Apollo Global Management Investor Day Presentation Deck

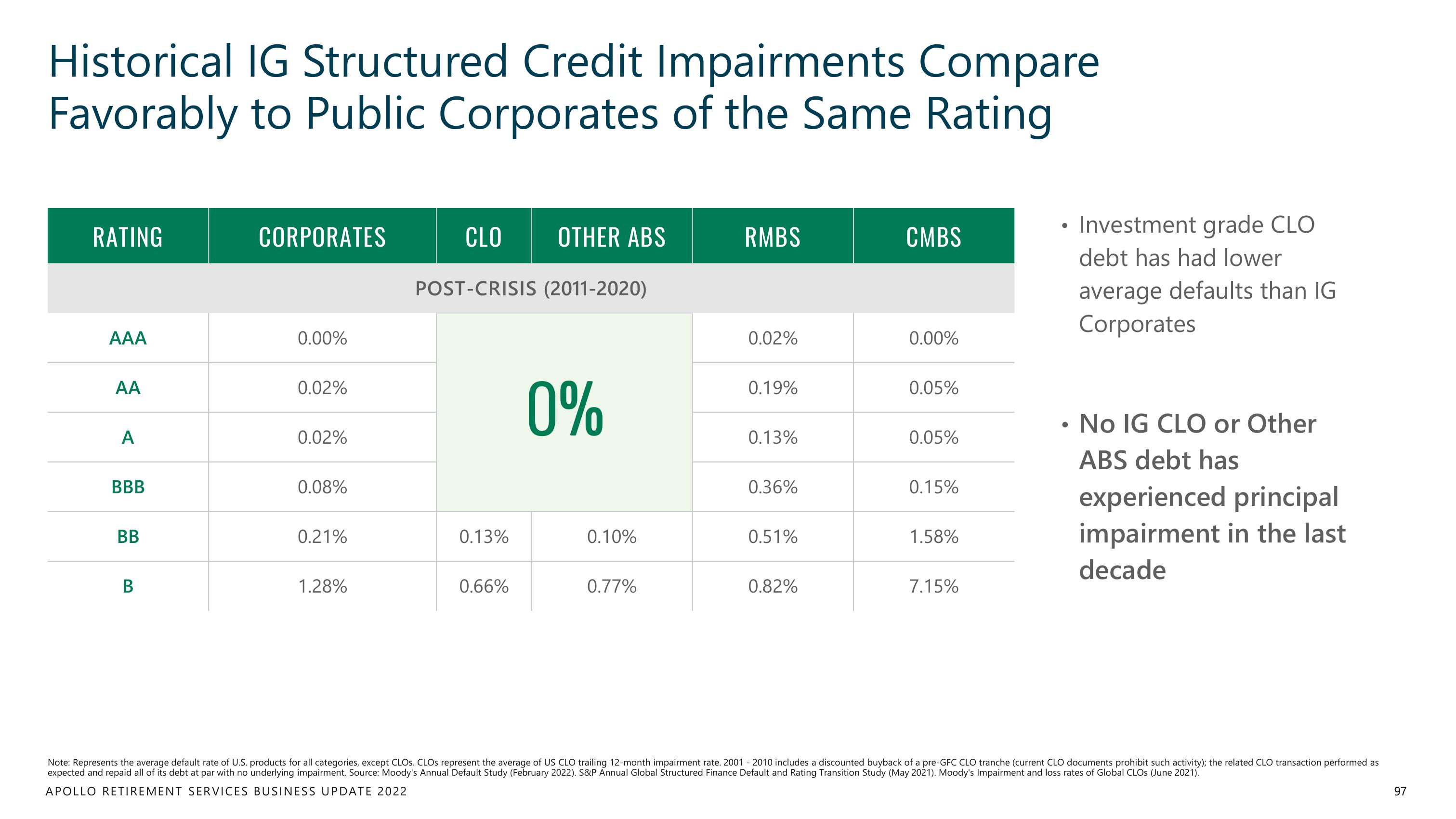

Historical IG Structured Credit Impairments Compare

Favorably to Public Corporates of the Same Rating

RATING

AAA

AA

A

BBB

BB

B

CORPORATES

0.00%

0.02%

0.02%

0.08%

0.21%

1.28%

CLO OTHER ABS

POST-CRISIS (2011-2020)

0.13%

0.66%

0%

0.10%

0.77%

RMBS

0.02%

0.19%

0.13%

0.36%

0.51%

0.82%

CMBS

0.00%

0.05%

0.05%

0.15%

1.58%

7.15%

• Investment grade CLO

debt has had lower

average defaults than IG

Corporates

●

No IG CLO or Other

ABS debt has

experienced principal

impairment in the last

decade

Note: Represents the average default rate of U.S. products for all categories, except CLOS. CLOS represent the average of US CLO trailing 12-month impairment rate. 2001 - 2010 includes a discounted buyback of a pre-GFC CLO tranche (current CLO documents prohibit such activity); the related CLO transaction performed as

expected and repaid all of its debt at par with no underlying impairment. Source: Moody's Annual Default Study (February 2022). S&P Annual Global Structured Finance Default and Rating Transition Study (May 2021). Moody's Impairment and loss rates of Global CLOS (June 2021).

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

97View entire presentation