Allwyn Results Presentation Deck

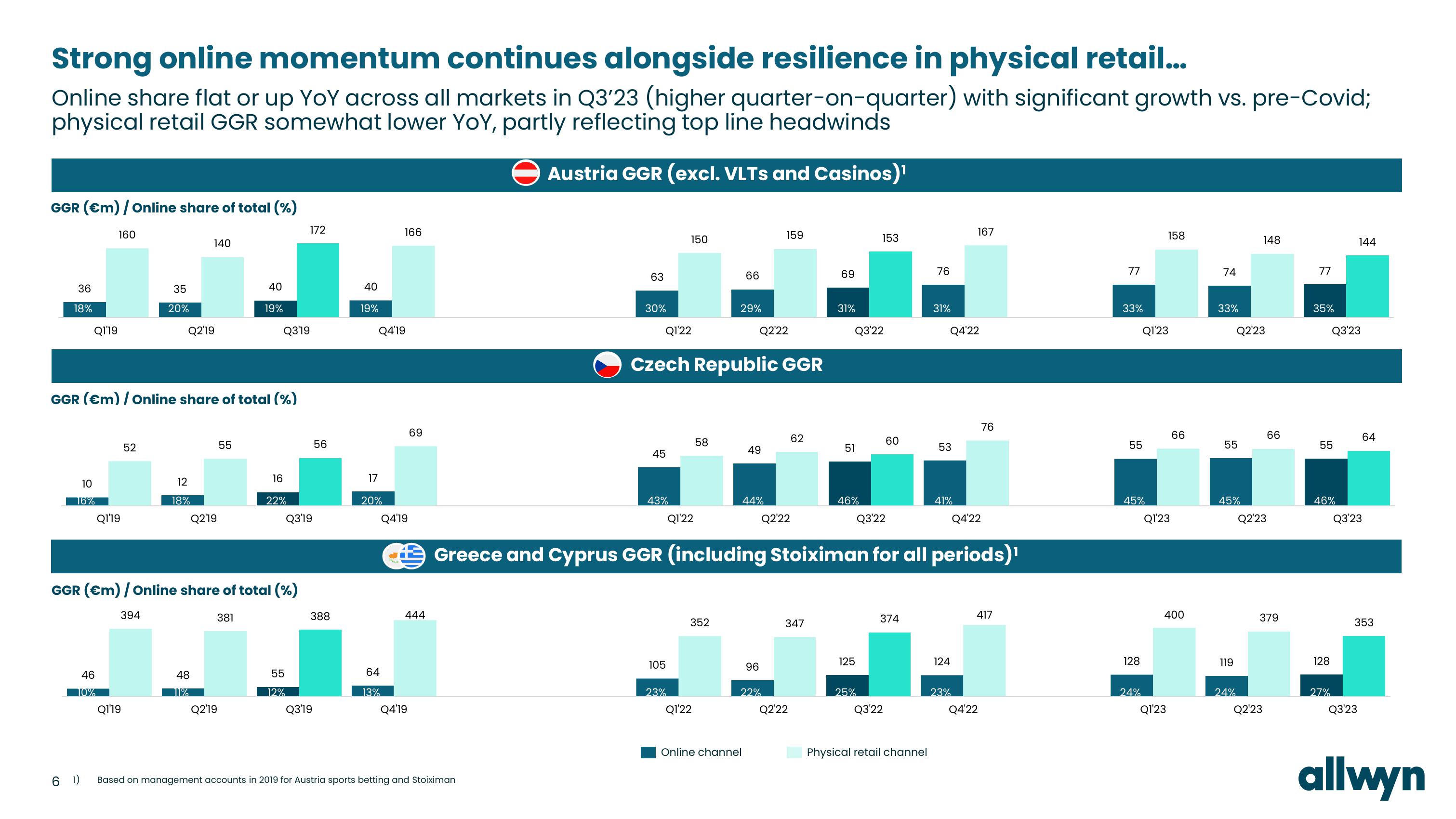

Strong online momentum continues alongside resilience in physical retail...

Online share flat or up YoY across all markets in Q3'23 (higher quarter-on-quarter) with significant growth vs. pre-Covid;

physical retail GGR somewhat lower YOY, partly reflecting top line headwinds

Austria GGR (excl. VLTS and Casinos)¹

GGR (€m) / Online share of total (%)

36

18%

Q1'19

10

16%

160

46

10%

6 1)

Q1'19

GGR (€m) / Online share of total (%)

35

20%

52

Q1'19

Q2'19

12

18%

140

48

11%

Q2'19

GGR (€m) / Online share of total (%)

394

381

40

19%

55

Q2'19

Q3'19

16

22%

55

12%

172

Q3'19

56

388

Q3'19

40

19%

Q4'19

17

20%

166

64

13%

Q4'19

69

444

Q4'19

63

Based on management accounts in 2019 for Austria sports betting and Stoiximan

30%

Q1'22

45

43%

150

105

Czech Republic GGR

23%

Q1'22

58

352

Q1'22

66

29%

Online channel

Q2'22

49

44%

159

96

Q2'22

22%

62

347

Q2'22

69

31%

Q3'22

51

46%

153

Greece and Cyprus GGR (including Stoiximan for all periods)¹

125

Q3'22

25%

60

374

Q3'22

76

Physical retail channel

31%

Q4'22

53

41%

167

124

23%

76

Q4'22

417

Q4'22

77

33%

55

45%

128

24%

Q1'23

158

Q1'23

Q1'23

66

400

74

33%

55

45%

119

Q2'23

24%

148

Q2'23

Q2'23

66

379

77

35%

55

46%

128

Q3'23

27%

144

64

Q3'23

Q3'23

353

allwynView entire presentation