Trian Partners Activist Presentation Deck

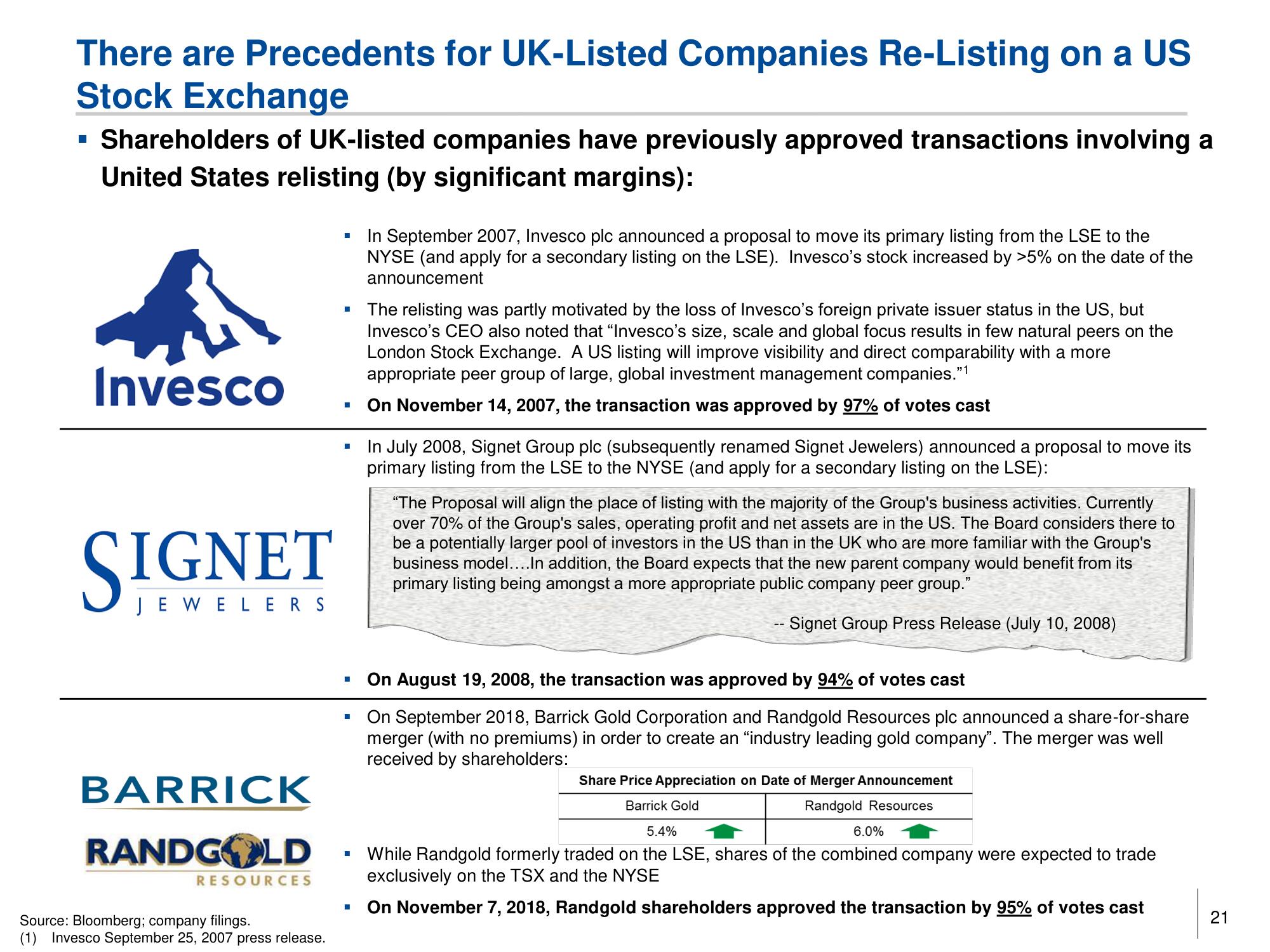

There are Precedents for UK-Listed Companies Re-Listing on a US

Stock Exchange

▪ Shareholders of UK-listed companies have previously approved transactions involving a

United States relisting (by significant margins):

Invesco

JEWELERS

BARRICK

RANDGLD

RESOURCES

Source: Bloomberg; company filings.

(1) Invesco September 25, 2007 press release.

-

■

■

■

■

I

H

In September 2007, Invesco plc announced a proposal to move its primary listing from the LSE to the

NYSE (and apply for a secondary listing on the LSE). Invesco's stock increased by >5% on the date of the

announcement

The relisting was partly motivated by the loss of Invesco's foreign private issuer status in the US, but

Invesco's CEO also noted that "Invesco's size, scale and global focus results in few natural peers on the

London Stock Exchange. A US listing will improve visibility and direct comparability with a more

appropriate peer group of large, global investment management companies."1

On November 14, 2007, the transaction was approved by 97% of votes cast

In July 2008, Signet Group plc (subsequently renamed Signet Jewelers) announced a proposal to move its

primary listing from the LSE to the NYSE (and apply for a secondary listing on the LSE):

"The Proposal will align the place of listing with the majority of the Group's business activities. Currently

over 70% of the Group's sales, operating profit and net assets are in the US. The Board considers there to

be a potentially larger pool of investors in the US than in the UK who are more familiar with the Group's

business model.... In addition, the Board expects that the new parent company would benefit from its

primary listing being amongst a more appropriate public company peer group."

-- Signet Group Press Release (July 10, 2008)

On August 19, 2008, the transaction was approved by 94% of votes cast

On September 2018, Barrick Gold Corporation and Randgold Resources plc announced a share-for-share

merger (with no premiums) in order to create an "industry leading gold company". The merger was well

received by shareholders:

Share Price Appreciation on Date of Merger Announcement

Barrick Gold

Randgold Resources

5.4%

6.0%

While Randgold formerly traded on the LSE, shares of the combined company were expected to trade

exclusively on the TSX and the NYSE

On November 7, 2018, Randgold shareholders approved the transaction by 95% of votes cast

21View entire presentation