Amazon Shareholder Engagement Presentation Deck

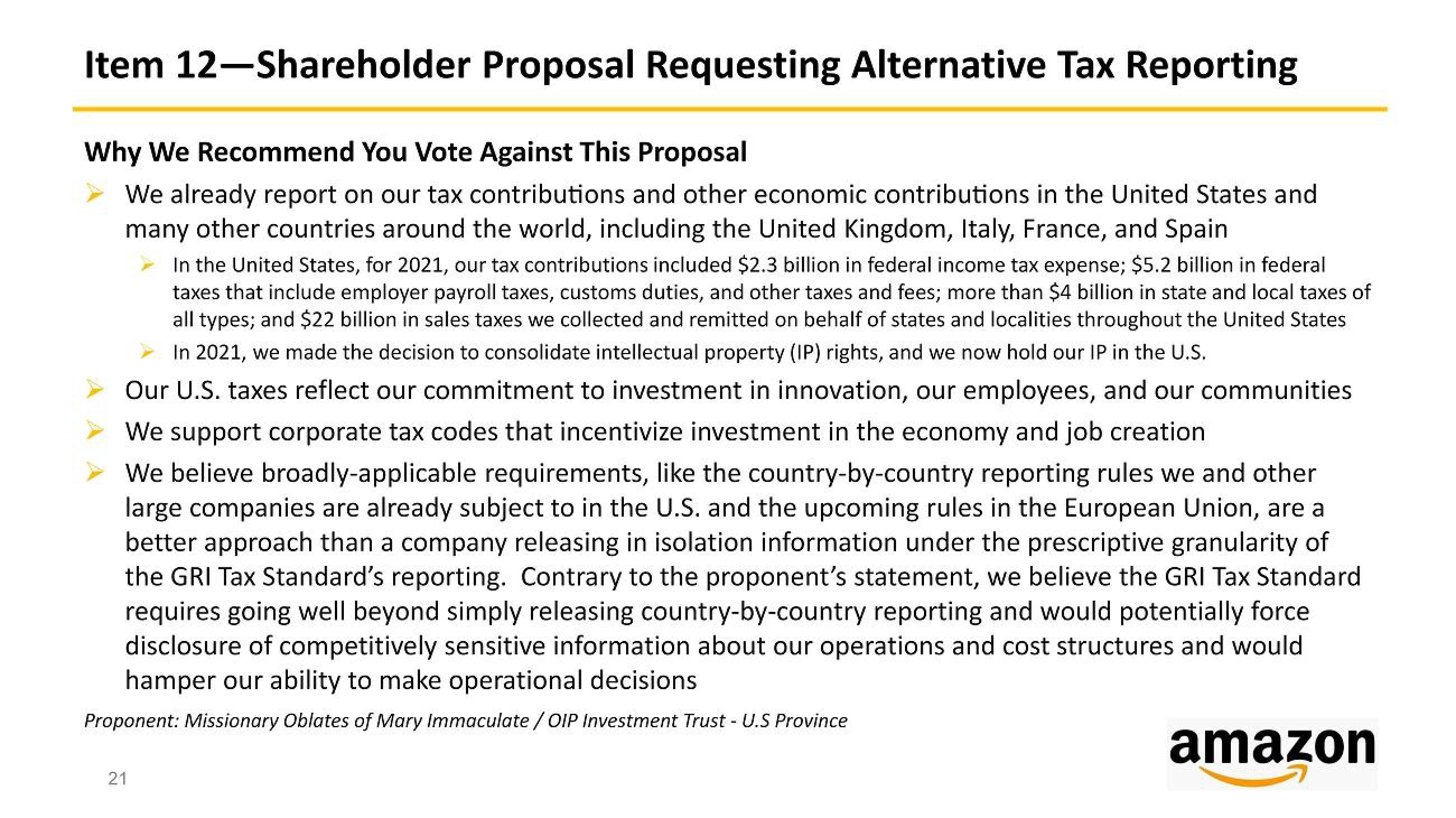

Item 12-Shareholder Proposal Requesting Alternative Tax Reporting

Why We Recommend You Vote Against This Proposal

➤ We already report on our tax contributions and other economic contributions in the United States and

many other countries around the world, including the United Kingdom, Italy, France, and Spain

In the United States, for 2021, our tax contributions included $2.3 billion in federal income tax expense; $5.2 billion in federal

taxes that include employer payroll taxes, customs duties, and other taxes and fees; more than $4 billion in state and local taxes of

all types; and $22 billion in sales taxes we collected and remitted on behalf of states and localities throughout the United States

In 2021, we made the decision to consolidate intellectual property (IP) rights, and we now hold our IP in the U.S.

Our U.S. taxes reflect our commitment to investment in innovation, our employees, and our communities

We support corporate tax codes that incentivize investment in the economy and job creation

We believe broadly-applicable requirements, like the country-by-country reporting rules we and other

large companies are already subject to in the U.S. and the upcoming rules in the European Union, are a

better approach than a company releasing in isolation information under the prescriptive granularity of

the GRI Tax Standard's reporting. Contrary to the proponent's statement, we believe the GRI Tax Standard

requires going well beyond simply releasing country-by-country reporting and would potentially force

disclosure of competitively sensitive information about our operations and cost structures and would

hamper our ability to make operational decisions

Proponent: Missionary Oblates of Mary Immaculate / OIP Investment Trust - U.S Province

amazon

21View entire presentation