Kinnevik Results Presentation Deck

Intro

Net Asset Value

VALUE-BASED CARE

Value-Based Care consists of care delivery companies that take risk on

patient health outcomes and are rewarded if they keep their patients

healthy and out of the hospital. This stands in contrast to care delivery

businesses that charge patients and payers on a fee-for-service basis.

Value-based care enjoys strong secular tailwinds, and companies em-

ploying this business model have therefore historically been valued at a

significant premium to fee-for-service businesses.

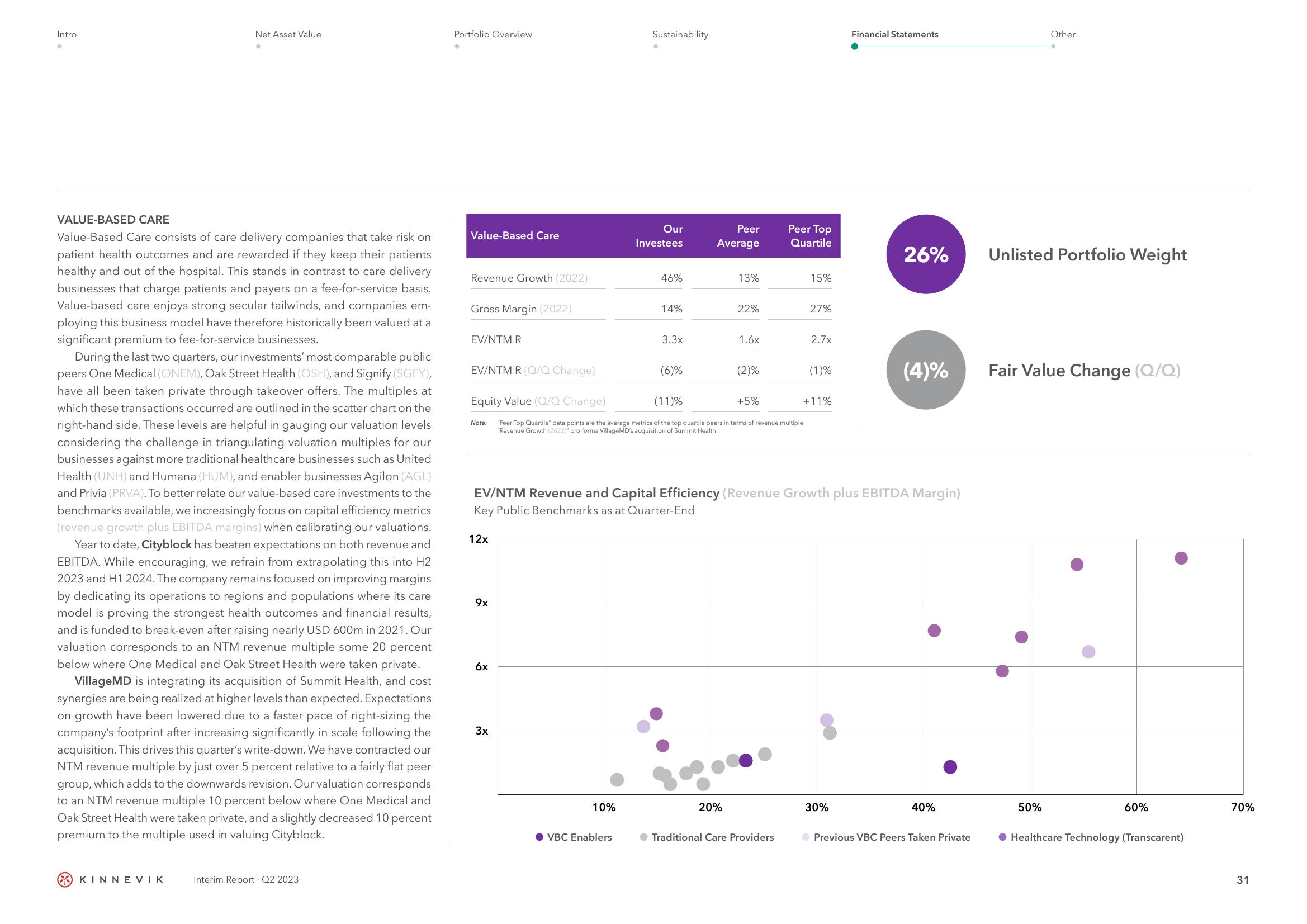

During the last two quarters, our investments' most comparable public

peers One Medical (ONEM), Oak Street Health (OSH), and Signify (SGFY),

have all been taken private through takeover offers. The multiples at

which these transactions occurred are outlined in the scatter chart on the

right-hand side. These levels are helpful in gauging our valuation levels

considering the challenge in triangulating valuation multiples for our

businesses against more traditional healthcare businesses such as United

Health (UNH) and Humana (HUM), and enabler businesses Agilon (AGL)

and Privia (PRVA). To better relate our value-based care investments to the

benchmarks available, we increasingly focus on capital efficiency metrics

(revenue growth plus EBITDA margins) when calibrating our valuations.

Year to date, Cityblock has beaten expectations on both revenue and

EBITDA. While encouraging, we refrain from extrapolating this into H2

2023 and H1 2024. The company remains focused on improving margins

by dedicating its operations to regions and populations where its care

model is proving the strongest health outcomes and financial results,

and is funded to break-even after raising nearly USD 600m in 2021. Our

valuation corresponds to an NTM revenue multiple some 20 percent

below where One Medical and Oak Street Health were taken private.

VillageMD is integrating its acquisition of Summit Health, and cost

synergies are being realized at higher levels than expected. Expectations

on growth have been lowered due to a faster pace of right-sizing the

company's footprint after increasing significantly in scale following the

acquisition. This drives this quarter's write-down. We have contracted our

NTM revenue multiple by just over 5 percent relative to a fairly flat peer

group, which adds to the downwards revision. Our valuation corresponds

to an NTM revenue multiple 10 percent below where One Medical and

Oak Street Health were taken private, and a slightly decreased 10 percent

premium to the multiple used in valuing Cityblock.

KINNEVIK

Interim Report Q2 2023

Portfolio Overview

Value-Based Care

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Note:

12x

9x

6x

3x

Sustainability

10%

Our

Investees

VBC Enablers

46%

14%

3.3x

(6)%

Equity Value (Q/Q Change)

(11)%

+5%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

"Revenue Growth (2022)" pro forma Village MD's acquisition of Summit Health

Peer

Average

13%

22%

20%

1.6x

(2)%

Peer Top

Quartile

Traditional Care Providers

15%

EV/NTM Revenue and Capital Efficiency (Revenue Growth plus EBITDA Margin)

Key Public Benchmarks as at Quarter-End

27%

2.7x

(1)%

+11%

Financial Statements

30%

26%

(4)%

40%

Previous VBC Peers Taken Private

Other

Unlisted Portfolio Weight

Fair Value Change (Q/Q)

50%

60%

● Healthcare Technology (Transcarent)

70%

31View entire presentation