Melrose Mergers and Acquisitions Presentation Deck

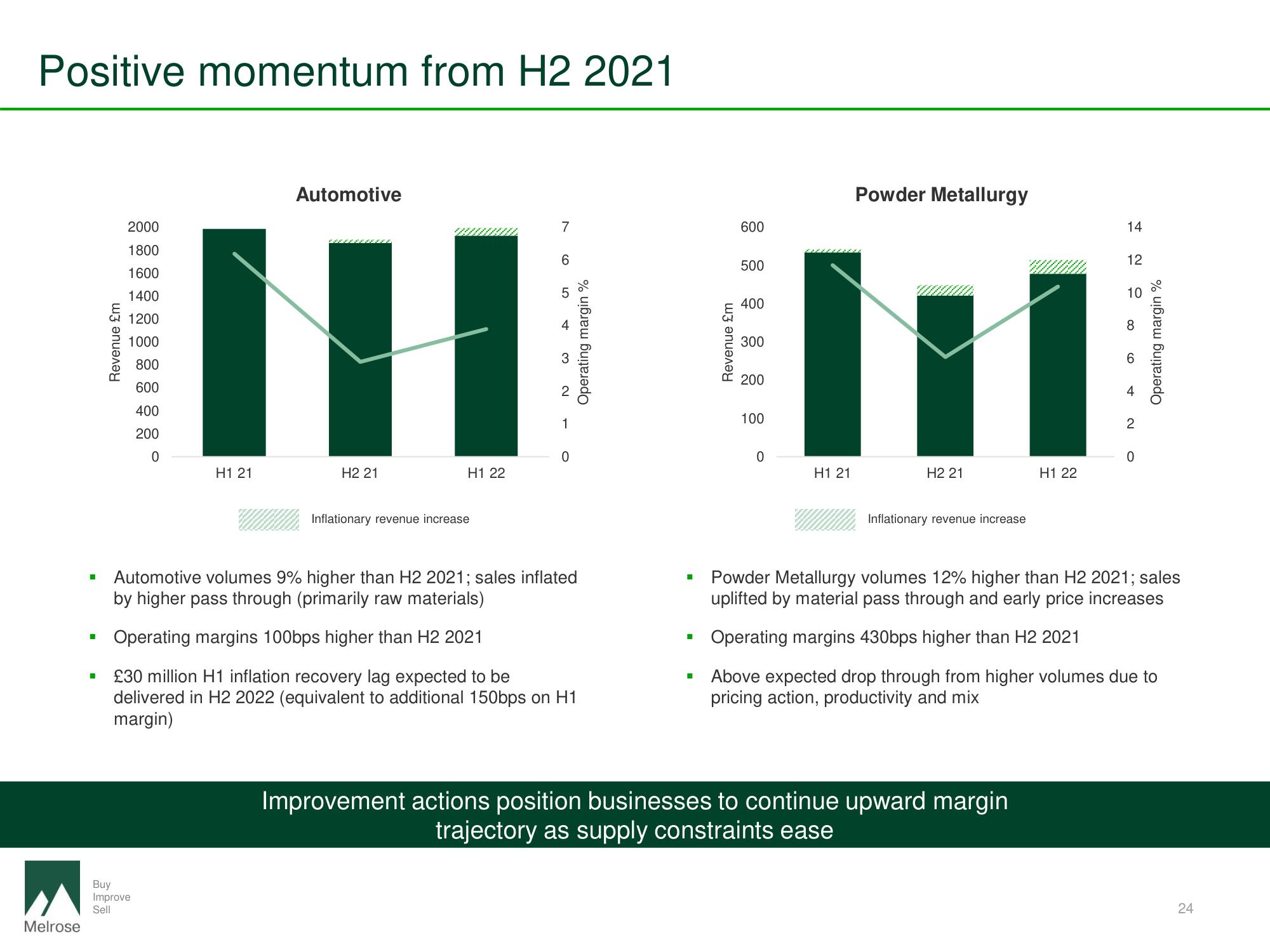

Positive momentum from H2 2021

Melrose

■

Revenue £m

2000

1800

1600

1400

1200

1000

800

600

400

200

0

H1 21

Automotive

Buy

Improve

Sell

H2 21

H1 22

Inflationary revenue increase

7

6

5 do

N

1

0

Operating margin %

Automotive volumes 9% higher than H2 2021; sales inflated

by higher pass through (primarily raw materials)

Operating margins 100bps higher than H2 2021

£30 million H1 inflation recovery lag expected to be

delivered in H2 2022 (equivalent to additional 150bps on H1

margin)

■

■

Revenue £m

600

500

400

300

200

100

0

H1 21

Powder Metallurgy

H2 21

Inflationary revenue increase

H1 22

14

Improvement actions position businesses to continue upward margin

trajectory as supply constraints ease

12

10

8

CO

4

2

0

Operating margin %

Powder Metallurgy volumes 12% higher than H2 2021; sales

uplifted by material pass through and early price increases

Operating margins 430bps higher than H2 2021

Above expected drop through from higher volumes due to

pricing action, productivity and mix

24View entire presentation