PJT Partners Investment Banking Pitch Book

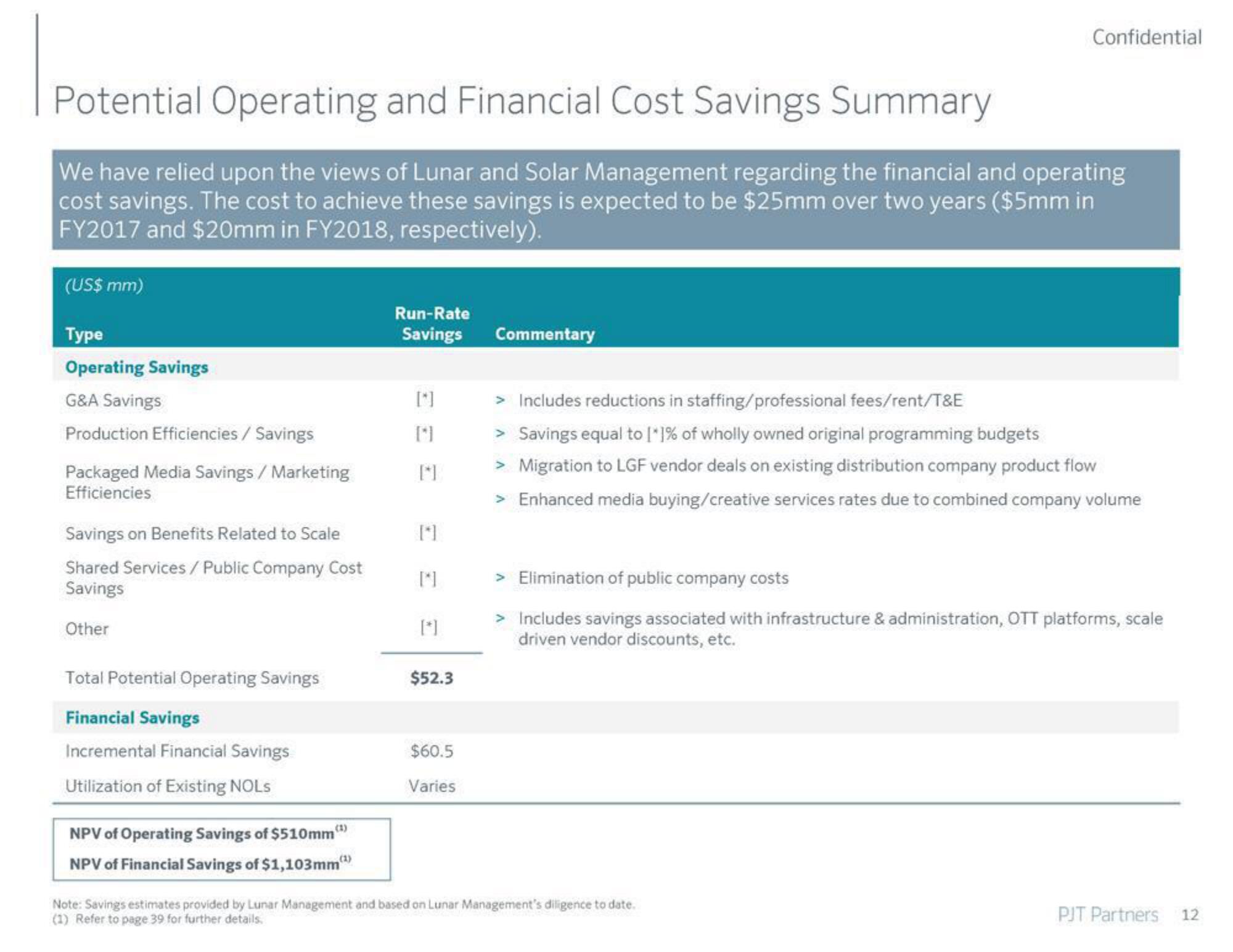

Potential Operating and Financial Cost Savings Summary

We have relied upon the views of Lunar and Solar Management regarding the financial and operating

cost savings. The cost to achieve these savings is expected to be $25mm over two years ($5mm in

FY2017 and $20mm in FY2018, respectively).

(US$ mm)

Type

Operating Savings

G&A Savings

Production Efficiencies / Savings

Packaged Media Savings/ Marketing

Efficiencies

Savings on Benefits Related to Scale

Shared Services/ Public Company Cost

Savings

Other

Total Potential Operating Savings

Financial Savings

Incremental Financial Savings

Utilization of Existing NOLS

(1)

NPV of Operating Savings of $510mm

NPV of Financial Savings of $1,103mm(¹)

Run-Rate

Savings

[*]

[*]

[*]

[*]

[*]

$52.3

$60.5

Varies

Commentary

Confidential

> Includes reductions in staffing/professional fees/rent/T&E

> Savings equal to [*]% of wholly owned original programming budgets

> Migration to LGF vendor deals on existing distribution company product flow

> Enhanced media buying/creative services rates due to combined company volume

Elimination of public company costs

Includes savings associated with infrastructure & administration, OTT platforms, scale

driven vendor discounts, etc.

Note: Savings estimates provided by Lunar Management and based on Lunar Management's diligence to date.

(1) Refer to page 39 for further details.

PJT Partners

12View entire presentation