Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

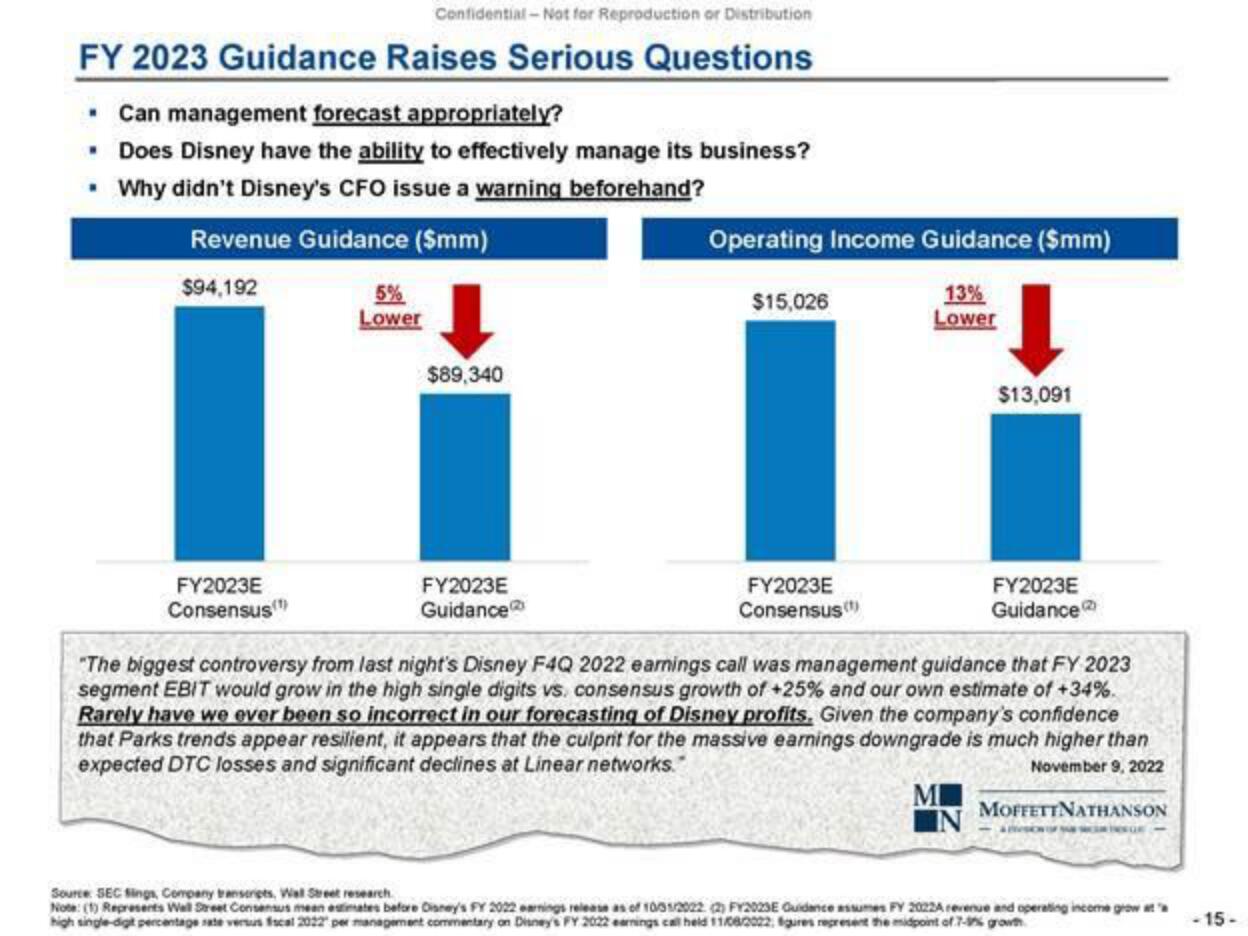

FY 2023 Guidance Raises Serious Questions

. Can management forecast appropriately?

• Does Disney have the ability to effectively manage its business?

. Why didn't Disney's CFO issue a warning beforehand?

Revenue Guidance ($mm)

$94,192

FY2023E

Consensus

5%

Lower

$89,340

FY2023E

Guidance

Operating Income Guidance ($mm)

13%

Lower

$15,026

FY2023E

Consensus (¹)

$13,091

FY2023E

Guidance

"The biggest controversy from last night's Disney F4Q 2022 earnings call was management guidance that FY 2023

segment EBIT would grow in the high single digits vs. consensus growth of +25% and our own estimate of +34%.

Rarely have we ever been so incorrect in our forecasting of Disney profits. Given the company's confidence

that Parks trends appear resilient, it appears that the culprit for the massive earnings downgrade is much higher than

expected DTC losses and significant declines at Linear networks."

November 9, 2022

MOFFETTNATHANSON

Source SEC fings, Company transcripts, Wall Street research.

Note: (1) Represents Wall Street Consensus mean estimates before Disney's FY 2022 earnings release as of 10/01/2022 (2) FY2023E Guidance assumes FY 2022A revenue and operating income grow at a

high single-digt percentage rate versus fiscal 2022 per management commentary on Disney's FY 2022 earnings call held 11/08/2022. gures represent the midpoint of 7-9% growth

- 15-View entire presentation