Baird Investment Banking Pitch Book

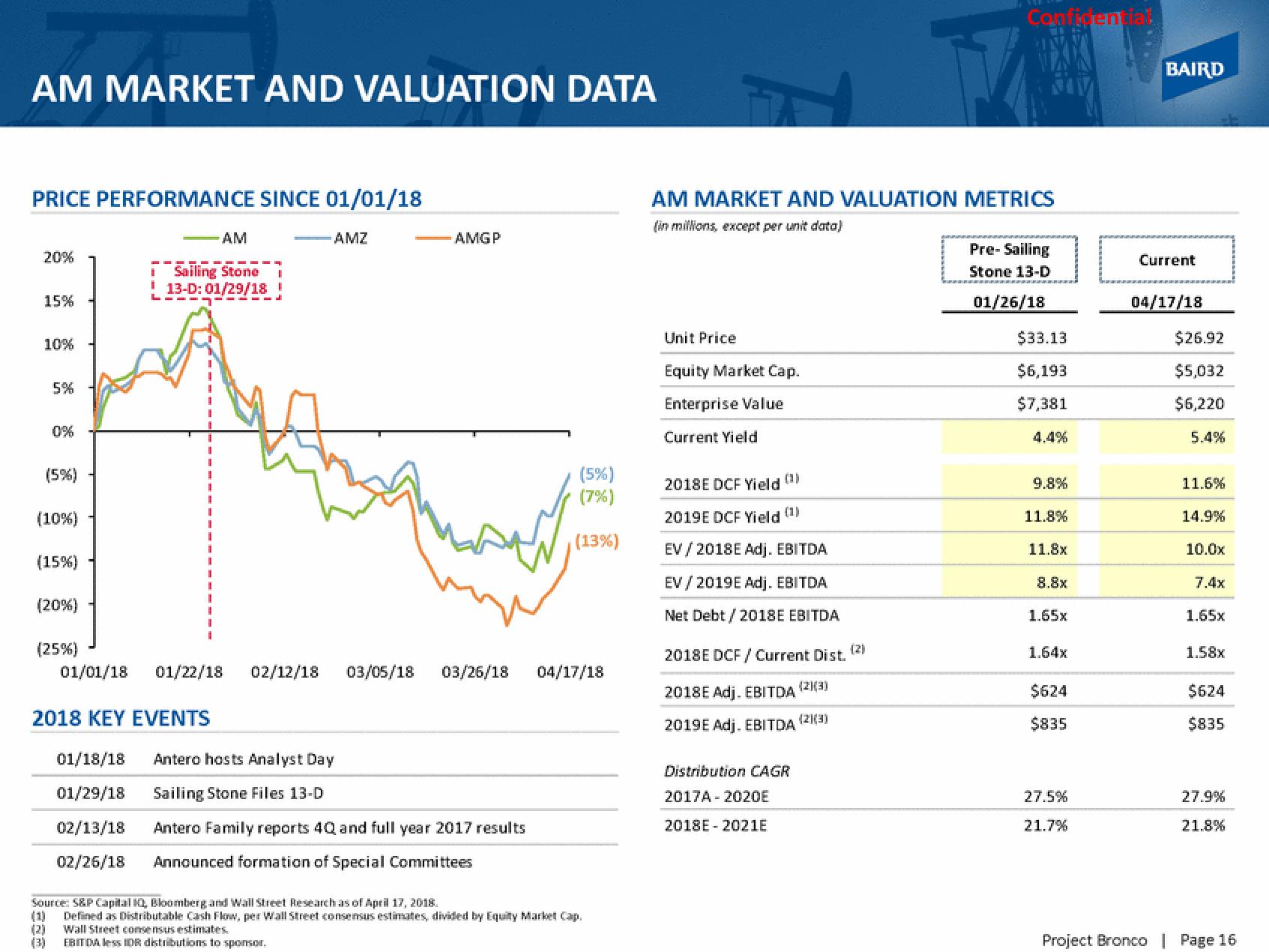

AM MARKET AND VALUATION DATA

PRICE PERFORMANCE SINCE 01/01/18

20%

15%

10%

5%

0%

(5%)

(10%)

(15%)

(20%)

(25%)

(1)

(2)

AM

Sailing Stone

! 13-D: 01/29/18 !

AMZ

2018 KEY EVENTS

01/18/18 Antero hosts Analyst Day

01/29/18 Sailing Stone Files 13-D

02/13/18

02/26/18

AMGP

01/01/18 01/22/18 02/12/18 03/05/18 03/26/18 04/17/18

(5%)

(7%)

(13%)

Antero Family reports 4Q and full year 2017 results

Announced formation of Special Committees

Source: S&P Capital IQ, Bloomberg and Wall Street Research as of April 17, 2018.

Defined as Distributable Cash Flow, per Wall Street consensus estimates, divided by Equity Market Cap.

Wall Street consensus estimates.

EBITDA less IDR distributions to sponsor.

AM MARKET AND VALUATION METRICS

(in millions, except per unit data)

Unit Price

Equity Market Cap.

Enterprise Value

Current Yield

2018E DCF Yield

2019E DCF Yield

EV / 2018E Adj. EBITDA

EV/2019E Adj. EBITDA

Net Debt / 2018E EBITDA

(1)

2018E DCF / Current Dist.

2018E Adj. EBITDA

2019E Adj. EBITDA

Distribution CAGR

2017A-2020E

2018E-2021E

(2)(3)

(2)(3)

Confident

(2)

Pre-Sailing

Stone 13-D

01/26/18

$33.13

$6,193

$7,381

9.8%

11.8%

11.8x

8.8x

1.65x

1.64x

$624

$835

27.5%

21.7%

3

BAIRD

Current

04/17/18

$26.92

$5,032

$6,220

5.4%

11.6%

14.9%

10.0x

7.4x

1.65x

1.58x

$624

$835

27.9%

21.8%

Project Bronco | Page 16.View entire presentation