Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

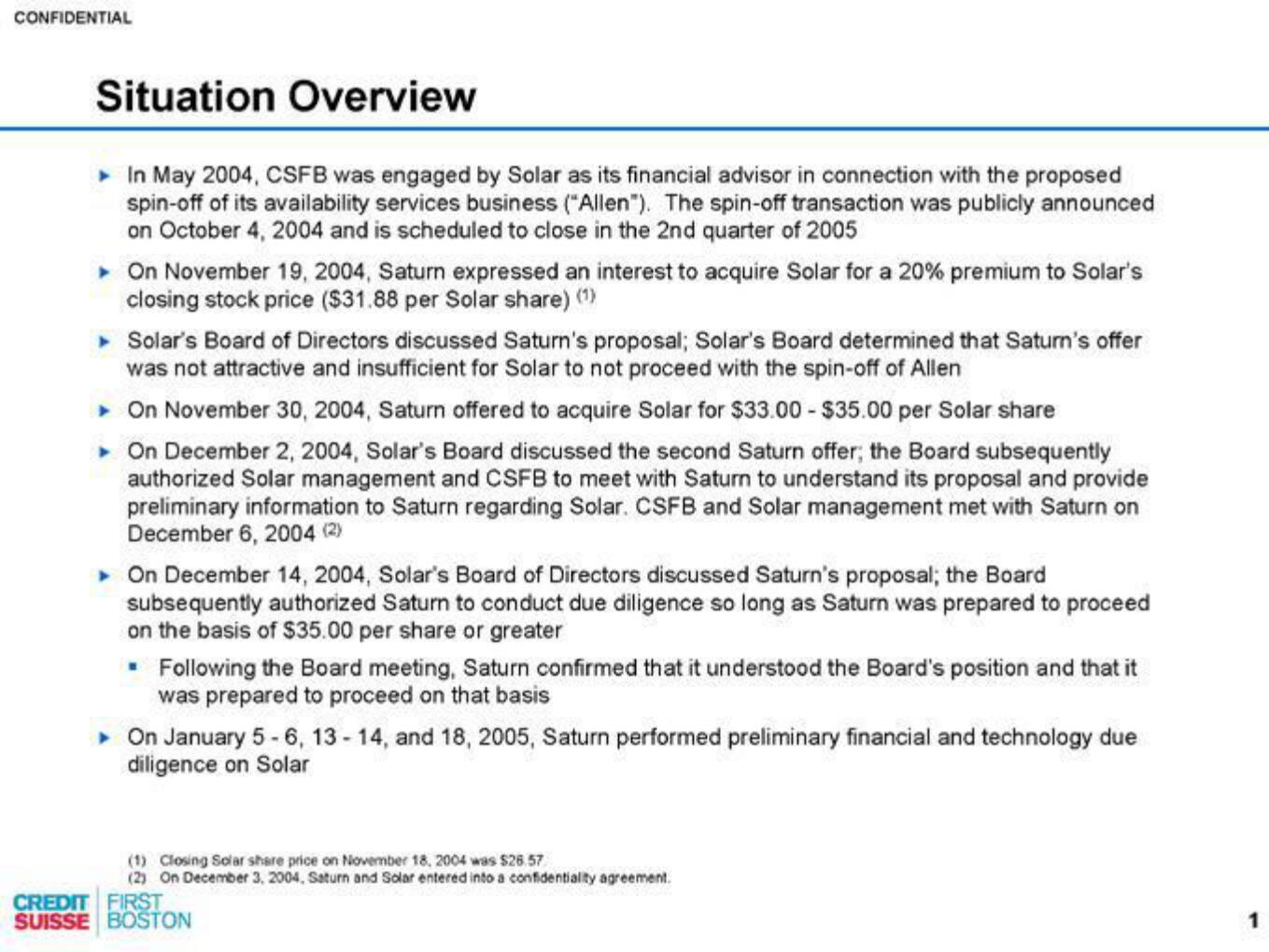

Situation Overview

▸ In May 2004, CSFB was engaged by Solar as its financial advisor in connection with the proposed

spin-off of its availability services business ("Allen"). The spin-off transaction was publicly announced

on October 4, 2004 and is scheduled to close in the 2nd quarter of 2005

On November 19, 2004, Saturn expressed an interest to acquire Solar for a 20% premium to Solar's

closing stock price ($31.88 per Solar share) (¹)

▸ Solar's Board of Directors discussed Saturn's proposal; Solar's Board determined that Saturn's offer

was not attractive and insufficient for Solar to not proceed with the spin-off of Allen

▸ On November 30, 2004, Saturn offered to acquire Solar for $33.00 - $35.00 per Solar share

▸ On December 2, 2004, Solar's Board discussed the second Saturn offer; the Board subsequently

authorized Solar management and CSFB to meet with Saturn to understand its proposal and provide

preliminary information to Saturn regarding Solar. CSFB and Solar management met with Saturn on

December 6, 2004 (2)

▸ On December 14, 2004, Solar's Board of Directors discussed Saturn's proposal; the Board

subsequently authorized Saturn to conduct due diligence so long as Saturn was prepared to proceed

on the basis of $35.00 per share or greater

▪ Following the Board meeting, Saturn confirmed that it understood the Board's position and that it

was prepared to proceed on that basis

▸ On January 5-6, 13-14, and 18, 2005, Saturn performed preliminary financial and technology due

diligence on Solar

(1) Closing Solar share price on November 18, 2004 was $26.57

(2) On December 3, 2004, Saturn and Solar entered into a confidentiality agreement.

CREDIT FIRST

SUISSE BOSTON

1View entire presentation