Cannae SPAC Presentation Deck

dun & bradstreet

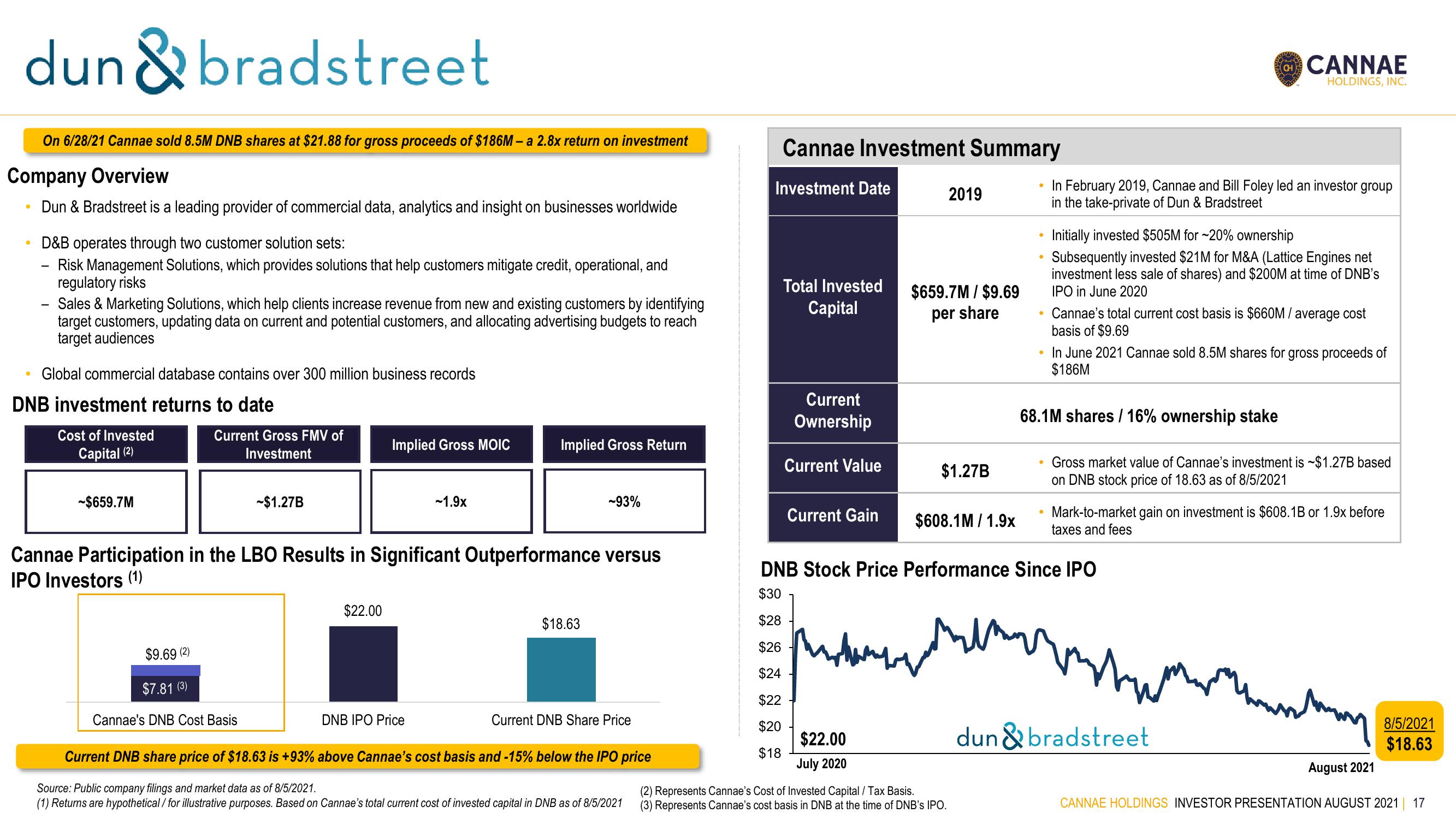

On 6/28/21 Cannae sold 8.5M DNB shares at $21.88 for gross proceeds of $186M-a 2.8x return on investment

Company Overview

Dun & Bradstreet is a leading provider of commercial data, analytics and insight on businesses worldwide

D&B operates through two customer solution sets:

Risk Management Solutions, which provides solutions that help customers mitigate credit, operational, and

regulatory risks

●

-

●

Sales & Marketing Solutions, which help clients increase revenue from new and existing customers by identifying

target customers, updating data on current and potential customers, and allocating advertising budgets to reach

target audiences

Global commercial database contains over 300 million business records

DNB investment returns to date

Cost of Invested

Capital (2)

-$659.7M

Current Gross FMV of

Investment

~$1.27B

$9.69 (2)

$7.81 (3)

Cannae's DNB Cost Basis

Implied Gross MOIC

$22.00

-1.9x

Cannae Participation in the LBO Results in Significant Outperformance versus

IPO Investors (1)

DNB IPO Price

Implied Gross Return

-93%

$18.63

Current DNB Share Price

Current DNB share price of $18.63 is +93% above Cannae's cost basis and -15% below the IPO price

Source: Public company filings and market data as of 8/5/2021.

(1) Returns are hypothetical/ for illustrative purposes. Based on Cannae's total current cost of invested capital in DNB as of 8/5/2021

Cannae Investment Summary

Investment Date

Total Invested

Capital

Current

Ownership

Current Value

Current Gain

$22.00

July 2020

2019

$659.7M / $9.69

per share

$1.27B

$608.1M / 1.9x

(2) Represents Cannae's Cost of Invested Capital / Tax Basis.

(3) Represents Cannae's cost basis in DNB at the time of DNB's IPO.

●

0

In February 2019, Cannae and Bill Foley led an investor group

in the take-private of Dun & Bradstreet

•

CH

CANNAE

HOLDINGS, INC.

Initially invested $505M for ~20% ownership

Subsequently invested $21M for M&A (Lattice Engines net

investment less sale of shares) and $200M at time of DNB's

IPO in June 2020

• Cannae's total current cost basis is $660M / average cost

basis of $9.69

●

• In June 2021 Cannae sold 8.5M shares for gross proceeds of

$186M

DNB Stock Price Performance Since IPO

$30

$28

$26

$24

$22

$20

$18

68.1M shares / 16% ownership stake

Gross market value of Cannae's investment is $1.27B based

on DNB stock price of 18.63 as of 8/5/2021

Mark-to-market gain on investment is $608.1B or 1.9x before

taxes and fees

wwwwwww

dun & bradstreet

August 2021

8/5/2021

$18.63

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 | 17View entire presentation