Spotify Results Presentation Deck

Executive Summary

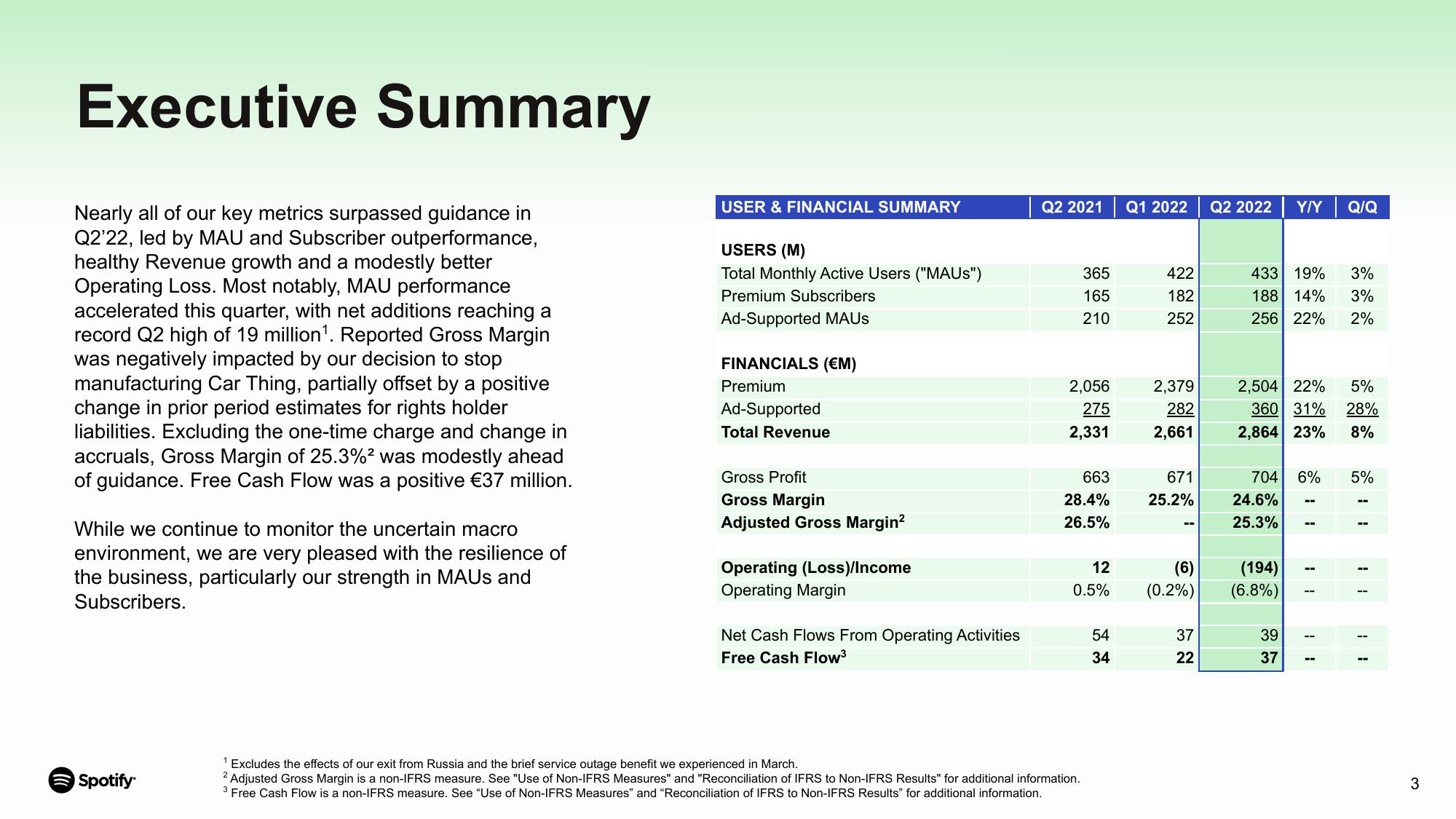

Nearly all of our key metrics surpassed guidance in

Q2'22, led by MAU and Subscriber outperformance,

healthy Revenue growth and a modestly better

Operating Loss. Most notably, MAU performance

accelerated this quarter, with net additions reaching a

record Q2 high of 19 million¹. Reported Gross Margin

was negatively impacted by our decision to stop

manufacturing Car Thing, partially offset by a positive

change in prior period estimates for rights holder

liabilities. Excluding the one-time charge and change in

accruals, Gross Margin of 25.3%² was modestly ahead

of guidance. Free Cash Flow was a positive €37 million.

While we continue to monitor the uncertain macro

environment, we are very pleased with the resilience of

the business, particularly our strength in MAUs and

Subscribers.

Spotify

USER & FINANCIAL SUMMARY

USERS (M)

Total Monthly Active Users ("MAUS")

Premium Subscribers

Ad-Supported MAUS

FINANCIALS (EM)

Premium

Ad-Supported

Total Revenue

Gross Profit

Gross Margin

Adjusted Gross Margin²

Operating (Loss)/Income

Operating Margin

Net Cash Flows From Operating Activities

Free Cash Flow³

Q2 2021 Q1 2022

365

165

210

2,056

275

2,331

663

28.4%

26.5%

12

0.5%

1 Excludes the effects of our exit from Russia and the brief service outage benefit we experienced in March.

2 Adjusted Gross Margin is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

3 Free Cash Flow is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

54

34

422

182

252

2,379

282

2,661

671

25.2%

Q2 2022

37

22

433 19%

188 14%

256 22%

Y/Y Q/Q

2,504 22%

360 31%

2,864 23%

(6) (194)

(0.2%) (6.8%)

704 6%

24.6%

25.3%

39

37

--

--

11

--

3%

3%

2%

5%

28%

8%

5%

3View entire presentation