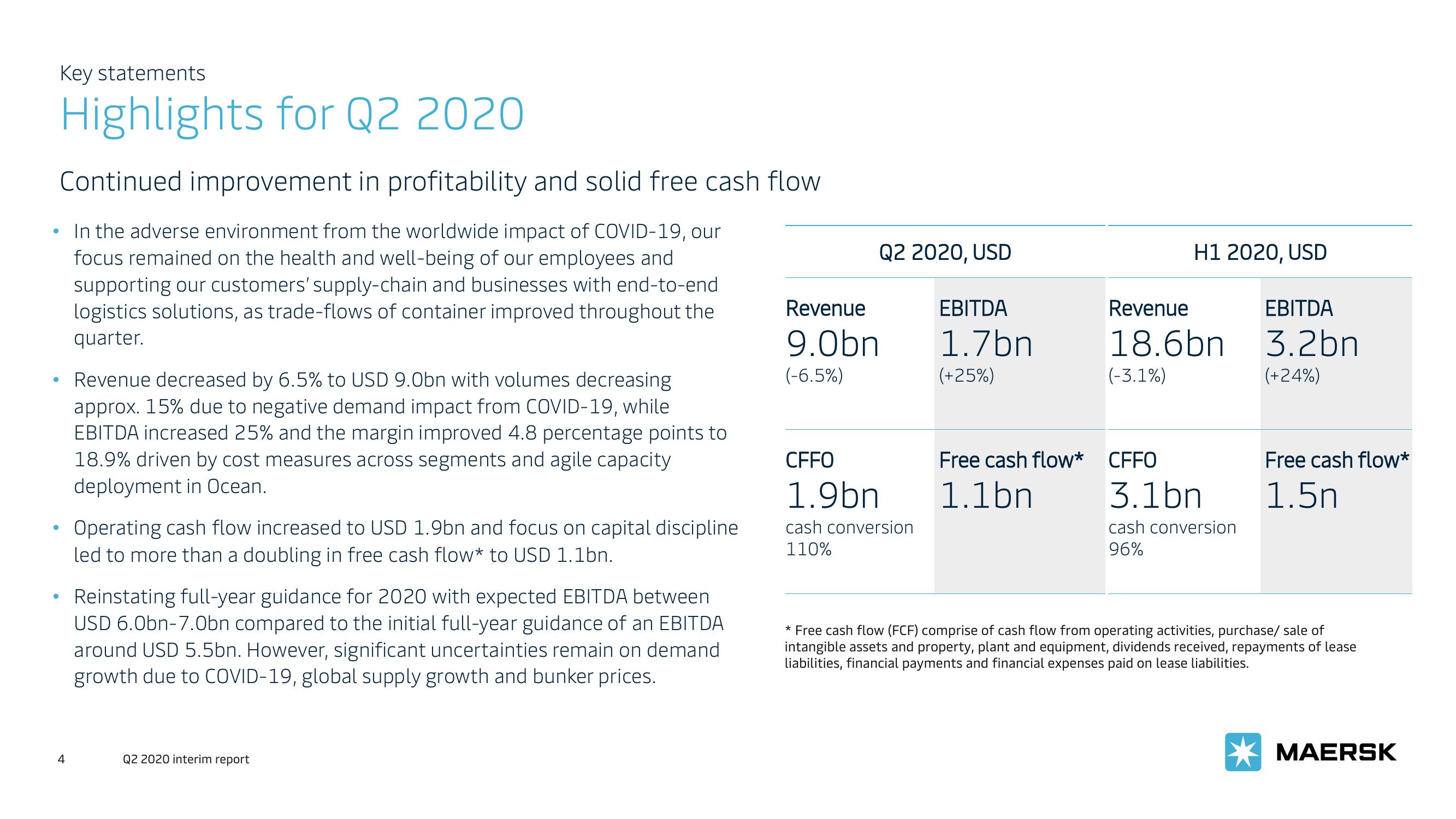

In the adverse environment from the worldwide impact of COVID-19, our

focus remained on the health and well-being of our employees and

supporting our customers' supply-chain and businesses with end-to-end

logistics solutions, as trade-flows of container improved throughout the

quarter.

4

Revenue decreased by 6.5% to USD 9.0bn with volumes decreasing

approx. 15% due to negative demand impact from COVID-19, while

EBITDA increased 25% and the margin improved 4.8 percentage points to

18.9% driven by cost measures across segments and agile capacity

deployment in Ocean.

Operating cash flow increased to USD 1.9bn and focus on capital discipline

led to more than a doubling in free cash flow* to USD 1.1bn.

Reinstating full-year guidance for 2020 with expected EBITDA between

USD 6.0bn-7.0bn compared to the initial full-year guidance of an EBITDA

around USD 5.5bn. However, significant uncertainties remain on demand

growth due to COVID-19, global supply growth and bunker prices.

Q2 2020 interim report

Revenue

9.0bn

(-6.5%)

CFFO

1.9bn

Q2 2020, USD

cash conversion

110%

EBITDA

1.7bn

(+25%)

H1 2020, USD

Revenue

18.6bn

(-3.1%)

Free cash flow* CFFO

1.1bn

3.1bn

cash conversion

96%

EBITDA

3.2bn

(+24%)

Free cash flow*

1.5n

* Free cash flow (FCF) comprise of cash flow from operating activities, purchase/ sale of

intangible assets and property, plant and equipment, dividends received, repayments of lease

liabilities, financial payments and financial expenses paid on lease liabilities.

MAERSKView entire presentation