Lyft Results Presentation Deck

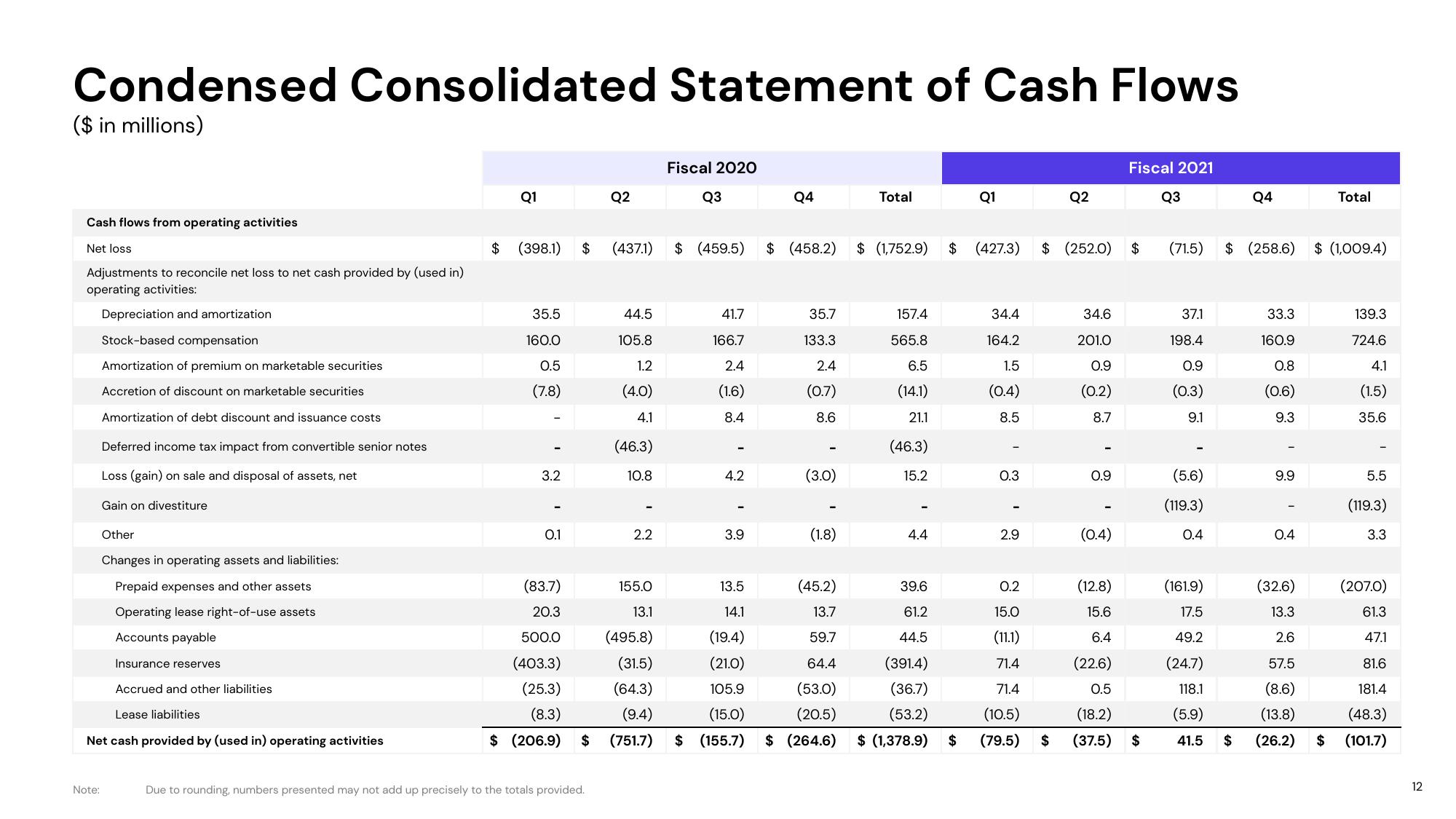

Condensed Consolidated Statement of Cash Flows

($ in millions)

Cash flows from operating activities

Net loss

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities:

Depreciation and amortization

Stock-based compensation

Amortization of premium on marketable securities

Accretion of discount on marketable securities

Amortization of debt discount and issuance costs

Note:

Deferred income tax impact from convertible senior notes

Loss (gain) on sale and disposal of assets, net

Gain on divestiture

Other

Changes in operating assets and liabilities:

Prepaid expenses and other assets

Operating lease right-of-use assets

Accounts payable

Insurance reserves

Accrued and other liabilities

Lease liabilities

Net cash provided by (used in) operating activities

$

Q1

(398.1)

35.5

160.0

0.5

(7.8)

3.2

0.1

(83.7)

20.3

500.0

(403.3)

(25.3)

(8.3)

$ (206.9)

$

Q2

Due to rounding, numbers presented may not add up precisely to the totals provided.

$ (437.1) $ (459.5) $ (458.2)

44.5

105.8

1.2

(4.0)

4.1

(46.3)

10.8

2.2

Fiscal 2020

155.0

13.1

(495.8)

(31.5)

(64.3)

(9.4)

(751.7)

Q3

41.7

166.7

2.4

(1.6)

8.4

4.2

Q4

3.9

35.7

133.3

2.4

(0.7)

8.6

(3.0)

(1.8)

Total

$ (1,752.9)

157.4

565.8

6.5

(14.1)

21.1

(46.3)

15.2

4.4

13.5

(45.2)

14.1

13.7

(19.4)

59.7

(21.0)

64.4

105.9

(53.0)

(15.0)

(20.5)

$ (155.7) $ (264.6) $ (1,378.9) $

39.6

61.2

44.5

(391.4)

(36.7)

(53.2)

Q1

$ (427.3) $ (252.0)

34.4

164.2

1.5

(0.4)

8.5

0.3

2.9

Q2

0.2

15.0

(11.1)

71.4

71.4

(10.5)

(79.5) $

34.6

201.0

0.9

(0.2)

8.7

I

0.9

(0.4)

(12.8)

15.6

6.4

(22.6)

0.5

(18.2)

(37.5)

Fiscal 2021

$

$

Q3

(71.5)

37.1

198.4

0.9

(0.3)

9.1

I

(5.6)

(119.3)

0.4

(161.9)

17.5

49.2

(24.7)

118.1

(5.9)

41.5

Q4

$ (258.6)

33.3

160.9

0.8

(0.6)

9.3

9.9

0.4

Total

$ (1,009.4)

(32.6)

13.3

2.6

57.5

(8.6)

(13.8)

$ (26.2) $

139.3

724.6

4.1

(1.5)

35.6

5.5

33

(119.3)

3.3

(207.0)

61.3

47.1

81.6

181.4

(48.3)

(101.7)

12View entire presentation