Liberty Global Results Presentation Deck

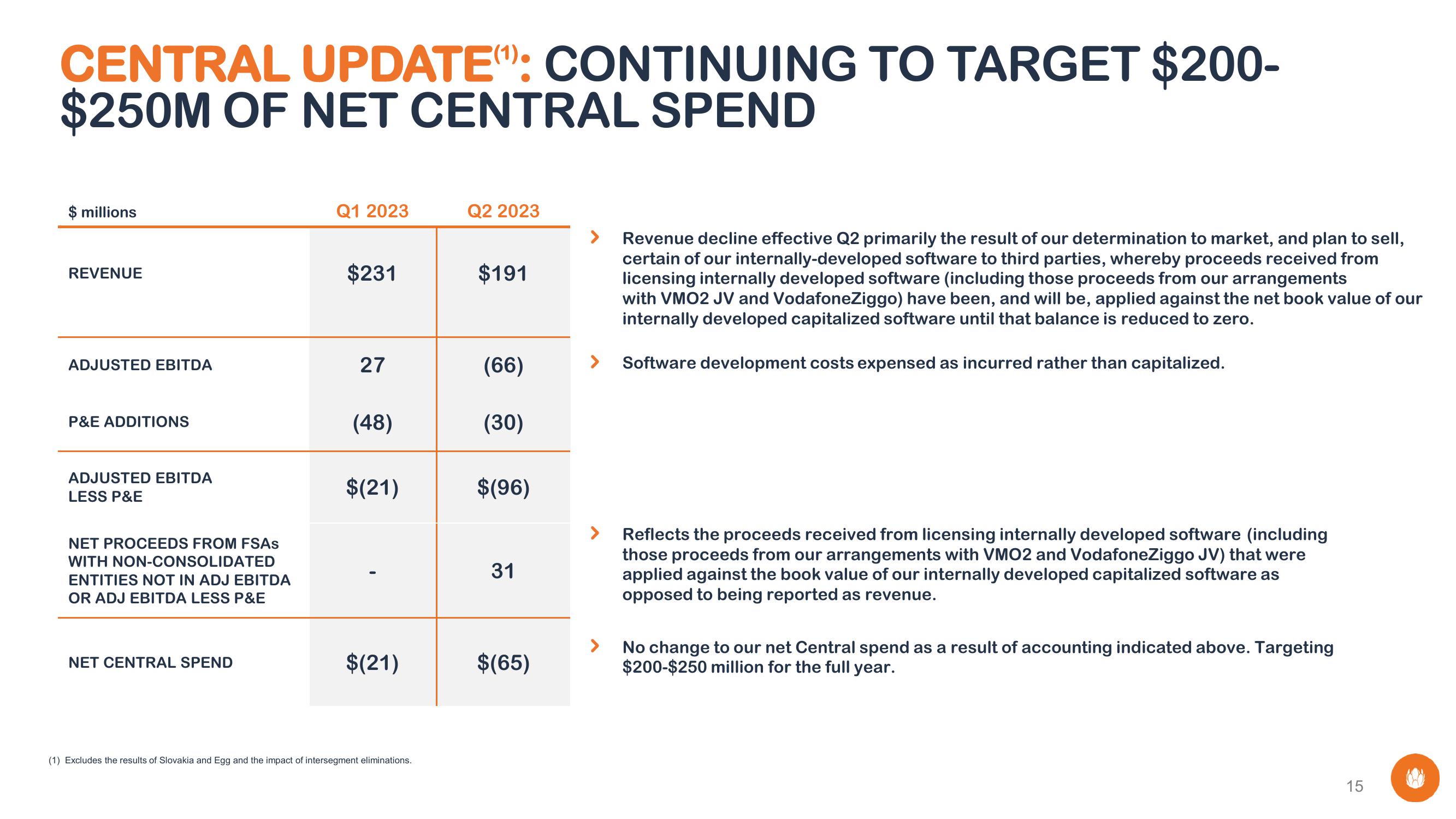

CENTRAL UPDATE": CONTINUING TO TARGET $200-

$250M OF NET CENTRAL SPEND

$ millions

REVENUE

ADJUSTED EBITDA

P&E ADDITIONS

ADJUSTED EBITDA

LESS P&E

NET PROCEEDS FROM FSAs

WITH NON-CONSOLIDATED

ENTITIES NOT IN ADJ EBITDA

OR ADJ EBITDA LESS P&E

NET CENTRAL SPEND

Q1 2023

$231

27

(48)

$(21)

$(21)

(1) Excludes the results of Slovakia and Egg and the impact of intersegment eliminations.

Q2 2023

$191

(66)

(30)

$(96)

31

$(65)

Revenue decline effective Q2 primarily the result of our determination to market, and plan to sell,

certain of our internally-developed software to third parties, whereby proceeds received from

licensing internally developed software (including those proceeds from our arrangements

with VMO2 JV and VodafoneZiggo) have been, and will be, applied against the net book value of our

internally developed capitalized software until that balance is reduced to zero.

Software development costs expensed as incurred rather than capitalized.

Reflects the proceeds received from licensing internally developed software (including

those proceeds from our arrangements with VMO2 and VodafoneZiggo JV) that were

applied against the book value of our internally developed capitalized software as

opposed to being reported as revenue.

No change to our net Central spend as a result of accounting indicated above. Targeting

$200-$250 million for the full year.

15

(View entire presentation