CURO Group Holdings Credit Presentation Deck

CURO Business Segments - US Direct Lending

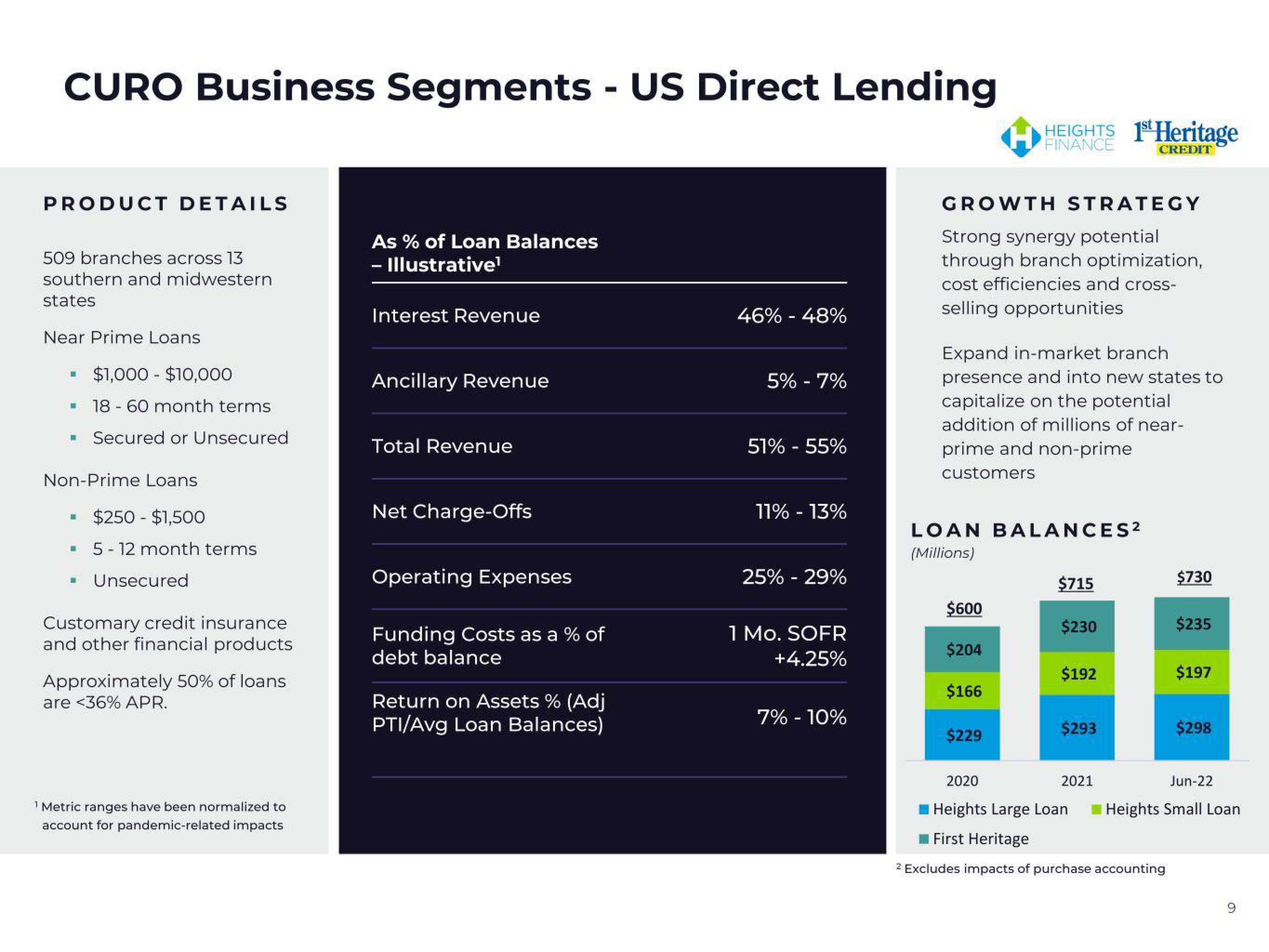

PRODUCT DETAILS

509 branches across 13

southern and midwestern

states

Near Prime Loans

$1,000 $10,000

☐ 18 - 60 month terms

Secured or Unsecured

■

R

Non-Prime Loans

$250 - $1,500

R 5-12 month terms

■ Unsecured

W

Customary credit insurance

and other financial products

Approximately 50% of loans

are <36% APR.

¹ Metric ranges have been normalized to

account for pandemic-related impacts

As % of Loan Balances

- Illustrative¹

Interest Revenue

Ancillary Revenue

Total Revenue

Net Charge-Offs

Operating Expenses

Funding Costs as a % of

debt balance

Return on Assets % (Adj

PTI/Avg Loan Balances)

46% - 48%

5% - 7%

51% -55%

11% -13%

25% -29%

1 Mo. SOFR

+4.25%

7% - 10%

GROWTH STRATEGY

Strong synergy potential

through branch optimization,

cost efficiencies and cross-

selling opportunities

HEIGHTS 1 Heritage

FINANCE

CREDIT

Expand in-market branch

presence and into new states to

capitalize on the potential

addition of millions of near-

prime and non-prime

customers

LOAN BALANCES²

(Millions)

$600

$204

$166

$229

$715

$230

$192

$293

2020

Heights Large Loan

First Heritage

2 Excludes impacts of purchase accounting

2021

$730

$235

$197

$298

Jun-22

Heights Small Loan

9View entire presentation