Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

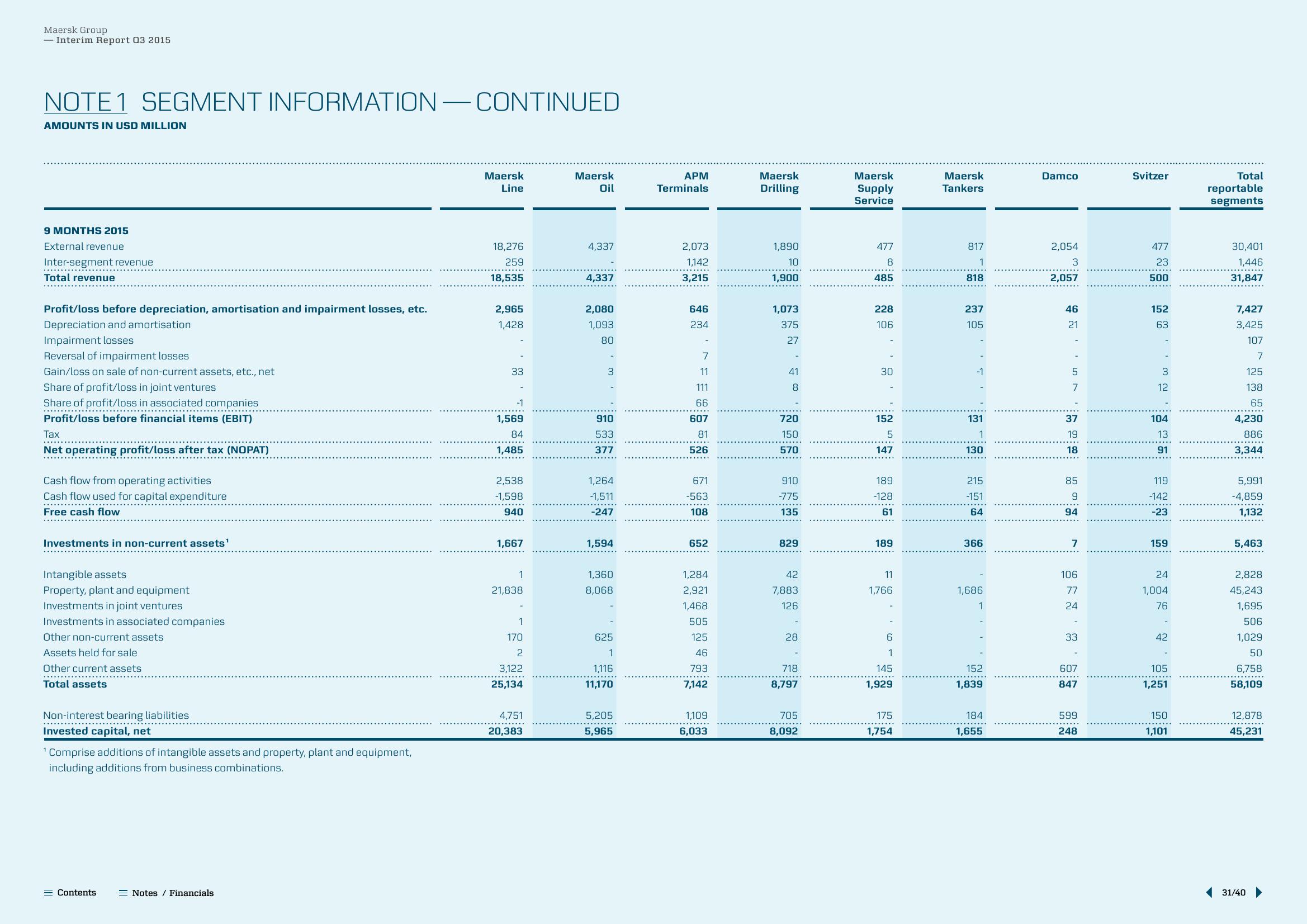

NOTE 1 SEGMENT INFORMATION — CONTINUED

AMOUNTS IN USD MILLION

9 MONTHS 2015

External revenue

Inter-segment revenue

Total revenue

Profit/loss before depreciation, amortisation and impairment losses, etc.

Depreciation and amortisation

Impairment losses

Reversal of impairment losses

Gain/loss on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

**********

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Free cash flow

Investments in non-current assets¹

Intangible assets

Property, plant and equipment

Investments in joint ventures

Investments in associated companies

Other non-current assets

Assets held for sale

Other current assets

*********.

Total assets

Non-interest bearing liabilities

Invested capital, net

¹ Comprise additions of intangible assets and property, plant and equipment,

including additions from business combinations.

= Contents

Notes / Financials

Maersk

Line

18,276

259

18,535

2,965

1,428

33

-1

1,569

84

1,485

2,538

-1,598

940

1,667

1

21,838

1

170

2

3,122

25,134

4,751

20,383

Maersk

Oil

4,337

4,337

2,080

1,093

80

3

910

533

377

1,264

-1,511

-247

1,594

1,360

8,068

625

1

1,116

11,170

5,205

5,965

APM

Terminals

2,073

1,142

3,215

646

234

7

11

111

66

607

81

526

671

-563

108

652

1,284

2,921

1,468

505

125

46

793

7,142

1,109

6,033

Maersk

Drilling

1,890

10

1,900

1,073

375

27

-

41

8

720

150

570

910

-775

135

829

42

7,883

126

28

718

8,797

705

8,092

Maersk

Supply

Service

477

8

485

228

106

30

152

5

147

189

-128

61

189

11

1,766

6

1

145

1,929

175

1,754

Maersk

Tankers

817

1

818

237

105

-1

131

1

130

215

-151

64

366

1,686

1

152

1,839

184

1,655

Damco

2,054

3

2,057

46

21

5

7

37

19

18

85

9

94

7

106

77

24

33

607

847

599

248

Svitzer

477

23

500

152

~ w.,

104

13

91

119

-142

-23

159

24

1,004

76

42

105

1,251

150

1,101

Total

reportable

segments

30,401

1,446

31,847

7,427

3,425

107

7

125

138

65

4,230

886

3,344

5,991

-4,859

1,132

5,463

2,828

45,243

1,695

506

1,029

50

6,758

58,109

12,878

45,231

31/40View entire presentation